With the rise of personal debt, US consumers are now more concerned about their credit health. That means there is a large audience you can promote credit repair services to. The best part is that this industry pays a lot, with some programs paying up to a 90% commission per sale.

If you are interested in earning money from this promising niche, we’re here to help. Our lists covered 20 credit repair affiliate programs below. Let’s dive in to see which program matches your goal most.

Quick Comparison

| Program Name | Commission (%) or $ | Cookie Duration (Days) | Niche Suitable |

|---|---|---|---|

| myFICO | $5–$25 | 60 | Credit monitoring, Credit score education |

| Credit Saint | $80 | 60 | Credit repair, Credit improvement |

| Credit Firm | $20 | 180 | Credit repair, Credit disputes, Debt issues |

| Legal Harbor | $40 | 90 | Credit repair via legal route |

| National Debt Relief | $27.5 + 12% sub-affiliate | Not provided | Debt relief, Debt management |

| The Credit People | $100–$200 | Not provided | Premium credit repair services |

| CuraDebt | $38–$45 | 45 | Debt relief, Tax debt, Credit repair |

| The Credit Pros | Up to $120 | Not provided | Credit repair, Identity protection |

| Credit Fix Guy | 25% commission | 30 | Credit repair for beginners/low-budget users |

| IDIQ | $100 | 60 | Credit monitoring, Identity protection |

Affiliate Earnings Calculator

Estimate your affiliate income based on Traffic, CTR, AOV, and Commission rate. Drag the sliders below to explore different scenarios.

Estimated Results

These figures are for illustrative purposes – feel free to adjust them to fit your specific niche.

- Conversion Rate here is defined as the percentage of traffic that buys.

- Does not account for refunds, cancellations, or varying commission rates by product.

Top 20 Credit Repair Affiliate Programs

1. myFICO

myFICO creates FICO scores to monitor credit health and track detailed changes over time. Lenders can access 28 different FICO scores, even for mortgages and auto loans.

Affiliates can join the myFICO affiliate program via Awin, earning from $5 to $25 on every qualified purchase. The cookie duration is 60 days, counting from the first click of customers on your link.

You can use their banners and text links to create appealing ads on your marketing channels. Moreover, their dedicated affiliate team supports you with tips and advice for promoting products and boosting sales.

|

2. Credit Saint

Credit Saint helps users fix unfair or negative information harming users’ credit. They customize action plans with step-by-step guidance on improving credit scores and achieving financial goals.

Managed through CJ Affiliate, the Credit Saint affiliate program offers affiliates an $80 commission on each sale. You can earn credit for purchases within a 60-day cookie duration counting from customers’ first click on your link.

You can save time on creating content with their professional pre-made creatives. Plus, their in-house dedicated affiliate team will give you helpful tips on boosting sales and traffic.

|

3. Credit Firm

Credit Firm has been a leading credit repair service provider for US citizens for over 20 years. They assist users in solving credit bureau disputes, inquiry challenges, goodwill interventions, debt validation requests, and cease-and-desist letters.

The Credit Firm affiliate program offers a $20 commission on every qualified plan subscription. You’ll have up to 180 days from customers’ initial click on your link to earn credit for their purchases.

Credit Firm gives affiliates banners, widgets, and text links to increase clicks and conversions. You can also utilize their videos to make more reliable content for your target audience. Moreover, you have full access to their data feed to update new services for your promotions.

|

4. Legal Harbor

Legal Harbor leverages consumer protection laws to repair users’ credit. They take strong approaches to hold creditors and credit bureaus accountable for non-compliance with FCRA guidelines.

Legal Harbor runs their affiliate program via CJ Affiliate and offers a $40 commission on a service fee of $99.95. The cookie duration is 90 days, staying on customers’ devices once they click your link.

The brand supplies banners, landing pages, and other promotional materials to help you build content faster. If you write your own editorial content, you must follow their guidelines and request approval before publishing.

|

5. National Debt Relief

National Debt Relief reduces or solves unsecured users’ debt to protect their credit scores. They aim to help users regain control of their finances to achieve better credit outcomes.

