Insurance is part of basic needs in life to protect policyholders from unexpected financial loss. This industry has always been a massive field for affiliate marketing, with everyone as a potential audience.

As an insurance affiliate, you can connect people with reputable providers, share helpful insights, and earn commissions on successful sales.

We’ve collected the top 16 best insurance affiliate programs from top reliable providers like USAA, Liberty Mutual, and Hiscox. Read carefully to find out which program can match your earning goals.

Quick Comparison

| Program Name | Commission (%) / $ | Cookie Duration (Days) | Niche Suitable |

|---|---|---|---|

| Liberty Mutual | $3–$10 per lead | 30 days | Auto, Home, Renters, Insurance Niches |

| Lemonade | $15–$20 per subscription | 30 days | Renters, Pet, Home, Modern Insurance |

| Hiscox | $25 per quote | 45 days | Small Business, Luxury Property, Specialized Insurance |

| Ethos Life | $55 per sale | 7 days | Life Insurance |

| Next Insurance | $25 per quote | 30 days | Small Business, Contractors, Consultants |

| Everyday Life Insurance | $50–$250 per quote | 30 days | Life Insurance, High Coverage Plans |

| InsureMyTrip | $7 per subscription | 30 days | Travel Insurance |

| World Nomads | $1.5 per quote | 60 days | Travel Insurance, Backpackers, Adventure Travel |

| Aflac | $16 per quote | 30 days | Health Insurance, Supplemental Coverage |

| Allianz Assistance | 10–20% per quote | 30 days | Travel Insurance (Global) |

Affiliate Earnings Calculator

Estimate your affiliate income based on Traffic, CTR, AOV, and Commission rate. Drag the sliders below to explore different scenarios.

Estimated Results

These figures are for illustrative purposes – feel free to adjust them to fit your specific niche.

- Conversion Rate here is defined as the percentage of traffic that buys.

- Does not account for refunds, cancellations, or varying commission rates by product.

16 Top Insurance Affiliate Programs in 2026

1. Liberty Mutual

Liberty Mutual ranks among the top mutual insurance companies with comprehensive options for auto, home, renters, pets, and life. They also have insurance products for specialty lines like marine, energy, and aviation.

Managed through CJ Affiliate, the Liberty Mutual insurance affiliate program offers from $3 to $10 commission per lead based on types of insurance.

- Renters Insurance: $3 commission

- Home Insurance: $10 commission

- Auto Insurance: $10 commission

With a 30-day cookie duration, you can still earn a commission even if customers don’t purchase immediately after clicking on your link.

Liberty Mutual frequently updates promotions to help you drive more conversions and earn extra commissions. You can also ask for custom creatives to improve your content quality and boost engagement.

|

2. Lemonade

Lemonade offers full-stack insurance for renters, homeowners, cars, pets, and life in the US and European countries. They also donate unclaimed premiums to social charities through their Giveback program.

Affiliates need to sign up for Impact Radius to join the Lemonade affiliate program. You can only earn a commission on each subscription for renters and pet insurance.

- Renters: $15 commission

- Pet insurance: $20 commission

The cookie stays on customers’ devices once they click your affiliate link. If they make a purchase within 30 days, you can earn a commission.

|

3. Hiscox

Hiscox provides small and micro businesses with suitable insurance and reinsurance offers. Their services cover personal lines such as high-value household, fine art, luxury motor, and other unique properties.

Hiscox runs their insurance affiliate program via CJ Affiliate and offers a $25 commission per completed quote. The cookie duration remains active for 45 days from the moment customers click on your link.

You should make use of their pre-made banners and links to diversify your content on different marketing channels. You can also put their deals on your website or social media accounts to attract more attention and boost sales.

|

4. Ethos Life

Ethos Life simplifies the life insurance application process by removing the medical exams and blood tests. They offer low coverage from $2 per day to support families in difficult financial situations.

Affiliates can join their insurance affiliate program via Impact and enjoy a $55 commission on each successful sale. You can get your commission as long as customers purchase within a 7-day cookie duration.

You can use any creative assets from their library to create effective promotional campaigns and improve sales. You can also ask your affiliate team for permission before using case studies to create promotional content.

|

5. Next Insurance

Next Insurance customizes small business insurance in various niches like food and beverage, construction, consulting, education, and more. They utilize AI to offer faster quotes and more affordable coverages.

