Joining an investing affiliate program can bring significant profits to boost your overall income. The investing industry offers numerous opportunities, with various investing options like forex, stocks, crypto, and more to promote.

According to Gallup, about 162 million US citizens (nearly half of the population) own stock. Many people seek chances in long-term investing to build wealth and achieve financial stability. Therefore, you can make money by introducing ta op investment platform with lucrative numbers for them.

In this article, we’ve gathered 15 best investing affiliate programs for you. Read through and consider each program carefully to apply for the right one.

Quick Comparison

| Program Name | Commission (%) / Fixed | Cookie Duration (Days) | Niche Suitable |

|---|---|---|---|

| Ally Invest | $25 per purchase (≈ fixed CPA) | 30 days | Investing, automated portfolios, fintech |

| Robinhood | $20–$50 per action (funded account / Gold) | 7 days | Stocks, crypto, trading beginners |

| Money Metals | $16 per new customer | 30 days | Precious metals, bullion investing |

| Pepperstone | $340–$750 CPA | N/A | Forex trading, CFD, pro traders |

| The Motley Fool | $24–$480 CPA | 7 days | Stock picks, investing education |

| Bitbond | 30% commission | N/A | Crypto, blockchain tokenization |

| Forex Mentor | 30% commission | 60 days | Forex courses, investing education |

| Zacks Trade | $70 CPA | 7 days | Stock trading, brokerage |

| Coinbase | 50% commission on trading fees | 30 days | Crypto exchanges, DeFi |

| Rocket Dollars | 15% per new account | 30 days | Retirement investing, IRA/401k |

Affiliate Earnings Calculator

Estimate your affiliate income based on Traffic, CTR, AOV, and Commission rate. Drag the sliders below to explore different scenarios.

Estimated Results

These figures are for illustrative purposes – feel free to adjust them to fit your specific niche.

- Conversion Rate here is defined as the percentage of traffic that buys.

- Does not account for refunds, cancellations, or varying commission rates by product.

Best Investment Affiliate Programs: 15 Top Offers of 2026

1. Ally Invest

Ally Invest provides investment options for users of all budgets with an automated portfolio. They integrate with other Ally Financial services to help clients manage their banking and investments in one place.

The Ally Invest affiliate program offers affiliates a commission starting at $25 per successful purchase. You can get an approved commission if customers purchase within a 30-day cookie duration.

Affiliates can easily join their affiliate program via CJ Affiliate. You only need to create an account and find the Ally Invest affiliate program to apply for.

|

2. Robinhood

Robinhood creates a diverse investing market for traders in crypto, trading, and stocks. Their investing service requires no account minimums to join with safe and secure account protection.

Once you join their investing affiliate program through Impact, you can earn up to $50 commission based on subscription types:

- Funded account: $20 commission

- Gold subscription: $50 commission

You can earn a commission for purchases within a 7-day cookie duration. Plus, you’ll receive monthly payouts if your account balance is at least $50.

Affiliates can attend exclusive events of Robinhood and receive special offers throughout the years to boost their marketing efforts. Moreover, you can put their exclusive promotions in your campaigns to boost more attraction and conversions.

|

3. Money Metals

Money Metals is an online bullion exchange of investment-grade products such as gold, silver, platinum, and more. Their service mainly helps large US retail customers with suitable savings plans and secure storage solutions.

Managed by ShareASale, this metal investing affiliate program allows affiliates to earn $16 per new customer. You can only get a commission if new customers make their first trade. The cookie duration lasts for 30 days from customers’ first click on your affiliate link.

Money Metals provides a variety of promotional assets to fit your marketing channel. You can select from their library of text links and banners to create attractive investing content. You should also utilize email creatives with visually appealing graphics to grab more attention.

|

4. Pepperstone

Pepperstone handles billion-dollar investing trades for thousands of users every day. The brand supports well-known trading platforms, such as MetaTrader4, TradingView, and cTrader, to help beginners.

The Pepperstone investing affiliate program offers affiliates from $340 to $750 on every successful subscription via affiliate links. Keep in mind that the commission payouts vary based on the client’s registration country.