The National Debt Relief affiliate program allows affiliates to earn a $27.5 commission on every qualified free debt relief quote request. You can also refer new affiliates and earn a 12% commission on each sale they make.

You can put banners and text links in blog posts or social media accounts to increase visibility and engagement. You can attract potential leads from all US states, except for Connecticut, Oregon, Vermont, and West Virginia.

|

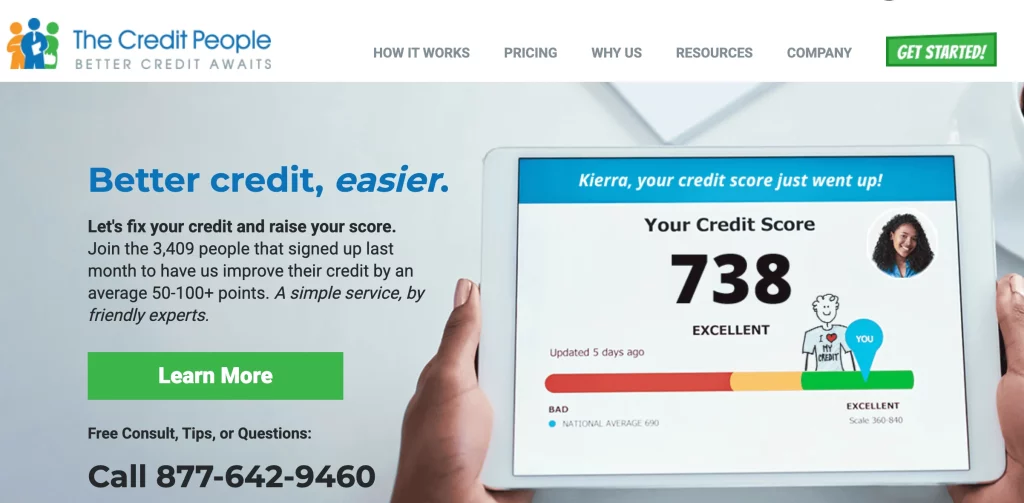

6. The Credit People

The Credit People identifies inaccuracies in clients’ credit reports, such as late payments, charge-offs, collections, and bankruptcies. They address derogatory marks on users’ credit reports and give detailed plans for every progress.

After joining their affiliate program, you can earn from $100 to $200 across all plan subscriptions. The brand pays affiliates monthly via check or ACH payments.

You can find a vast collection of pre-made creatives on the affiliate online dashboard. You can also receive email updates on their products or promotional tips. Plus, they provide effective promotional guidance for affiliates based on their primary marketing platforms.

|

7. CuraDebt

CuraDebt helps individuals and small businesses in reducing unsecured debt and repairing credit scores. They negotiate with creditors to lower debts than the original balance.

Once joining the CuraDebt affiliate program, you can earn up to a $45 commission based on the type of leads.

- Tax debt consultation: $45

- Pay per call: $39

- Normal lead: $38

The program also offers a 45-day cookie duration, starting with customers’ first click on your link. Therefore, you can only earn credit for purchases made within this time frame.

|

8. The Credit Pros

The Credit Pros is a financial technology firm specializing in credit repair and credit score improvement services. They identify damaging inaccuracies to help users improve and build healthier credit scores in the long term.

You can apply for the Credit Pros affiliate program via ShareASale. Their program allows affiliates to earn up to a $120 commission on each sale.

You can use different banners and creatives to make intriguing content for your target audience. They also allow you to use coupon codes, but the maximum discount value is $50 on each sale.

|

9. Credit Fix Guy

Credit Fix Guy delivers affordable credit repair services for all financial problems. Users can receive dispute letters within 24 hours and achieve credit repair enhancement in 30 days.

After joining their affiliate program, you can earn a 25% commission for every qualified subscription. A 30-day cookie duration allows you to earn credit for all customer purchases within this period.

The brand creates different types of links for affiliates to share across all social media platforms and websites. You can also integrate banner ads in email newsletters, social media posts, or blogs to drive traffic to Credit Fix Guy’s site.

|

10. IDIQ

IDIQ leverages AI to monitor and protect the identity and credit history of over 4 million members. Users can respond quickly to potential threats thanks to their real-time notifications for suspicious activities across credit reports.