You need to sign up for Impact Radius to join the Next Insurance affiliate program. Affiliates can earn a $25 commission on every qualified quote via their affiliate links.

The cookie remains active for 30 days from the moment customers click on your link. As long as they complete a quote during this period, you’ll get your commission.

|

6. Everyday Life Insurance

Everyday Life Insurance uses advanced technology to evaluate users’ needs and recommend suitable life insurance. They offer life insurance coverage of up to $10 million with terms lasting for 40 years.

Affiliates must sign up for Impact Radius to join the Everyday Life Insurance affiliate program. After being approved for their program, you can enjoy earning from $50 to $250 commission on every qualified quote.

The cookie duration lasts 30 days from the first click of customers on your link. You’ll get a commission if they complete the application process within this period.

|

7. InsureMyTrip

InsureMyTrip compares travel insurance services from over 25 trusted providers to help users make informed decisions. They help travelers find insurance plans for international travel, medical emergencies, and trip cancellations.

The only way to join the travel insurance affiliate program is to sign up for Impact Radius. You’ll get a $7 commission only for each successful subscription.

The cookie duration lasts 30 days, starting from customers’ first click on your affiliate link. That means you can still have a chance to earn credit if customers don’t buy immediately.

|

8. World Nomads

World Nomads offers travel insurance coverage for both short-term and long-term trips globally. Their insurance covers over 150 activities and provides 24/7 access to nearby medical facilities.

The World Nomads insurance affiliate program offers a $1.5 commission across all types of quotes. You can earn a credit for purchases within a 60-day cookie duration starting from customers’ initial click on your link.

World Nomads creates a suite of high-quality content to help you save time when building promotional campaigns. You can also request any creative asset to help boost your website engagement and conversions.

|

9. Aflac

Aflac provides financial protection to millions of policyholders in the US and Japan. Their supplemental insurance pays cash directly to policyholders for all unexpected medical expenses.

Aflac runs their health insurance affiliate program via CJ Affiliate. You can join and earn a $16 commission on every qualified quote. The cookie duration remains active for 30 days from the first click of customers on your link.

You should note that their enrollment period is from September to November yearly. That means you need to create a variety of guides and urgency-driven content to boost conversions during this period.

|

10. Allianz Assistance

Allianz Assistance has provided fully covered global travel insurance and emergency assistance for over 130 years. They are the official insurance partner of Olympics and Paralympics athletes until 2028.

After joining their insurance affiliate program via CJ Affiliate, you can earn from 10% to 20% commission per successful quote. You’ll get around £14 on each sale with an average order value of £70. You will benefit from customers’ purchases within 30 days from their first click on your link.

Allianz Assistance offers a large selection of banners and text links to match your content on both website and social media platforms. They also send regular newsletters with the latest offers to help you promote new deals to your audience.

|

11. USAA

- Commission rate: $4-20

- Cookie duration: 30 days

USAA supplies insurance, banking, and retirement solutions for service members of the US Army Force. Their insurance covers automobile, homeowner, renters’, umbrella, and personal property.

12. Embroker

- Commission rate: $250

- Cookie duration: 30 days

Embroker customizes business insurance based on unique needs and expert guidance. They simplify the underwriting process of comparing, purchasing, and managing insurance policies at reduced costs.

13. Argo Pet Insurance

- Commission rate: £25

- Cookie duration: 60 days

Argo Pet Insurance creates money-saving pet insurance for cats, dogs, and rabbits. They offer 3 types of insurance policies, including Time Limited, Maximum Benefit, and Lifetime.

14. Choice Home Warranty

- Commission rate: $20

- Cookie duration: Not mentioned

Choice Home Warranty protects homeowners from paying high home repair fees with coverage plans. Their optional insurance covers additional appliances like pools, second refrigerators, or stand-alone freezers.

15. Thimble

- Commission rate: $30

- Cookie duration: Not mentioned

Thimble processes quick online insurance for over 140 professions, such as contractors, landscapers, freelancers, and so on. Policyholders can cancel insurance anytime directly on their app without any legal procedures.

16. SquareOne

- Commission rate: $50-175

- Cookie duration: Not mentioned

SquareOne is a top Canadian home and car insurance company for personalized insurance policies. Users can get insured online in less than 5 minutes without filling out any legal documents.