You can receive payouts via wire transfer within 15 days of your payment request. However, you must meet a $500 payment threshold to receive your earnings.

|

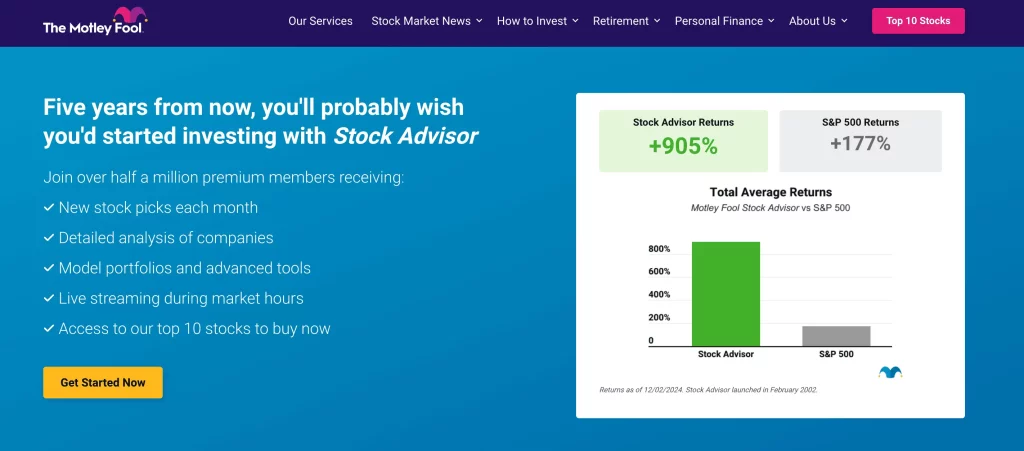

5. The Motley Fool

The Motley Fool helps investors achieve their financial goals with personal advice on managing money and investing. They provide stock recommendations, detailed market analysis, and educational resources to boost client’s wealth over time.

You must sign up for Flexoffers to join the Motley Fool investing affiliate program. You can earn commissions between $24 to $480 depending on the type of customer purchases.

The cookie duration lasts for 7 days, starting from customer’s initial click on your link. If they purchase within a week, you can earn an approved commission.

|

6. Bitbond

Bitbond is a leading asset tokenization that allows users to borrow or invest in Bitcoin currencies. They deliver powerful blockchain financial technology to help clients create digital versions of bonds.

After joining their crypto investing affiliate program, you can enjoy a 30% commission rate on every successful subscription. You’ll receive monthly commission payouts in cryptocurrencies like ETH, MATIC, AVAX, and BNB.

As a Bitbond affiliate, you can give your audience a 10% discount code to encourage more purchases. These codes last one year, and you can create a new one after they expire.

Their affiliate program is available for crypto influencers, content creators and organizations in investing. However, you must have at least 1,000 followers to join their program if you’re a crypto influencer.

|

7. Forex Mentor

Forex Mentor provides forex investors with detailed educational resources and professional mentorship programs. Their courses and programs cover technical analysis, risk management, and market psychology.

If you join this investing education affiliate program, you can earn a 30% commission rate on each qualified purchase. You’ll get your credit for any purchase made within 60 days from customers’ first click on your link.

ShareASale processes your affiliate payouts on the 20th of each month. You can receive your earnings via check, direct deposit, wire transfer, or Payoneer.

Forex Mentor updates their marketing tools on the ShareASale dashboard. You can use both banners and text links in your content to improve promotional results.

|

8. Zacks Trade

Zacks Trade is an online broker designed for traders and investors with access to multiple trading platforms. Their low-cost service offers high-performance trading tools suitable for both professionals and beginners.

The Zacks Trade affiliate program is run by CJ Affiliate, offering a $70 commission rate per new account. Plus, they pay affiliates $5 to around $15 on every qualified lead via affiliate links. The cookie duration remains active for 7 days from the moment customers click on your link.

You’ll receive regular sales and content tips from their affiliate team to improve your promotion plans. Moreover, Zacks Trade pays higher commissions for affiliates with high-quality referred accounts.

|

9. Coinbase

Coinbase creates a global cryptocurrency exchange platform for people to trade, buy, or sell Bitcoin, Ethereum, and more. They also provide investors with educational resources to help them make a real crypto investment.

You can join their investing affiliate program and earn a 50% commission rate on each new customer’s transaction on Coinbase. You’ll also earn a commission on every trade in the next 3 months.

Once customers click on your link, you have 30 days to get a commission from their purchase. Coinbase transfers payouts directly to your bank account or PayPal upon request.

|

10. Rocket Dollars

Rocket Dollars allows users to invest in alternative assets through their self-directed retirement accounts. Users can choose from different types of accounts, such as Traditional IRA, Roth IRA, or Solo 401(k).