Affiliates can join the IDIQ affiliate program and enjoy a $100 commission on every completed sale. The cookie duration lasts 60 days, counting from the moment customers click on your link.

Their dedicated affiliate team helps affiliates create effective promotional campaigns with tips and advice. You will also be the first to know about their new products and exclusive promotions.

|

11. Credit RX America

- Commission rate: 15%

- Cookie duration: Not mentioned

Credit RX America offers credit repair solutions without any upfront or monthly fees. Additionally, they help users achieve mortgage approval and other financial opportunities.

12. The Credit App

- Commission rate: 90%

- Cookie duration: Not mentioned

The Credit App helps contractors and small businesses report defaults and nonpayments to the credit bureaus. They also notify businesses about individuals with high credit risk to avoid bad debt.

13. MyFreeScoreNow

- Commission rate: $16

- Cookie duration: Not mentioned

MyFreeScoreNow gives users free access to credit scores and reports on three main financial bureaus. They also alert users to significant changes in their reports and avoid potential identity theft or inaccuracies.

14. Adam Credit

- Commission rate: $99

- Cookie duration: Not mentioned

Adam Credit offers personalized credit repair solutions for legal and real estate clients. They educate users about credit profiles to help them improve their financial health.

15. Credit Monkey

- Commission rate: $100-$125

- Cookie duration: Not mentioned

Credit Monkey develops automatic software to dispute inaccurate items on credit reports. They ensure all corrections align with three main bureaus, including Experian, TransUnion, and Equifax.

16. MP Credit Repair

- Commission rate: $50-100

- Cookie duration: Not mentioned

MP Credit Repair works with credit bureaus and creditors to help clients clean up their credit reports. They provide educational resources and detailed guidance for users choosing the “Do It Yourself” repair option.

17. Reliant Credit Repair

- Commission rate: 40%

- Cookie duration: Not mentioned

Reliant Credit Repair guides users in improving credit scores and overall financial health for future issues. They also dispute inaccuracies and remove derogatory marks to avoid unexpected damage to credit reports.

18. Dispute Panda

- Commission rate: 30%

- Cookie duration: Not mentioned

Dispute Panda creates an AI-powered letter generation engine for credit repair professionals. The software can help write realistic disputed letters and track dispute progress in real-time.

19. Credit Glory

- Commission rate: $100

- Cookie duration: Not mentioned

Credit Glory helps users identify disputing errors on credit reports, such as delinquencies, collections, and bankruptcies. They even offer free phone consultations to give personalized support on improving credit scores.

20. DisputeBee

- Commission rate: 35%

- Cookie duration: Not mentioned

DisputeBee is a credit repair software platform for both professional companies and individuals. They assist users in writing dispute letters to credit bureaus, debt collectors, and creditors.

What Critical Factors Should You Evaluate When Choosing Credit Repair Affiliate Programs?

Choosing the right partner isn’t just about chasing the biggest payout.

A “$500 per sale” offer looks great, but it’s worthless if the program converts poorly or the tracking window closes before your reader buys.

To build a real business instead of just hoping for lucky spikes, you need to look at the whole package.

This framework breaks down the non-negotiables—from how you get paid to how long you get credit for the sale. This ensures you pick a program that actually fits your traffic and cash flow needs.

Commission Structure Alignment: Matching Payment Models to Your Income Goals

The first filter is financial fit. Different commission models change how you run your business and manage your cash flow.

In the credit repair niche, you generally have three choices. Picking the wrong one for your stage of business can be a costly mistake.

| Feature | CPA (Cash Flow King) | Recurring (Passive Income) | Hybrid (Middle Ground) |

| Payout Type | One-time fee, usually $150-$400 | 20–40% monthly commission. | Small upfront fee plus recurring percentage. |

| Best For | Paid ads and PPC specialists. | SEO, bloggers, and YouTubers. | Cautious affiliates seeking balance. |

| Primary Advantage | Immediate cash to reinvest and scale. | Builds stable, compounding monthly baseline. | Combines quick cash with long-term value. |

| Metaphor | Hunting: immediate reward per kill. | Farming: plant seeds for later harvest. | Balanced strategy for stability and growth. |

| Time to Profit | Fast; immediate returns on spend. | Slow; takes months to see significant money. | Moderate; provides both instant and future pay. |

My Verdict: If you are new and bootstrapping, prioritize CPA. Cash flow problems kill more businesses than a lack of profit.