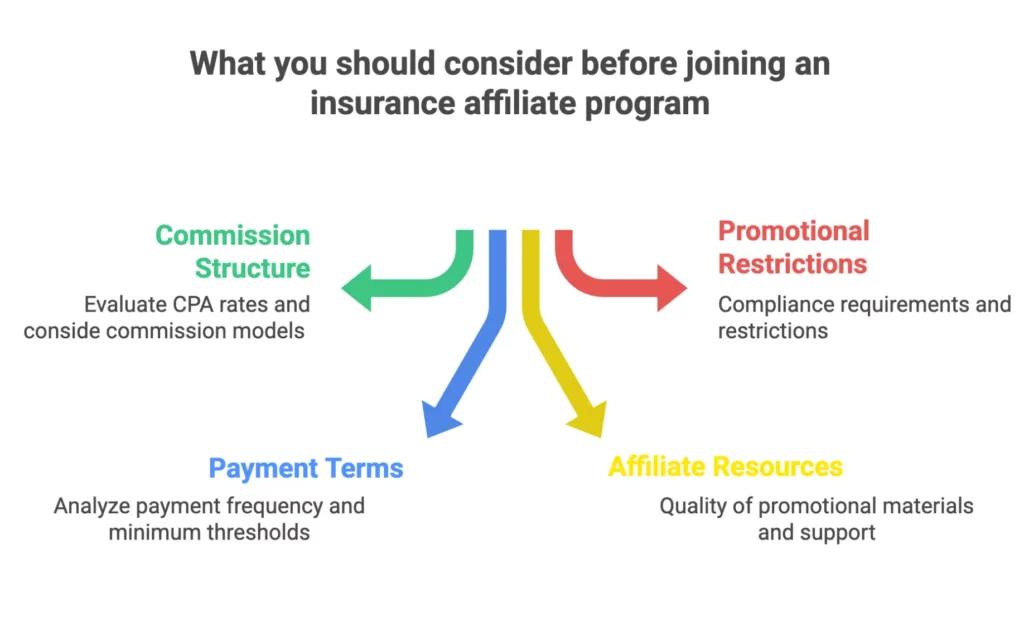

How Do You Choose the Right Insurance Affiliate Program to Join?

Most new affiliates make the same mistake: they join the program with the highest advertised payout. They assume a $100 CPA (Cost Per Action) is automatically better than a $75 CPA.

This is a trap.

In the insurance industry, the advertised commission is often a “vanity number.” The real money is in the details—approval rates, payment schedules, and performance.

Choosing the right program can increase your earnings by 40-60% simply by swapping a difficult program for a high-converting one.

Here is a framework to ensure a program is actually profitable, not just promising.

Evaluate Commission Structure: Looking Beyond Advertised CPA Rates

One concept separates amateurs from pros: the Effective Commission Rate (ECR).

The advertised CPA is what the network says they pay. The ECR is what you actually earn per lead.

Insurance leads often require checks like health questions or credit scores. As a result, not every lead you send will be “payable.”

For example, you send 10 leads to two different programs:

Program A offers a flashy $100 CPA, but strict rules mean only 40% of leads get approved.

Program B offers a modest $75 CPA, but lenient rules mean 70% of leads get approved.

Most beginners choose Program A. But let’s look at the math for 10 leads:

Program A: 4 approved leads × $100 = $400 Earnings

Program B: 7 approved leads × $75 = $525 Earnings

👉 By choosing the “lower paying” program, you earn 31% more revenue.

Knowing that approval rates matter is one thing. However, you also need to know what a “good” rate actually looks like in the real world.

You can use these industry standards to see if a program is playing fair:

- Renters Insurance: 70–85% (Easiest to convert)

- Auto Insurance: 50–70%

- Health Insurance: 45–65%

- Term Life Insurance: 40–60% (Strictest rules)

Moreover, you should check if the program offers tiered commissions. Smart advertisers reward volume because consistent traffic is hard to find.

A tiered structure might look like this:

- Leads 1–20: $50 CPA

- Leads 21–50: $60 CPA

- Leads 51+: $75 CPA

Even if a competitor offers a flat $65, the tiered program becomes more profitable once you scale past 50 leads a month. Always calculate based on where you plan to be, not where you start.