When joining the Rocket Dollars investing affiliate program, you can get a 15% commission rate on every new account made via your affiliate link. The cookie duration starts tracking for 30 days once customers click on your link.

You can use their display ads and videos in various content like blogs, instructional videos, or social posts to boost engagement. They also provide attractive content to save you time on building promotional campaigns.

|

11. Golden Eagle Coins

- Commission rate: 15%

- Cookie duration: Not mentioned

Golden Eagle Coins runs a large inventory of over 5,000 coins and precious items for online deals. They use advanced encryption technology to protect users’ sensitive information during trading processes.

12. Lifetime Investors

- Commission rate: 50%

- Cookie duration: Not mentioned

Lifetime Investors offers investment courses and coaching programs for beginners. They also develop market trend advisories to inform users about the correct time to invest.

13. Wall Street Journal

- Commission rate: $30

- Cookie duration: 7 days

Wall Street Journal publishes the latest finance news about stock prices, bonds, and other commodities. They also include investing insight and guides in all articles to educate both beginners and experienced readers.

14. Binance

- Commission rate: 30%

- Cookie duration: Not mentioned

Binance is one of the biggest blockchain systems for digital asset exchange and investment. Investors can also explore earning chances in staking, savings, and yield farming from Binance Earn.

15. Coinrule

- Commission rate: 30%

- Cookie duration: Not mentioned

Coinrule helps investors build their personal trading and investing strategies with automated tools. They also create pre-designed templates to help users evaluate investment risks before starting their plans.

Why Should You Promote Investing Affiliate Programs?

Most new affiliate marketers make the same mistake: they choose a niche based on “passion” rather than business logic.

The investment niche is different. It is one of the few markets where traffic quality matters more than traffic volume.

Because financial companies make high profits from each customer over time, they can afford to pay affiliates significantly more than retail or lifestyle brands.

In this section, we’ll break down the specific economic advantages that make this niche worth your time.

The High Commission Potential That Outpays Most Affiliate Niches

Investment commissions often look too good to be true. Payouts in the finance world are much larger than what a person finds in tech or retail.

To understand the opportunity, you have to look at the Cost Per Acquisition (CPA) economics.

When you refer a customer to buy a book on Amazon, that customer is worth a small, one-time profit. But when you refer an active trader to a brokerage, that customer generates revenue for years.

Data from the brokerage industry suggests that an active retail trader generates between $500 and $5,000+ annually in platform fees. As the customer value is so high, brokers are willing to pay a premium to acquire them.

Here is how that difference plays out for you:

The “Retail” Trap (Amazon Associates): You promote a $50 investment book. With a ~4% commission, you earn $2.00.

The “Investment” Advantage (Webull/Tastytrade): You promote a brokerage account. Webull often pays $60–$75 per funded account. Specialized platforms like Tastytrade can pay $200+ per referral.

Let’s look at a concrete comparison of two websites with identical traffic, each generating just 10 qualified sales per month:

|

Program A (“Big Payout”) |

Program B (“Modest” Winner) |

|

|

Commission |

$150 |

$75 |

|

Conv. Rate |

1% (Hard to sell) |

3% (Trusted/Easier) |

|

Result (1k Clicks) |

10 sales |

30 sales |

|

Total Revenue |

$1,500 |

$2,250 |

|

EPC |

$1.50 |

$2.25 |

Evergreen Market Demand Across All Economic Cycles

A common myth is that the investment niche only works during “Bull Markets” when everyone is making money.

If you were selling crypto-mining rigs or speculative NFT courses, that might be true. Those are cyclical trends—they boom when prices are up and vanish when prices crash.

However, fundamental investing is different. The demand doesn’t disappear during a downturn; the motivation simply changes.

In good times (Bull Markets): People are driven by “FOMO,” or the fear of missing out. They search for things like “how to start trading” and “best growth stocks.”

In bad times (Bear Markets): People are driven by a need for security. They search for “recession-proof assets” or “high-yield savings accounts” to protect what they have.

If you look at search data for “best investment apps” over the last five years, you won’t see wild spikes and crashes. Instead, you see a steady line of interest that stays high year after year. 📊

Multiple Specialized Sub-Niches for Targeted Positioning

You don’t need to compete with giant finance sites. The investment world is huge. You can win by picking one small, profitable slice of the market.

Here are four specific groups you can focus on:

The Passive Investors 🤖

These people use “Robo-Advisors” to grow their money automatically. These tools are easy to promote because they are simple and cheap to start.