Once you have a stable bankroll, start mixing in recurring offers to build long-term wealth.

But getting the right commission structure is only half the battle. You also need to ensure you actually get credit for the customers you send.

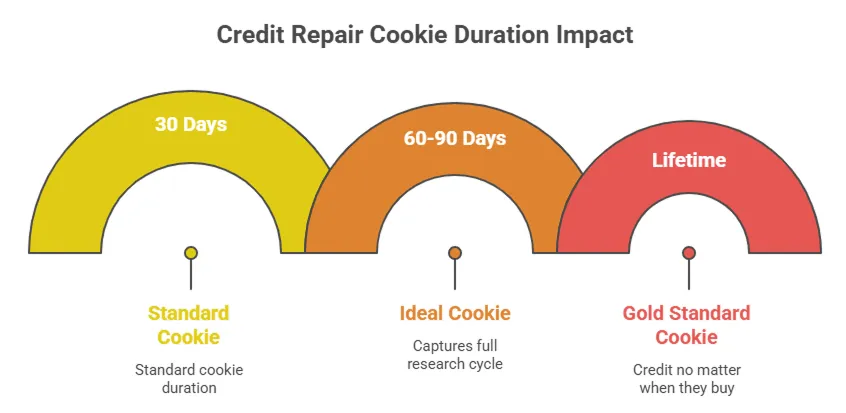

Cookie Duration Impact: Capturing Extended Decision-Making Cycles

Imagine doing the hard work to educate a customer, getting them to click your link, and watching them buy 31 days later—only to earn $0.

This happens constantly in credit repair because of “Cookie Duration.”

A cookie is the digital tag that tracks a user back to your link. If the cookie expires before the customer buys, the “house” keeps the commission.

Credit repair isn’t an impulse buy like a $20 t-shirt. It’s a serious financial decision involving sensitive personal data.

📊 The Data: Industry benchmarks show the average decision time for credit repair services is 7 to 14 days.

🧠 The Behavior: A user reads your article on Monday, checks competitors on Wednesday, talks to their spouse on Friday, and finally buys the following Tuesday.

Most generic programs offer a standard 30-day cookie.

While this captures most sales, data shows that extending that window to 60-90 days can capture an additional 10-15% of conversions.

These are the “procrastinators” and the “deep researchers.”

When comparing two similar programs, always break the tie in favor of the longer cookie.

- Acceptable: 30 Days (Standard, but risky for high-ticket services).

- Ideal: 60-90 Days (Captures the full research cycle).

- Gold Standard: Lifetime/Sticky Cookies (You get credit no matter when they buy).

Bottom Line: Don’t let a short tracking window rob you of earned commissions.

If you create in-depth educational content that targets people early in their research, a 60+ day cookie is mandatory.

Now that you’ve ensured you’ll get credited for the sale (Cookie Duration), the next question is: When does that credit actually turn into cash in your bank account?

Payment Terms and Cash Flow: Understanding NET 30-60 Implications

Getting a $200 commission notification feels great—until you realize you won’t see that money for 90 days, especially when paying for traffic upfront.

Affiliate contracts specify NET 15, NET 30, or NET 60 terms, dictating your wait time after month-end.

With NET 60 terms:

- Earn $1,000 in January

- Month closes January 31st

- Wait through February and March

- Get paid April 1st

💰 Paid Media Buyers:

Long delays are dangerous. Spending $500 on January ads means you’re out-of-pocket for three months, unable to reinvest profits quickly.

You need NET 30, NET 15, or weekly payments to sustain campaigns.

🌱 Organic Creators:

Since you invest time rather than cash, NET 60 is annoying but manageable.

Check the fine print. For paid traffic scaling, weekly or bi-weekly payouts often beat higher commissions with slow terms.

