Debt settlement helps individuals lower their debt by reaching agreements with creditors to pay a reduced amount. This can help avoid more serious financial issues, such as bankruptcy and wage garnishment.

As the demand for debt relief services grows, the debt settlement industry is expected to increase from USD 2.94 billion in 2026 to USD 5.56 billion by 2034, according to Market Research Future.

Financial bloggers, influencers, and content creators can start earning commissions by promoting debt relief solutions to their audience.

We’ve compiled the 7 best debt relief affiliate programs with detailed commissions, benefits, and program features. Let’s find out which one is the best fit for you!

Quick Comparison

| Program Name | Commission | Cookie Duration | Niche Suitable |

|---|---|---|---|

| National Debt Relief | $27.5/lead + 12% sub-affiliate | 30 days | Debt relief, credit card debt, US finance |

| Debt.com | Up to $1,000/enrollment | 30 days | Debt settlement, credit counseling, US & Puerto Rico traffic |

| CuraDebt | $38–$52/lead + $100–$175/conversion + 10% sub-affiliate | Not specified | Debt relief, tax relief, business debt |

| Oak View Law Group | 20–25%/registration + 12.5% sub-affiliate | N/A | Legal debt relief, bankruptcy, US legal finance |

| Guardian Debt Relief | $32/lead – $45/call – $325/deal + 15% sub-affiliate | N/A | Debt negotiation, legal support |

| Debt Consolidation Care | 20–25%/lead + bonuses ($200–$1500) + 12.5% sub-affiliate | N/A | Credit counseling, debt settlement |

| New Era Debt Solutions | Commission revealed after approval | Unknown | High-debt US clients ($10k+ unsecured) |

Affiliate Earnings Calculator

Estimate your affiliate income based on Traffic, CTR, AOV, and Commission rate. Drag the sliders below to explore different scenarios.

Estimated Results

These figures are for illustrative purposes – feel free to adjust them to fit your specific niche.

- Conversion Rate here is defined as the percentage of traffic that buys.

- Does not account for refunds, cancellations, or varying commission rates by product.

7 High-Commission Debt Settlement Affiliate Programs You Should Join

1. National Debt Relief

National Debt Relief is among the largest debt relief services in the United States. They assist individuals in lowering their unsecured debt, such as credit card balances, personal loans, and medical bills.

When joining the National Debt Relief affiliate program, you will receive a $27.5 commission on each qualified lead you drive. You can also boost your earnings by referring new affiliates and earning 12% commission from the sales they generate.

The brand teams up with Shareasale to run their debt settlement affiliate program. You can join the network to access the brand’s professionally designed banners and exclusive text links for your promotion.

|

2. Debt.com

Debt.com connects users with certified financial professionals to help them manage and settle their debts. The company provides various services, including debt settlement, debt management plans, credit counseling, and consolidation loans.

You can earn up to $1,000 for every successful enrollment made through your site with their debt settlement affiliate program. The cookie will stay valid for 30 days following the customer’s first click on your link.

Affiliates must focus on U.S. or Puerto Rico-based audiences to be eligible for the Debt.com program. You can share the brand’s pre-made links and other materials on your site to promote their debt management and debt settlement services.

The brand will process your commission payments directly through bank transfer on a monthly basis. You’ll receive a personal dashboard to monitor your performance, along with detailed reports to see how well your promotions are doing on different platforms.

|

3. CuraDebt

CuraDebt is one of the longest-standing companies in the debt relief and tax resolution industry. They help individuals and small businesses manage and reduce unsecured debts through debt settlement, tax debt relief, and debt consolidation services.

You can earn commissions for each qualified lead and conversion you refer. You will receive different commissions depending on the specific debt relief service you promote.

- Debt relief: $38/lead + $100/conversion

- Tax relief: $45/lead + $140/conversion

- Business debt relief: $52/lead + $175/conversion

Besides, you can introduce affiliates to the CuraDebt settlement affiliate program and earn a 10% commission on their monthly referral earnings.