Analyze Payment Terms and Minimum Thresholds: Ensuring Cash Flow Viability

In affiliate marketing, running out of cash is the biggest killer. It actually ruins more businesses than bad ads do.

Imagine you earn $5,000 in January. That sounds great!

But if the program pays slowly, you might not see that money until April. If you used a credit card to pay for your ads, you could go bankrupt while waiting for your check.

To avoid this “cash trap,” you have to check two things: Net Terms and Minimum Payouts.

“Net Terms” is just a fancy way of saying how many days you have to wait for your money after the month ends. Here is the common breakdown:

Net-30 (The Standard): You get paid 30 days after the month ends. For example, your January earnings arrive on March 1st.

Net-60 (The Slow Lane): A 60-day delay. This is common in life insurance because companies want to make sure the customer doesn’t cancel. 🛑

Net-90 (The Danger Zone): A 90-day delay. This is very rare and usually a bad deal for you.

Minimum payout is another thing you should pay attention to. It is the amount of money you must earn before the company sends a check. If you don’t hit that number, your money just sits there.

Here is how these two things can hurt a new affiliate:

Imagine you join a program with Net-60 terms and a $500 minimum payout. Since you are just starting, you earn $300 each month.

Month 1 (January): You earn $300. This is below the $500 limit, so you get nothing. ❌

Month 2 (February): You earn another $300. Your total is now $600. You finally hit the limit!

As you hit the limit in February, the “Net-60” clock starts on March 1st.

Month 3 & 4: You wait all through March and April. ⏳

As a result, your payment finally arrives at the end of April. That is a 90-120 day cash flow gap.

Verify Affiliate Resource Quality

Most beginners treat their affiliate manager like a customer service rep. They only call them when a payment is late or a link is broken.

This is a huge mistake.

In the insurance world, a good program is more than just a tracking link. It is a support system. Data shows that people who use the tools provided by their program earn 25% to 40% more money.

The reason is simple: Speed. When you use proven tools, you don’t waste time guessing what works. 🏃💨

Let’s look at how much time and money you save when you use these resources.

Doing it all yourself

You build everything from scratch. You spend weeks designing pages, writing emails, and testing headlines.

By the time you finish, you have spent $3,000 and two months of your time. You don’t see your first profit until Month 3.

Using managed support

You join a program with a helpful manager. They give you a landing page template that is already proven to work.

You launch your ads in just 48 hours. Because the page is already tested, you are profitable by Week 2. ✅

Review Promotional Restrictions and Compliance Requirements

Insurance is a very strict industry. It isn’t like selling e-books or gadgets. Because insurance involves legal contracts, there are strict laws you must follow.

If you break the rules, you won’t just get a warning. You will likely be banned immediately. Even worse, you will lose all the money you haven’t been paid yet.

That’s why you should watch out for these four major deal-breakers to keep your account safe.

Trademark Bidding (The #1 Ban Reason) 🚫

You cannot use a famous brand’s name to sell your ads. For example, you cannot bid on words like “Geico insurance” or “State Farm rates” in Google Ads.

The Result: Almost every program bans this. If you do it once, you will likely be kicked out of the program instantly.

Paid Rewards (Incentivized Traffic) 🎁

You cannot offer people cash, points, or prizes to get an insurance quote. You might think a “free gift card” will help you get leads, but it is actually illegal in many states. It isn’t just a rule—it’s the law.

Email Marketing Limits 📧

Don’t assume you can just blast out emails. Some programs ban email marketing entirely. Others are very picky. They may require you to use only their “approved” subject lines to make sure you aren’t breaking spam laws.

Misleading Promises 🛑

Never make absolute guarantees that you can’t prove. Avoid phrases like “Lowest Rates Guaranteed” or “Save $500 Instantly.”

What Traffic Sources Work Best for Insurance Affiliate Marketing?

You have selected your niche and picked a high-quality program. Now comes the hard part: getting people to see your offer.

Not all traffic is equal. A visitor from TikTok might be curious, but a visitor searching “best life insurance for seniors” is ready to buy.

Below is a breakdown of the most powerful traffic sources and how to decide which one fits your budget.

Traffic Source #1: Organic Search/SEO

For most successful insurance affiliates, SEO is their #1 source of income. 💸

The reason SEO works so well is because of intent.

When someone types “how to choose life insurance” or “best auto insurance for new drivers” into a search engine, they are actively looking for a solution.