The Active Traders 📈

These users trade stocks and options every day. They use complex tools and pay many fees. Because they trade so much, they can earn you much higher commissions.

The Crypto Fans ₿

This group is usually young and tech-savvy. They use different apps than traditional stock buyers. This is a great way to reach a whole new audience.

The Income Seekers 🏠

They want steady cash from dividends or real estate. They want long-term safety and regular payouts.

Recurring Revenue Potential Through Revenue Share Models

Once you pick a specific niche, you can unlock a powerful way to make money called “Recurring Revenue.”

Most people are used to being paid once for their work, but revenue sharing works differently.

Standard affiliate programs pay a one-time “bounty” for each sale. It is like hunting; if you don’t catch anything today, you don’t eat. Stopping your traffic means your income hits zero immediately.

With Revenue Share, you earn a percentage of the money the company makes for as long as your referral stays active. One loyal customer can pay you for years.

Let’s look at the actual math to see how the system works in the real world.

Imagine you refer one active trader to a broker. If that trader generates $500 in fees for the company each month, and your share is 25%, you earn $125 each month.

A single referral may seem small at first, but the total adds up fast as you find more people.

Referring just two traders a month gives you 24 active users by the end of the year.

Suddenly, you are earning a “salary” of $3,000 every month, even if you take a vacation.

By choosing the revenue share path, you stop trading your time for money and start building an asset. You are a business owner with a steady income that pays you while you sleep.

How to Choose the Right Investing Affiliate Program?

Picking the right partner is the most important step for your business. Not every company offers high payouts or takes good care of its customers.

Let’s follow these simple steps to find an investing affiliate program that pays you well.

Evaluate Commission Structure vs. Conversion Potential

The biggest mistake new affiliates make is chasing the highest payout without asking: “How hard is it to get this money?”

In the investment niche, there is a direct link between the Commission Amount and the Barrier to Entry.

High commissions ($300+) usually come with high friction (large deposit requirements), while lower commissions often convert significantly better.

Let’s compare two real-world scenarios to see why the highest payout isn’t always the winner.

|

Scenario A (Low Friction) |

Scenario B (High Ticket) |

|

|

Brand example |

Webull |

Premium Traditional Broker |

|

Payout |

$60 per lead |

$300 per lead |

|

User requirement |

Deposit $0.01 |

Deposit $5,000 (90-day hold) |

|

Conversion rate |

8–12% (High) |

1–2% (Low) |

|

Key advantage |

Near-zero barrier to entry. |

High individual payout. |

If you send 100 qualified visitors to both offers:

-

Webull: 10 conversions (10%) x $60 = $600

-

Premium Broker: 1 conversion (1%) x $300 = $300

So the lesson is don’t be seduced by the big number. You will often make double the revenue promoting a “cheaper” offer simply because the conversion friction is lower. Always ask: Does the user need to deposit $5 or $5,000 to trigger my payout?

Verify Program Reputation and Support Quality

You must ensure a partner is honest before you sign up for any program.

Some unethical companies steal money by hiding your valid sales. The practice is known as “shaving,” and it can ruin your business overnight.

When finding a reliable partner, you need to check a company’s reputation beforehand. Using a few simple checks will protect your hard work and your future income.

The first check involves searching for reviews from other affiliates rather than customers.

Industry forums will show if people complain about missing money or tracking errors. If other professionals are reporting issues, you should find a different partner immediately.

Beyond forum reviews, the speed of communication is another important sign of a good program.

You can test a company by emailing the affiliate manager with a basic question. A manager who takes more than three days to reply will likely be even slower when a payment problem occurs.

Once you know the manager is responsive, you need to look closely at the payment schedule.

Getting paid within 30 days is the standard for most healthy companies. A wait of more than 60 days is a major warning sign that the business may have financial problems.

Match Program to Your Audience Profile

Even a great program will fail if it does not fit your specific audience.

Promoting complex tools to someone who is just starting to save will quickly destroy their trust. You need to pick the right tool for the right person to be successful.

To find the best match, you should look at how much money and experience your readers have.

You need to group your readers by experience, capital, and investing style. This matching process is the best way to predict your success in the investment world.

The Beginner (Capital: <$1,000) 🐣

These users are intimidated by charts and jargon. They want simplicity.

-

Best Fit: Robinhood or Webull.

-

Why: Extremely simple interface, fractional shares, and low/no deposit minimums.