The CuraDebt affiliate program offers captivating banners and attractive creatives to support your promotions. Additionally, you can access expert training and guidance to help you connect with the right audience and enhance your marketing efforts.

|

4. Oak View Law Group

Oak View Law Group offers expert legal assistance in debt management, including debt settlement, bankruptcy, and other financial solutions. They offer personalized strategies and legal representation to help consumers manage and resolve their debt problems.

When joining their debt settlement affiliate program, you can earn a generous 20-25% commission on each successful registration you drive. Besides, you can earn an extra 12.5% from the commissions generated by affiliates you refer.

Once your balance reaches a minimum of $100, you can choose to receive commission payments via check, e-check, or direct deposit. The brand offers appealing banners, text links, and sign-up forms to attract your audience and boost conversions effortlessly.

|

5. Guardian Debt Relief

Guardian Debt Relief provides consumers with debt relief services, including debt settlement and debt negotiation. They work with Guardian Litigation Group to provide free legal support to defend clients against lawsuits from creditors.

Their debt settlement affiliate program gives you the opportunity to earn varying commissions depending on the type of lead you generate:

- Pay-per-lead: $32/lead

- Pay-per-call: $45/lead

- Pay-per-deal: $325/deal

Additionally, referring affiliates to the program gives you the chance to earn extra income. You’ll receive a 15% commission for each qualified lead they bring in.

Their affiliate program is managed via ShareASale. Affiliates can sign in to their account and get a unique tracking link to start promoting the brand’s services. Furthermore, the platform offers a smart dashboard to help you stay updated on your performance metrics, such as clicks, sales, and commissions.

|

6. Debt Consolidation Care

Debt Consolidation Care provides various debt relief services, including credit counseling, debt settlement, and consolidation programs. Plus, their educational materials help consumers understand their financial situations, the effects of debt, and the different strategies available for debt relief.

Debt settlement affiliates can earn a high 20-25% commission on every qualified lead generated from their unique link. Once you reach $100 in earnings, you can choose to receive your payment by check or wire transfer.

Not only will you earn commissions from your leads, but the brand will also reward you with bonuses. You can earn large bonuses by referring more leads to Debt Consolidation Care.

- 100 – 149 leads: $200

- 150 – 249 leads: $300

- 250 – 399 leads: $500

- 400 – 699 leads: $800

- 700 – 999 leads: $1200

- Above 1000 leads: $1500

What’s more, you will have the opportunity to refer new partners to this debt settlement affiliate program. For every partner you bring in, you’ll earn 12.5% of the earnings they generate.

|

7. New Era Debt Solutions

New Era Debt Solutions helps people reduce their unsecured debt, like credit card balances, personal loans, and department store cards. They charge a fee between 14% and 23% of the initial debt, and payment is only made once the company has successfully negotiated a reduction.

You can simply register for their debt settlement affiliate program and patiently wait for approval. After becoming their affiliate, you can start promoting by placing your unique affiliate link on your website, blog, or in articles and emails.

However, qualified leads must be based in the United States, excluding Iowa, Maine, and South Dakota. Additionally, they must have at least $10,000 in unsecured credit card debt.

|

How Do You Qualify Leads for Debt Settlement Affiliate Programs?

Generating traffic is only half the battle. In the debt settlement industry, volume means nothing if the leads don’t qualify.

If a user fills out your form but doesn’t meet the specific financial criteria required by the settlement firms, that lead is rejected. That means you earn $0.

That’s why you need to filter the programs using the following criteria.

Minimum Debt Thresholds

The most common reason for a rejected lead is simply not having enough debt.

Most debt settlement programs strictly require a minimum of $10,000 in unsecured debt (combined across all accounts).

Settlement companies typically charge a performance fee of 15% to 25% of the enrolled debt.

If a client only has $3,000 in debt, the fee isn’t enough to cover the cost of legal negotiations and servicing the account for 2-4 years.