They have a problem, and they want to buy a product to fix it right now.

Thereby, search traffic converts much better than general browsing. People who are searching are ready to take action.

The magic of SEO is that your work “stacks” on top of itself. It looks like this:

Months 1–3: You write 10 articles. Your traffic is near zero, but you are laying the foundation. 🧱

Month 6: You write 10 more articles. Suddenly, your first 10 articles start ranking on Google. Traffic begins to trickle in. 💧

Month 12: You write 10 more. Now you have 30 articles working for you 24 hours a day. 🌊

An article you wrote six months ago can still generate leads and commissions today without costing you another cent.

NOTE: Even if you have a budget for paid ads, you should still start with SEO. It is the best way to prove that your website actually works.

If you can’t get a “free” visitor to click your link, you definitely shouldn’t pay $5 per click to find out why. It’s better to leverage SEO to test your pages and master your strategy before you risk your cash.

Traffic Source #2: Paid Search/Google Ads

Google Ads is the fastest way to get traffic. It is also the fastest way to lose money if you don’t know your numbers.

Paid search works best as a secondary source for affiliates who have already optimized their site.

The goal isn’t just “traffic”—it is profit. You are trying to buy a visitor for $3 and sell them to an insurance carrier for $50.

Before you spend a dime, do the math. Let’s say you earn a $50 commission for a life insurance lead.

| The Math ($50 Payout) | Traffic Outcome | |

| Scenario A: Average | 3% Conv. = $1.50 Max CPC | Not competitive. Likely won’t win any traffic in the insurance niche. |

| Scenario B: Optimized | 8% Conv. = $4.00 Max CPC | Highly competitive. Able to outbid rivals and win premium traffic. |

If those numbers seem high, remember that they are just the average.

In the real world, insurance is one of the most expensive things to advertise on Google. Here is what you can expect to pay for just one click:

- Auto Insurance: $2 – $8 CPC

- Life Insurance: $4 – $12 CPC

- Health Insurance: $8 – $15 CPC

- Medicare: $6 – $18+ CPC

A fact is that 60-70% of beginners who start with paid ads fail because their sites don’t convert well enough to cover these costs.

Our advice for you is not to start with paid ads until you know your website works.

If you can’t get leads from free traffic, you definitely shouldn’t pay $10 a click to find out why. Master your site first, then turn on the ads.

Traffic Source #3: Facebook/Social Media Ads

Social media ads work differently than Google search ads. On Google, you are answering a question. On Facebook, you are interrupting a conversation.

As you are “interrupting” someone’s day, social media traffic doesn’t turn into buyers as often.

A search visitor might take action 8% of the time, while a social media visitor only takes action 2% of the time.

However, social media has one huge advantage: it is very cheap. While a single click on Google might cost $5.00, a click on Facebook can cost as little as $0.10.

However, Facebook and Instagram don’t work for every type of insurance. They work best for specific “life moments.” You should target people who have just gone through a big change:

🏠 Renters Insurance: Target young people in big cities who just moved.

🐶 Pet Insurance: Target people who just became new pet owners.

🍼 Life Insurance: Target newlyweds or new parents.

It sounds easy, but there is a catch. Facebook calls insurance a “Special Ad Category.”

This means you cannot target people by their exact age, gender, or zip code.

This law is intended to prevent discrimination. You have to let Facebook’s computer (the algorithm) do the hard work of finding your buyers for you.

Traffic Source #4: Email Marketing

Insurance is a “timing” purchase. A visitor might land on your site today, but their policy doesn’t expire for another three months. If you try to sell to them today, you lose.

Email marketing solves the timing problem. It allows you to “nurture” a lead until they are ready to buy.

Most affiliates only focus on the immediate sale. Smart affiliates play the long game.

The amateur: Makes a sale to 1% of visitors. The other 99% leave and are gone forever. ❌

The pro: Makes that same 1% sale. However, they also get 12% of visitors to sign up for an email list.

The result is that over the next few months, some of those subscribers finally buy. By staying in touch, the Pro doubles their income from the exact same traffic. 💰

Nevertheless, nobody wants to sign up for a “newsletter.” You need to offer a tool or resource in exchange for their email, such as:

- Checklists: “The New Parent Safety Checklist” (Life Insurance).

- Calculators: “Find Out If You’re Overpaying: The 60-Second Rate Calculator.”