The “Set-and-Forget” Investor (Capital: $1,000–$10,000) 🏦

These people have savings but no time to trade active markets. They want automation.

-

Best Fit: M1 Finance or Betterment.

-

Why: Automated rebalancing and “pie” based investing make it easy to manage a portfolio.

The Active Trader (Capital: $10,000+) ⚡

These users demand speed, execution quality, and advanced charting. They will ignore simple apps.

-

Best Fit: Tastytrade, Interactive Brokers, or TD Ameritrade.

-

Why: Professional-grade tools and lower margin rates.

Review Promotional Restrictions and Compliance Requirements

Finding the perfect program is exciting, but you must first understand the legal rules.

The financial sector is strictly regulated by law. Breaking these rules can lead to lost commissions or even serious legal trouble.

Strict rules exist because financial products carry more risk than regular goods. You should review the terms and conditions for common deal-breakers before you start.

One major rule involves “Branded Keyword Bidding.“

Most brokers forbid you from buying search ads for their specific company name. Using a brand name in your ads will result in an instant ban.

Next, paying people to sign up is also prohibited. People call such a practice “Incentivized Traffic.“

Offering cash or gifts to new users brings in low-quality leads that companies do not want. You must attract real investors who are genuinely interested in the service.

Finally, you must also include specific legal disclaimers on your website.

You are required to state clearly that “investing involves risk” and that “capital is at loss.” Missing these warnings can cause a company to suspend your account immediately.

The need for warnings means you should always work as if a government regulator is reading every word.

Transparency is the best way to protect your business and your readers. You must never promise guaranteed returns or tell people to invest money they cannot afford to lose. 🛡️

What Should You Promote in the Investing Affiliate Niche?

Many new affiliates think “investing” just means promoting stocks. In reality, the investing niche is a massive ecosystem of tools, platforms, and services, each with its own economic model.

To maximize your revenue, you need to understand the full menu of products available to you. Some products offer quick, one-time cash payouts, while others build long-term recurring wealth.

In this section, we will categorize the major product types you can promote. Let’s dive in.

Investment Platforms and Brokerages

This is the bread and butter of the investing niche.

No matter what strategy your audience follows, whether they are day traders or passive savers, they all need a place to put their money.

You have a diverse range of platforms to choose from:

-

Stock & ETF Brokers: Powerhouses like Webull, TD Ameritrade, and Interactive Brokers serve the core market.

-

Crypto exchanges: Platforms like Coinbase, Binance, and Kraken serve the digital asset crowd.

-

Robo-advisors: Betterment and Wealthfront dominate the passive investing space.

-

Specialized platforms: Tastytrade (options) and Fundrise (real estate crowdfunding) target specific sub-niches.

This category offers the highest volume earning potential.

Most platforms operate on a CPA (Cost Per Acquisition) model, paying you a one-time fee for every funded account.

The payout range is typically $50–$150 for standard accounts, spiking to $300–$600+ for premium or high-deposit accounts.

Especially, some platforms, particularly in crypto (Binance) and forex (Interactive Brokers), offer Revenue Share models. You may earn 10–50% of the trading fees your referrals generate forever.

Trading and Investing Education

High profit margins mean you can promote a wide variety of learning materials. These options range from basic online classes to expensive personal mentorships. You might choose to focus on day trading academies that teach fast-paced strategies to active users. 📈

While some people want fast results, others prefer learning about options or swing trading through specialized courses. You can also target long-term investors who want to study fundamental analysis and value investing. No matter the topic, educational products usually pay a percentage of the total sale rather than a small flat fee. 🎓

Earning a percentage is often better for your business because the payouts are very generous. Commissions typically fall between 20% and 40% of the course price. For example, selling one $997 course with a 30% commission puts $299 in your pocket immediately. 💰

A single education sale earns you much more than a standard brokerage referral. Some premium mentorship programs even pay $1,000 to $2,000 for every new student you find. Focusing on education allows you to turn small amounts of traffic into significant, long-term profits. 🚀

While platforms are the tools, education is the manual.

Selling knowledge is often harder than giving away a free app, but the payouts are significantly higher because digital products have near-zero overhead.

High profit margins mean you can promote a wide variety of learning materials.

-

Day trading academies: Programs like Warrior Trading or Investors Underground teach active trading strategies.

-

Options & Swing trading: Specialized courses from providers like Option Alpha or Tastytrade‘s educational arm.

-

Value investing: Long-term strategy courses for fundamental analysis.