Some aggressive programs might accept leads as low as $7,500 or even $5,000. However, the industry standard for a “billable lead” remains at $10k+.

You should note that total debt amount isn’t the only factor. The type of debt matters just as much.

Settlement programs are designed specifically for unsecured debt (debt not tied to collateral like a house or car).

✅ Debts That Qualify (The “Yes” List):

- Credit Cards: The main focus of the industry (Visa, Mastercard, Discover, Amex).

- Medical Bills: Often negotiable, though hospital policies vary.

- Personal Loans: Unsecured installment loans from banks or online lenders.

- Private Student Loans: Sometimes accepted, though much harder to settle than credit cards.

- Collection Accounts: Old debts that have been sold to third-party agencies.

❌ Debts That Do NOT Qualify (The “No” List):

- Secured Debts: Mortgages, auto loans, and title loans. (You can’t settle these without losing the asset).

- Federal Student Loans: These require specific federal programs, not private settlement.

- IRS Tax Debt: This requires tax relief services, which is a completely different market.

- Payday Loans: Usually too small and short-term to fit into a multi-year program.

Bankruptcy Status

Bankruptcy is the hard “stop” signal in lead qualification.

Think of active bankruptcy as a legal forcefield. Once a person files, the court issues an “automatic stay.”

Therefore, you cannot work with anyone who is currently in the middle of bankruptcy.

However, there is a massive difference between someone in bankruptcy and someone considering it.

Here is how to separate the bad leads from the good ones. 👇

Active bankruptcy (Disqualified) 🚫

If a user answers “Yes” to being in bankruptcy, the lead is a no-go. This covers all legal filings. You simply cannot help them right now.

Recently finished (Likely Disqualified) 📉

If someone finished their bankruptcy in the last 6 to 12 months, buyers will usually reject them. Why? Because these people haven’t had time to build up enough new debt to settle yet.

“Considering” bankruptcy (Great Fit) ⭐

This is the sweet spot. Someone who is thinking about bankruptcy but hasn’t filed yet is often the perfect match. They are stressed about money but haven’t taken legal action. You can offer them a way to avoid filing.

Old bankruptcy (Qualified) ✅

If a user filed more than two years ago, they are usually eligible. The old case doesn’t matter anymore. If they have piled up new credit card debt since then, they can still join a program.

Income Requirements

Finding the right client is a balancing act. ⚖️ People must be broke enough to need help, but stable enough to afford the service.

Here is the reality: The debt company does not pay off the debt for the client.

Instead, the client puts money into a special savings account every month. Once there is enough cash in that account, the company uses it to make a deal with the creditors.

To qualify for the debt program, a person needs enough income to cover their basic needs, like rent, food, and lights, plus a monthly payment ($200 to $800)

Companies check this during the first call. They often ask for pay stubs or bank statements.

So, where does the money come from? It doesn’t always have to be a 9-to-5 job. Most programs accept these sources:

- Work: Regular wages or freelance income. 👷

- Benefits: Social security, disability, or pensions. 🏛️

- Support: Alimony or consistent child support. 👶

- Self-employment: They usually need three months of bank statements as proof. 💼

Hardship Verification

Debt and income are just the math. The “hardship” is the real reason the deal gets done. 📉

Banks and credit card companies do not lower debts just to be nice. They only do it if they are scared they will get nothing at all. They would rather get half the money now than zero dollars later.

To make them agree to a deal, the settlement company must prove the client is going through a “financial hardship.” 🆘

These are real-life events that make it impossible to pay the full bill.

- Getting fired or having hours cut

- Getting sick and missing work

- Breaking up often leads to money problems

- When a husband or wife passes away

- A broken roof or a natural disaster

Meanwhile, banks will not help if the person just wants a discount. These excuses do not work:

- “I hate paying high interest.”

- “I want to save extra cash for a vacation.”

- “I am just tired of paying bills.”

Credit Score Considerations

Many marketers think “bad credit” means a “bad lead.” In this business, that is actually wrong.