- Guides: “The Renter’s Rights Handbook.”

Once they sign up, automate the emails so you don’t have to send them manually.

Day 0 (Immediate): Send the Lead Magnet. (Welcome).

Day 3 (Education): “The one coverage mistake that costs thousands.” (Value).

Day 7 (Social Proof): “How Jane saved $400 on her policy.” (Trust).

Day 14 (Soft Pitch): “Ready to see your rates? Click here.” (Conversion).

When Are the Best Times to Promote Different Insurance Types?

In affiliate marketing, when you promote is just as important as what you promote.

Insurance isn’t a flat line. It has spikes and quiet periods driven by laws, weather, and bank accounts. Smart timing can increase your annual earnings by 40–80% compared to promoting blindly year-round.

If you treat every month the same, you lose money. You need to align your content and budget with the “harvest seasons” of each vertical.

Here is the blueprint for timing your campaigns for profit.

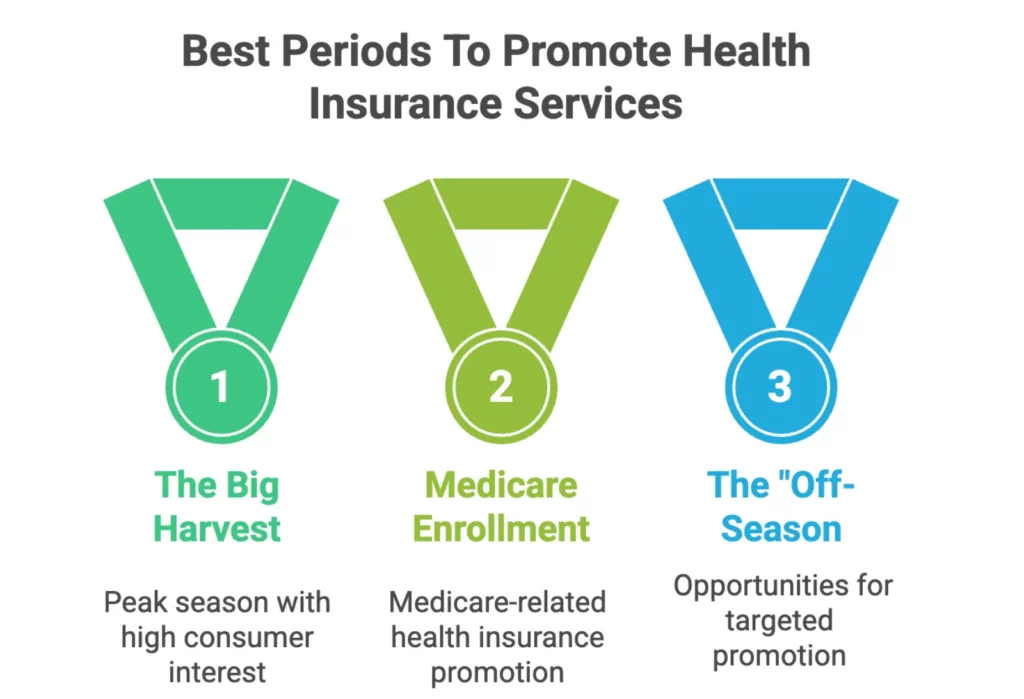

Health Insurance Seasonality: Capitalizing on the November-January Open Enrollment Peak

Health insurance is a “feast or famine” business. This means it is very quiet for most of the year, and then it gets incredibly busy all at once.

For most affiliates, about 75% of their total income is made in a short 10-week window. This is called the Open Enrollment Period (OEP).

To maximize your profits, you should plan your year around these three “buckets” of time:

The Big Harvest (Nov 1 – Jan 15)

During these weeks, the number of people searching for health insurance jumps by 400%.

This is when you should spend most of your ad budget. Everyone is looking for a plan, so it is the easiest time to make a sale.

Medicare Enrollment (Oct 15 – Dec 7)

This short window is when people choose their Medicare plans for the next year. It generates nearly all of the annual revenue for Medicare affiliates.

The “Off-Season” (Feb – Oct)

The rest of the year is much slower. Since people can’t just buy insurance whenever they want, you have to look for “trigger events.” These are life changes that allow someone to buy insurance outside of the normal window.