However, payment terms are only part of the equation.

True scaling requires a partner who actively supports your success, not just one who sends checks.

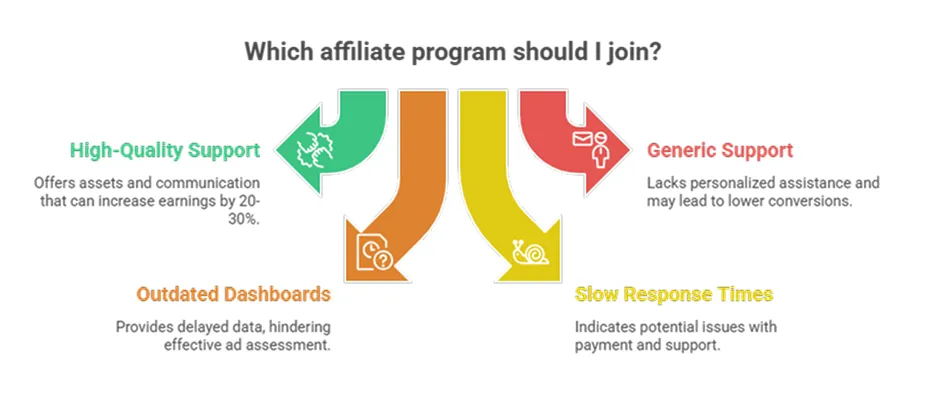

Affiliate Support Quality: The Hidden Profit Driver

Many beginners treat affiliate relationships as “set it and forget it”—grabbing links and disappearing. This is a mistake.

High-quality affiliate support isn’t just a bonus; it’s a profit multiplier. Affiliates who actively use provided assets and communicate with managers can see earnings increase by 20-30%.

Don’t settle for generic “support@company.com” addresses.

You need a real human contact who shares which offers convert best and may boost your commission once you prove your traffic quality.

Professional banners, pre-written email scripts, and tested landing page templates save time. The best programs provide a “business in a box” instead of forcing you to start from scratch.

Outdated dashboards that update weekly are dealbreakers. You need real-time data to assess if your new ad works or wastes money.

If programs take two weeks to respond to applications or ignore your questions, consider it a red flag.

Companies that ignore you while you’re trying to make them money will be worse when payment issues arise.

Prioritize programs treating you like a business partner. Being able to email a manager asking, “My conversions dropped yesterday—is your site having issues?” is invaluable for sustainable success.

How Do You Promote Credit Repair Affiliate Programs Effectively?

Traffic is the fuel for your affiliate business. You can have the best offer in the world, but without eyes on it, you make zero dollars.

The credit repair niche is competitive, but massive. The key is to pick one primary traffic source and master it before trying to do everything. Below are five proven strategies, ranging from “slow and steady” SEO to “pay-to-play” ad campaigns, complete with the real numbers you can expect.

SEO Content Strategy: Ranking for High-Intent Keywords

Build a digital asset that works for you 24/7.

By ranking for specific questions people ask Google, you catch them right when they are looking for a solution.

This is the “farming” approach: it takes hard work upfront, but the harvest lasts for years.

Don’t just write generic posts about “what is credit.” Target specific, painful problems with high search volume:

“How to remove collections from credit report” (~18,000 monthly searches)

“Credit repair services reviews” (~14,000 monthly searches)

“How to fix bad credit fast” (~22,000 monthly searches)

Create detailed guides (2,000–3,000 words) that are better than what is currently ranking.

Compare services honestly and break down the dispute process step-by-step. distinct links between your articles helps build your site’s authority in Google’s eyes.

You also need to take this to heart with SEO content:

- Timeline: 3-6 months to see real traffic.

- Potential: A single top-ranking article can bring in 500-2,000 targeted visitors a month.

- ROI: This offers the highest long-term profit because you stop paying for every click.

Paid Search Campaigns: Immediate Traffic with Google Ads

Skip the waiting game and pay to be at the top of page one immediately. This is the “hunting” approach.

You bid on keywords so that when someone searches for a solution, your ad appears first.