In fact, a perfect credit score is a bad sign. It proves the person isn’t really in financial trouble yet.

However, the score does tell a story about where they are in their life. Let’s check out the score breakdown below.

The “Falling” Score (550–650) – The Best Lead ✅

The best clients usually fall in this range. They had good credit recently, but they hit a crisis, like losing a job.

Now, their score is dropping fast because of missed payments. They are scared and want to stop the bleeding, so they are ready to act.

The “Bottom” Score (Below 500) – High Risk 🛑

Scores below 500 are tricky. This usually means the person has not paid bills for years.

The courts might already be involved to take money from their paycheck. These cases are very hard to fix, so many programs will turn them away.

Finally, your content must be honest about the trade-off. To make debt settlement work, the client must stop paying their creditors to force a negotiation.

- The consequence: This will tank their credit score further—often dropping it by 100 to 200 points initially.

- The trade-off: The client is trading a temporary credit crash for the permanent removal of $15,000+ in debt.

What Marketing Strategies Work Best for Debt Settlement Affiliates?

Now that you understand who to look for, let’s talk about how to reach them. Below are the strategies that actually get results.

Content Marketing (Organic SEO)

This is the foundation of a profitable business.

Paid ads stop working the second you stop paying, but organic content builds an asset that pays dividends for years.

You need to target specific questions that only a desperate person would ask:

- “How does debt settlement actually work?”

- “Debt settlement vs. Chapter 7 bankruptcy”

- “Is debt settlement worth ruining my credit?”

- “Freedom Debt Relief reviews”

Short, thin content gets crushed in this niche. To rank in the top searches, you need deep, 3,000 to 4,000-word guides.

State-Specific Guides: Debt laws vary by state. A guide on “Debt Settlement Laws in Texas” is often easier to rank than a national guide.

Real Case Studies: Show the math. “How John settled $24k for $12k” (always use compliant disclaimers).

The Honest Review: Admit the downsides, like the credit score drop and tax consequences. Paradoxically, admitting the flaws makes your recommendation stronger.

However, SEO is not a quick fix. You may expect a 6 to 12-month timeline before seeing real traffic.

Paid Search (Google Ads)

If SEO is a marathon, Google Ads is a sprint. It lets you skip the 12-month wait and get in front of desperate users instantly.

But in the debt vertical, that speed comes with high risk and high cost.

You will want users in immediate pain. Some high-intent keywords include:

- “Debt settlement programs near me”

- “Stop collection calls”

- “Can’t pay credit cards help”

- “Negotiate credit card debt”

The biggest barrier is that Google treats “Debt Services” as a restricted category.

Firstly, you can’t just launch an ad. You must apply for “Financial Services Verification” to run debt relief ads in the US or UK.

Secondly, one wrong claim (like promising “Reduce debt by 60%”) can get your account banned permanently.

The solution is to send traffic to an educational article on your site first, rather than direct-linking to the offer.

YouTube Strategy

While Google Ads captures intent, YouTube captures trust.

Debt is emotional. Reading an article helps, but seeing a real person explain the math builds a connection that text can’t match. Video viewers often convert at 2-3x the rate of blog readers.

You don’t need a Hollywood studio; you need authenticity. Here are some types of videos you can consider:

- “Settlement vs. Bankruptcy: Which is Better?” (Use a whiteboard to draw out the pros and cons).

- “5 Debt Settlement Mistakes to Avoid” (Position yourself as the expert protecting them from scams).

- “How to Negotiate with Chase/Amex” (Walk through a mock calculation of savings).

- “My Debt Settlement Experience” (Personal stories about overcoming debt perform incredibly well).

We also suggest several execution best practices.

⏱️Length: Aim for 8 to 15 minutes. This is the sweet spot – long enough to explain the details, but short enough to keep them watching.

🔗Getting Clicks: Always put your signup link in the very first line of the description and in the top comment.