Auto Insurance Seasonality: Leveraging Year-Round Consistency with Minor Peak Optimization

Unlike health insurance, people buy cars every day. Because drivers must have insurance by law, demand rarely drops off a cliff.

Auto insurance offers the most consistent year-round income. Traffic usually stays within a 20–30% range all year.

While there is no massive “Open Enrollment,” there are four times when demand ticks up:

January (New Year): A 15–20% bump. People make resolutions to save money and shop for better rates.

April (Tax Season): A 10–15% bump. People use tax refunds to buy cars or prepay premiums.

July (Moving Season): A 12–18% bump. People moving to new states often need new policies.

September (Back-to-School): An 8–12% bump. Parents buy cars for college students.

Renters Insurance Seasonality: Maximizing the May-August Moving Season Peak

Health insurance rules the winter. Renters insurance rules the summer.

Profit in the rental market follows the moving trucks. As most leases end in the summer, people need coverage immediately. In fact, smart affiliates earn over half of their yearly income between May and August.

As the weather warms up, search volume for “renters insurance” jumps by 250%. You’ll neeed to prepare for two specific waves of traffic:

The General Mover Wave (May–July) 📦

Most of your visitors will be families and young professionals switching apartments. The sheer number of people looking for a policy is massive during the early summer months.

The Student Rush (August–September) 🎓

The late-summer surge is a hidden gold mine. As students head back to college, searches for “student renters insurance” spike by over 300%.

You can try some specific topics for parents and students, such as

“Does a college dorm room need insurance?”

“Can parents pay for a child’s policy?”

Pet Insurance Seasonality: Maintaining Year-Round Consistency with December Holiday Boost

Pet insurance is different from other types of coverage. Laws or deadlines don’t force people to buy it. Instead, owners buy policies because they love their pets.

Since pets can get sick at any time, demand stays steady all year.

Traffic usually changes by only 20% from month to month. Such stability makes pet insurance perfect for anyone who wants a predictable, monthly income. 📈

However, even a steady market has moments when it grows much faster. The first major jump in traffic happens during the winter season.

Many families adopt “Christmas puppies” or “holiday kittens” in December. Many people decide to buy insurance as a gift for their pets or loved ones.

In fact, searches for “pet insurance as a gift” jump by as much as 300% during the final weeks of the year. 🎁

The holiday excitement doesn’t fade away once the decorations come down. That momentum continues right into the start of the next year as people set new goals.

A second wave of traffic hits in January. Like many New Year’s resolutions, people decide to get their finances in order. Owners sign up for insurance to ensure they never face a surprise vet bill they can’t afford.

FAQs

What is an insurance affiliate program?

An insurance affiliate program allows publishers, marketers, or content creators to earn commissions by referring leads or customers to insurance providers. Compensation is typically paid per lead, quote request, call, or completed policy.

How do insurance affiliate programs work?

Affiliates promote insurance offers using tracking links, landing pages, or phone numbers. When a user submits a form, requests a quote, or completes a call, the affiliate earns a commission based on the program’s payout model.

Are insurance affiliate programs profitable?

Yes. Insurance is one of the highest-paying affiliate verticals, with payouts ranging from $10 to $150+ per lead, and even higher for specialized policies like life, Medicare, or business insurance.

Most insurance affiliate programs pay per lead or per qualified call, not per sale. This lowers friction for users and allows affiliates to earn without waiting for a finalized policy purchase.

What is pay-per-call insurance affiliate marketing?

Pay-per-call programs reward affiliates when a referred user completes a qualified phone call, typically lasting 60–120 seconds. These programs often pay higher commissions because calls convert better than form leads.

Do insurance affiliate programs require licenses?

Affiliates generally do not need an insurance license if they only generate leads. However, some programs restrict wording and prohibit giving policy advice without certification.

Can affiliates promote multiple insurance companies at once?

Yes. Many affiliates use comparison-based content to promote multiple insurers, increasing conversion rates and EPC by letting users choose the best option.

How long does it take to get paid from insurance affiliate programs?

Payment cycles typically range from weekly to monthly, depending on lead validation periods and fraud checks. Pay-per-call programs often pay faster than form-based leads.

Conclusion

We’ve shared the best insurance affiliate programs in the above list. The insurance industry offers you strong earning potential with a broad target audience. Let’s carefully consider insurance services along side commissions to pick the best one for you.