A single education sale earns you much more than a standard brokerage referral. Some premium mentorship programs even pay $1,000 to $2,000 for every new student you find.

Trading Tools and Software

For serious traders, trading is a business. Just like a builder needs a hammer, a trader needs professional tools.

In the gold rush, the people who sold picks and shovels often made more money than the miners. You can do the same by sharing these tools with your audience.

Traders are happy to pay a monthly fee for the best gear. The most popular categories include:

Charting & Analysis: TradingView is the industry standard for web-based charting. TC2000 is a favorite among desktop power users.

Stock screeners: Tools like Finviz Elite or Stock Rover help investors filter thousands of stocks to find opportunities.

Specialized calculators: OptionStrat helps derivatives traders visualize complex profit/loss scenarios.

These tools typically cost between $15 and $60 per month.

Most SaaS (Software as a Service) tool programs offer a 30% lifetime recurring commission. The math is simple:

-

Refer 1 user to a $50/month charting package, and you earn $15/month.

-

Refer 100 users, and you have $1,500/month in passive income.

Tax Software for Investors

While platforms and education help your audience make money, there is one category that is mandatory for keeping it: Tax Software.

Unlike a course or a tool, which is a choice, tax compliance is a requirement. This urgency creates incredibly high conversion rates, particularly during tax season.

For general investors, standard solutions like TurboTax or H&R Block are the go-to. However, the real affiliate opportunity lies in specialized software for complex assets:

-

Crypto tax tools: CoinTracker, Koinly, and CryptoTrader.Tax are essential for anyone trading digital assets, as exchanges often provide poor tax reporting.

-

Trade logging: TradeLog helps active day traders handle complex “wash sale” rules that general software misses.

The payouts here are generally smaller but come with high volume.

Most programs pay a flat CPA of $15–$50 per sale, depending on the tier the user purchases.

Due to seasonal characteristics, you may expect to generate 60–70% of your annual revenue between January and April.

Investing Books and Informational Products

Finally, we have the entry point for almost every investor: Books.

Promoting books won’t make you rich directly. The commissions are tiny. However, books play a vital role in a business strategy because they help build deep trust with readers.

Thereby, you can suggest timeless classics about value investing or niche guides on technical trading.

Most people use Amazon Associates for these links, but Bookshop.org pays a much higher 10% commission.

Even with those higher rates, the total earnings from books remain relatively low.

A $20 book on Amazon only earns about $0.80 per sale. Even selling 500 books a month only yields around $9,000 in total income a year. 💰

Despite the small payouts, the real goal is to win a customer rather than a single commission.

When someone clicks an Amazon link for a book, you receive a tracking “cookie” for 24 hours. You earn a share of everything else the person buys during that window, including electronics or household goods.

Beyond earning extra commissions, recommending high-quality books proves you care about helping people.

A book acts as a “gateway” to much bigger sales in the future. A reader who buys a $20 book on options today is the perfect candidate for a $2,000 trading account next month.

FAQs

What are investing affiliate programs?

Investing affiliate programs allow publishers to earn commissions by referring users to investment platforms, brokers, robo-advisors, trading apps, or financial education products. Commissions are typically paid per lead, per funded account, or as a revenue share based on trading activity.

Are investing affiliate programs profitable?

Yes—investing affiliate programs are among the highest-paying affiliate niches. Commissions can range from $50 to $1,000+ per conversion, depending on the platform, country, and user qualification (e.g., funded account vs. free signup).

Do I need to be a licensed financial advisor to promote investing affiliates?

No. Most programs do not require a financial license. However, affiliates must include proper disclaimers and avoid giving personalized investment advice. Content should be educational and informational, not prescriptive.

Is affiliate marketing for investing legal?

Yes, investing affiliate marketing is legal in most countries. However, platforms are heavily regulated, and affiliates must comply with local advertising laws, financial disclosures, and platform-specific compliance rules.

How long does it take to earn commissions from investing affiliates?

Results vary, but with SEO-based strategies, most affiliates see initial conversions within 3–6 months, with compounding revenue over time as content ranks and trust builds.

Do investing affiliate programs pay recurring commissions?

Some do. Platforms offering revenue share or subscription-based tools can generate monthly recurring commissions, making them attractive for long-term passive income strategies.

Conclusion

It’s clear that the earning opportunities for affiliates in the investing niche have more potential than others. The target audience is willing to spend much as long as your promotional content is appealing and reliable. Let’s join the right program and build effective strategies to gain success in this niche.