Just like writing articles, you need to be patient. Expect to wait 6 to 12 months to see big results. However, the viewers you get from YouTube are usually the highest quality leads you can find. 🌟

Email Marketing

Search engines and videos are great for finding visitors, but email is the tool that keeps them around. 📧

Most people will not sign up the first time they see your site. They are often researching options, feeling nervous, or just aren’t sure what to do yet.

If they leave without giving you their contact info, you might lose them forever. Email allows you to stay in touch until they feel ready to move forward.

Asking people to simply “join a newsletter” rarely works anymore. To get their email address, you need to offer a free solution to a specific problem.

You can create a simple spreadsheet. Show them the math of paying minimum monthly payments versus using a settlement plan.

Then, give them the exact words to say when banks like Chase or Amex call them. Also, you provide a step-by-step list for becoming debt-free.

After you get their email, avoid spamming them. Instead, you guide them gently through the process over a few weeks.

Day 1 (Welcome): Send the free tool you promised immediately to build trust.

Day 3 (The problem): Send an email titled “Are You In Too Deep?” This helps them figure out how bad their situation really is.

Day 5 (The options): Compare their choices. Explain the differences between consolidation, bankruptcy, and settlement.

Day 7 (The solution): Explain exactly how debt settlement works. This is your first soft suggestion to join a program.

Day 14 (The close): Send a detailed review of a specific company. Make sure to include your signup link.

A good email list produces strong results. You can expect about 20% to 35% of people to open your emails.

Because you have spent two weeks helping these people, they are considered “warm” leads.

This means they are much more likely to sign up compared to strangers who just found your website.

Facebook Groups & Reddit

This strategy costs zero dollars but requires infinite patience.

It is about building a reputation in communities where your audience already hangs out.

- Reddit: r/personalfinance, r/debtfree, r/povertyfinance.

- Facebook: “Life After Debt” or “Credit Card Debt Support” groups.

If you drop an affiliate link in your first post, you will be banned. These groups hate self-promotion.

If you post an affiliate link in your first message, they will ban you. Your plan should be to find people asking simple, clear questions (for example, “Has anyone dealt with a Citibank lawsuit?“).

Write a detailed, helpful answer to explain their choices. Then, you can smoothly add a soft pitch.

You might say, “I’ve seen programs like [Company Name] work well here because they handle the legal work.”

The most important rule: do not link straight to the offer. Instead, you link to a helpful guide you wrote on your own website.

Podcast Sponsorships

If you want to reach a massive audience without building it from scratch, buy someone else’s.

Personal finance podcasts are huge. Listeners of shows about “debt payoff stories” or “financial recovery” are already pre-qualified. They are actively looking for help.

Typical rates are $25-$40 CPM (Cost Per Thousand listeners). A show with 10,000 listeners might cost $250-$400 for a spot.

Always pay for the show’s host to read your ad personally. Listeners trust the host like a friend. Because of this trust, these ads work three to five times better than a generic, pre-recorded commercial.

Nevertheless, podcasts are hard to track. A listener might hear the ad while driving and visit the site days later.

You should use a unique URL (e.g., YourSite.com/MoneyShow) or a promo code to track exactly where your leads come from.

What Legal and Compliance Requirements Apply to Debt Settlement Affiliates?

Now that you have a plan to get leads, you need to know the rules of the game. Making money is great, but staying out of legal trouble is even better.

FTC Telemarketing Sales Rule (TSR) for Debt Relief

In most businesses, breaking a rule might just get your ad account locked. In the debt settlement industry, breaking the rules can get you fined by the federal government. 🏛️

These laws exist to protect people who are already struggling with money. Even though you are just an affiliate, you are not immune.

The government views you as part of the team. If your website makes a fake promise, you are responsible, even if you don’t own the product.