Credit repair keywords are expensive because the customer value is high.

| Metric | Estimated Figures |

| Average CPC | $3.00 – $6.00 per click |

| Daily Budget | $50 per day test budget |

| Daily Traffic | 12 to 15 targeted clicks |

| Conversion Rate | 10% average landing page conversion |

| Sales Generated | 1 to 2 daily sales |

| Sale Payout | $200 revenue per individual sale |

| Total Revenue | $400 daily gross revenue |

| Daily Profit | $350 profit after ad spend |

You must separate Informational Keywords (e.g., “how to fix credit score”) from Commercial Keywords (e.g., “hire credit repair service”).

Informational clicks are cheaper but convert at lower rates (1-2%). Commercial clicks cost more but convert much higher (3-5%+).

It’s important to be realistic about what you will achieve with this approach:

Timeline: Instant. You can have traffic today.

Risk: You can lose money fast if you don’t know what you’re doing. Start small and watch your data closely.

Email Marketing: Building a Subscriber List That Converts at 5-10%

SEO and Ads bring people to your door, but Email invites them into your living room. Most visitors won’t buy credit repair services on their first visit.

They need to trust you first. Collecting an email allows you to “own” the audience rather than renting it from Google or Facebook.

Nobody joins a “newsletter” anymore. You need to offer immediate value in exchange for their email address. High-performing examples include:

“The Free Credit Score Improvement Checklist” (Quick wins)

“5 Credit Mistakes Costing You $10,000 in Interest” (Urgency)

“DIY Dispute Letter Template” (High utility)

Once they subscribe, don’t just send “Buy Now” links. Set up an automated 5-7 email sequence:

- Day 0: Deliver the freebie + a friendly introduction.

- Day 1: Explain why credit scores drop (education).

- Day 3: DIY vs. Professional help (the comparison).

- Day 5: Case study or social proof of the program you promote.

- Day 7: The hard offer/recommendation.

The Reality Check:

- Conversion Rate: Cold traffic converts at 1-3%, but a warmed-up email list often converts at 5-10%.

- Asset Value: Even if algorithms change or ad accounts get banned, you still own your list. It is your safety net.

Social Media Content: Instagram and TikTok for Engagement-Driven Promotion

Credit repair is surprisingly visual.

Seeing a score jump from 520 to 750 is satisfying to watch.

Platforms like TikTok and Instagram allow you to use this visual appeal to drive massive Focus on short-form, visual storytelling.

🦋 Transformation Stories: “Watch how I removed 5 collections in 90 days.” (Always include a disclaimer that results vary).

💯 “Did You Know?” Tips: Fast facts about credit laws (e.g., “Medical debt under $500 shouldn’t be on your report”).

🕵 Myth Busting: “Stop paying ‘credit sweep’ scammers—here is why.”

Social platforms hate affiliate links. If you link directly to an offer, you might get “shadowbanned” (hidden from users).

Instead, use a “Link in Bio” that directs traffic to your own comparison page or email sign-up form.

Accounts that lead with helpful content achieve 3-5x higher conversion rates than those that just post ads.

Unlike SEO, which takes months, a single good video can hit 100k views overnight, driving thousands of visitors to your link for free.

YouTube Video Reviews: Long-Form Trust-Building Content That Ranks and Converts

While TikTok is for attention, YouTube is for trust. Credit repair is a high-trust purchase—people are handing over their social security numbers and sensitive data.

They want to see exactly what they are signing up for before they buy. YouTube allows you to show them.

Don’t make a 10-minute commercial. Make a genuine, balanced review. The best videos (often converting at 5-8%) follow this structure:

The Hook: “Is [Company Name] a scam or legit? I tested it so you don’t have to.”

The Demo: Screen-share the actual dashboard. Show the onboarding process. Show the dispute letter generator. Prove you actually used it.

The Pros & Cons: Be honest about what sucks.

If the customer service is slow, say it. This honesty makes your final recommendation (“Despite the wait times, the results are worth it…”) much more believable.

: You are targeting the “bottom of the funnel”—people who are already 90% ready to buy but just need a nudge. Optimize your titles for:

- “[Program Name] Review 2024”

- “[Program A] vs [Program B] – Which is better?”