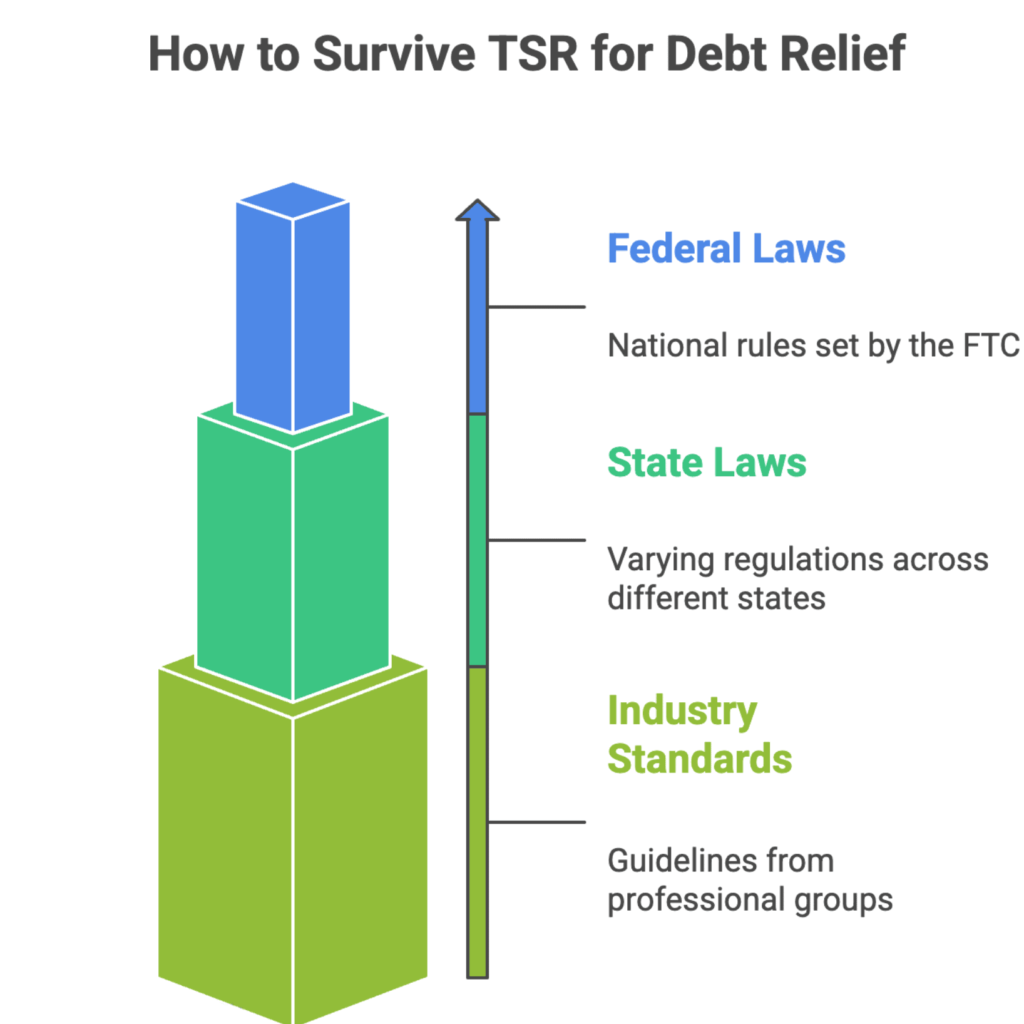

To survive, you must navigate three layers of rules:

Federal Laws: These are national rules set by the FTC. They control how you can sell over the phone and via email.

State Laws: Every state is different. For example, places like Georgia, Vermont, and West Virginia have effectively banned for-profit debt settlement.

Industry Standards: These are guidelines from professional groups that help keep the business honest.

Prohibited Claims (Specific Examples)

Compliance comes down to the specific words you use. The FTC looks for “net impression”—what does the average person think you are promising?

Here is the difference between dangerous hype and compliant copy.

❌ The “Kill Zone” (Never Say This):

Avoid these phrases at all costs. They will get you in trouble.

❌ “Eliminate 50% of your debt!”

You cannot state a specific percentage unless you have data proving this is the typical result for everyone, including drop-outs.

❌ “Debt Forgiveness Program”

“Forgiveness” implies a grant. Settlement is a negotiation. There is a legal difference.

❌ “New Government Debt Program”

Implying a connection to the government is fraud.

❌ “Stop Creditors Immediately”

Creditors can still sue and call during the process. You can’t promise to stop them instantly.

❌ “No Negative Impact to Credit”

This is a lie. Debt settlement always hurts credit scores initially.

Meanwhile, you can say these things to be in the “safe zone”.

✅”See if you qualify for debt relief options.”

✅”Clients who complete the program typically see significant savings.”

✅”Free consultation to evaluate your savings potential.”

✅”Resolve your debt for less than what you owe.”

State-Specific Restrictions

Debt settlement is not legal everywhere. The U.S. has 50 different sets of rules, and some states are hostile to the industry.

If you send a lead from a restricted state to a buyer, that lead will be rejected (and you won’t get paid). Worse, you could be flagged for promoting banned services.

Let’s look at the specific rules.

The “Red Light” States (Stop) 🛑

You should usually avoid these states completely. Most programs cannot legally operate here.

- Georgia

- Vermont

- West Virginia

The “Yellow Light” States (Caution) ⚠️

You can work in these states, but there are extra rules.

- California: You might need to follow strict debt collection laws.

- Colorado: You must use specific legal language on your site.

- Maine: Companies often need a special license here.

So, what should you do?

Geo-Targeting: Block traffic from GA, VT, and WV. This saves you money on wasted clicks.

Dynamic Disclaimers: Add a line near your button: “Service not available in GA, VT, WV.”

Check Your Offer: Every company has a different map. Ask your affiliate manager for their “Accepted States” list before you launch.

Affiliate Disclosure Requirements

Staying legal isn’t just about following debt laws. You also need to follow the basic rules of selling online. ⚖️

The most important rule is honesty. The government requires that if you get paid to recommend a product, your readers must know about it. Being transparent isn’t just the right thing to do; it is the law.

So, what exactly do you need to say?

Basically, you cannot hide the fact that you make money from the companies you review. You must tell your readers clearly. A simple sentence like this works best:

“This article has affiliate links. We earn a commission if you sign up, at no cost to you.”

However, simply writing that sentence isn’t enough. You also have to make sure people actually see it.

Placement: The note must appear before any affiliate links. Putting it at the bottom is not compliant because the user might click before scrolling down.

Clarity: Use plain English. Don’t use vague terms like “partner links.” Say “We earn a commission.”

Repetition: If your guide is 4,000 words long, disclose it at least twice. Remind readers near your comparison tables.

FAQs

What is a debt settlement affiliate program?

It’s a program where affiliates earn commissions for referring leads to companies that negotiate reduced debt balances for consumers.

How do affiliates get paid?

Most programs pay per qualified lead or per enrolled client, with payouts often ranging from $50 to $300+ per conversion.

Is debt settlement legal?

Yes, in many countries, but it’s regulated. Companies must follow consumer-protection and disclosure laws.

Who is the target audience?

Individuals with unsecured debt (credit cards, personal loans) who are struggling to make payments.

Do affiliates need licenses?

Typically no, but affiliates must comply with advertising rules and avoid misleading claims.

What traffic sources work best?

SEO content, paid search, native ads, and email marketing are the most common.

Is debt settlement risky for consumers?

It can impact credit scores and isn’t suitable for everyone, so clear disclosures are essential.

How long do cookies last?

Cookie durations vary by program, usually between 30 and 90 days.

Can affiliates promote internationally?

Some programs are country-specific, while others accept global traffic—always check program terms.

What makes a good affiliate partner?

Transparent offers, compliant marketing materials, reliable tracking, and timely payouts.

Conclusion

To wrap up, the 7 best debt settlement affiliate programs offer fantastic opportunities for marketers to earn commissions. By crafting informative, valuable content, you can build credibility with your audience and boost more conversions. Make sure to review the terms, commission rates, and cookie durations before joining any program to ensure you’re choosing the right fit for your goals.