A YouTube video is a digital asset. A video you upload today can generate commissions three years from now without you touching it again.

Most affiliates are too lazy to make videos. By just showing your face and screen, you instantly separate yourself from 90% of your competition.

What Are the 4 Critical Compliance Restrictions in Credit Repair Affiliate Programs?

Skip this section and you might as well close shop now.

Gaming affiliate marketing has fewer regulations than credit repair, but violating program terms still gets you banned and commissions seized.

Understand these critical rules to protect your income.

Trademark Bidding Restrictions

You generally cannot bid on brand names in Google or Bing Ads.

Promoting Razer? Don’t bid on “Razer” as a keyword. Companies already pay for those ads and won’t tolerate competition from affiliates.

Daily automated scans catch violations, resulting in commission reversal and immediate ban. Most programs have zero tolerance.

Bid on generic terms like “best gaming mouse” instead of brand names. Some programs allow “Brand + Review” keywords, but get written permission first.

Guarantee Claims

While not federally regulated like credit repair, making false performance claims damages trust and violates FTC guidelines.

Avoid: “Guaranteed 60 FPS” or “Will fix all lag issues”

Use Instead: “Designed for high performance” or “Users report improved gameplay”

Traffic Quality Requirements

Programs paying $50+ commissions aggressively monitor for fraud.

Prohibited sources by laws:

- Incentivized traffic (paying people to sign up)

- Bot traffic/click farms

- Adware/misleading ads

Programs track refund rates, engagement, and retention. Poor quality traffic gets you fired, even without breaking written rules.

FTC Disclosure Requirements

Disclosures must be impossible to miss.

Where to disclose on your platform of choice:

- Blog posts: Top of article before any links

- YouTube: Verbally state it plus first lines of description

- Social media: Use #Ad or #Affiliate in first three lines

Tiny footer links, vague terms like “Partner,” or unclear hashtags like #sp are not enough.

Be transparent. Valuable content earns audience support regardless of commissions. Hiding relationships destroys trust and invites legal trouble.

FAQs

❓ What is a credit repair affiliate program?

A credit repair affiliate program allows you to earn commissions by referring customers to credit repair services. When someone signs up through your referral link, you receive a payout or recurring commission.

❓ Are credit repair affiliate programs legitimate?

Yes. Many well-known companies like Lexington Law, Credit Saint, and The Credit People run legitimate affiliate programs. However, affiliates must follow strict compliance rules regarding financial advertising.

❓ How much can you earn from credit repair affiliate programs?

Most programs pay between $50–$150 per lead or sale, while some offer recurring commissions for subscription-based services.

❓ Do I need financial certification to promote credit repair services?

No certification is required, but affiliates must avoid giving legal or financial advice. You promote the service, not provide credit repair guidance.

❓ Is credit repair affiliate marketing allowed in all countries?

Not always. Many programs only accept affiliates from the US, Canada, UK, or selected regions due to legal compliance.

❓ Can beginners succeed with credit repair affiliate marketing?

Yes, but success depends on trust, education-based content, and compliance. Beginners often start with blog articles and YouTube explainers.

❓ Are credit repair affiliate programs high risk?

They are considered moderate-risk due to regulatory restrictions. Ads must avoid misleading claims like “guaranteed score increase.”

Yes, but many ad platforms restrict financial offers. Native ads, SEO, and content marketing are safer options.

❓ Is credit repair affiliate marketing sustainable long term?

Yes. Credit issues are ongoing worldwide, making this niche evergreen.

❓ Can affiliates promote multiple credit repair programs?

Yes. Many affiliates compare 3–5 providers to improve conversion rates.

Conclusion

Building a credit repair affiliate program on Shopify is a huge opportunity to grow your business.

It’s not about finding a magic trick; it’s about building a solid, compliant program and treating your partners well.

By following this guide, you now have the framework to build a program with a strong legal foundation, the right tech, and a plan to find and support amazing partners.

Remember, your affiliates are your business partners. Give them the tools and support they need, and you’ll build a powerful growth engine for years to come.