Many people nowadays rely on payday loans to cover emergencies like medical bills, car repairs, or unexpected expenses. This constant demand makes payday loans a high-demand niche with amazing earning potential for affiliates.

There are not many affiliate programs in this niche, but we’ve researched and found some amazing offers. Let’s consider these top 10 payday loan affiliate programs carefully in this article to find your perfect match.

Besides payday loans, you may be interested in other loan affiliate programs such as personal loans, auto loans, and business loans.

Quick Comparison

| Program Name | Commission (%) / Amount | Cookie Duration (Days) | Niche Suitable |

|---|---|---|---|

| Round Sky | Up to $250 per lead | Not specified | Payday loans, installment loans, title loans |

| Profitner | 90% Revshare / $230 per lead | Not specified | Payday loans, personal loans, financial offers |

| Volsor | 1 Kč – 300 Kč per lead (tiered quality) | Not specified | Payday loans, short-term loans in EU region |

| Viva Payday Loans Australia | 90% per lead | Not specified | Australia payday loans, low-credit borrowers |

| Lead Stack Media | 90% per lead (~$300) | Not specified | Payday loans, installment loans, insurance |

| OppLoan (via Impact) | $100 per lead | 15 days | US installment loans, personal loans |

| Zappian | Up to $250 per lead | Not specified | Loans, insurance, financial lead gen |

| Credit Clock | $350 per lead | Not specified | Bad-credit loans, same-day loans |

| LEAD Network | Negotiated commissions | Not applicable | Loans, insurance, legal, phone call leads |

| CashNetUSA | Custom commission by product | Not specified | Payday loans, installment loans |

Affiliate Earnings Calculator

Estimate your affiliate income based on Traffic, CTR, AOV, and Commission rate. Drag the sliders below to explore different scenarios.

Estimated Results

These figures are for illustrative purposes – feel free to adjust them to fit your specific niche.

- Conversion Rate here is defined as the percentage of traffic that buys.

- Does not account for refunds, cancellations, or varying commission rates by product.

Top 10 Best Payday Loans Affiliate Programs for Finance Bloggers

1. Round Sky

Round Sky generates and processes leads for payday loans, title loans, and installment loans. They help online buyers find trusted lenders with affordable and suitable financial solutions.

You can join their payday loans affiliate program and enjoy up to a $250 commission per successful lead. Round Sky pays affiliates on a weekly or bi-weekly basis via ACH, PayPal, wire transfer, or check.

You can customize their pre-made website templates to match your brand and marketing style. Moreover, you can embed widgets like forms, search boxes, and product displays on your site via IFrame widgets to generate more leads.

|

2. Profitner

Profitner ranks as a top payday loan affiliate network in the US for affiliates. They update various marketing tools and profitable loan products to help affiliates boost their income.

They manage affiliate programs from top lenders and offer up to 90% revenue share on each qualified loan subscription. You can also earn a $230 commission per lead via your affiliate link. Profitner transfers affiliate payouts weekly via Payoneer, wire transfer, ACH, PayPal, WebMoney, and Skrill.

Profitner provides affiliates with tested landing pages for their promotions. You can utilize these high-converted landing pages and forms to attract more target audiences.

|

3. Volsor

Volsor makes applying for payday loans and other short-term financial solutions easier for users in urgent need. Their advanced search engine helps users find quick loan solutions from top lenders with detailed financial reports.

The Volsor payday loans affiliate program offers affiliates up to 300 Kč per sale, depending on the quality of your lead.

- Tier 1 (Premium Lead): 300 Kč

- Tier 2 (Top Quality Lead): 100 Kč

- Tier 3 (Average Quality Lead): 50 Kč

- Tier 4 (Low Quality Lead): 10 Kč

- Tier 5 (Unusable Lead): 1 Kč

You can receive payouts on a monthly basis once you meet the payment threshold requirements. Their payout thresholds are PLN 400, EUR 100, USD 120, or CZK 2,500, based on your currencies.

You can integrate forms and banners in your promotional content to boost clicks and generate leads. Plus, you should create a welcome email series or follow-up emails from their email templates to increase engagement.

|

4. Viva Payday Loans Australia

Viva Payday Loans Australia finds quick cash loans from over 15 trusted local lenders across Australia. Their payday loan options are suitable for borrowers with low credit scores and Centrelink benefits.

After joining the Viva Payday Loans Australia affiliate program, you can enjoy up to a 90% commission per lead. You’ll have a higher chance to earn a commission with up to a 100% conversion rate for new monthly offers.

The brand offers affiliates easy-to-setup IFrame forms for loan requests to boost conversions. You’ll have an optional API to connect with over 60 lenders and find suitable loan products for your audience.

|

5. Lead Stack Media

Lead Stack Media delivers pre-qualified leads for industries like payday loans, installment loans, and insurance. They develop various advanced tools to help affiliates optimize lead quality and campaign performance.

You can join their payday loans affiliate program and earn up to a 90% commission for every loan approval. Therefore, you can earn around $300 per accepted lead via your affiliate link.

You can withdraw payouts on a weekly or monthly schedule based on your sales amount. You’ll receive earnings via bank transfer or PayPal once your account balance has $500.

|

6. OppLoan

OppLoan customizes fast loan solutions for middle-income consumers in the US. They provide online personal installment loans like payday or personal loans with affordable credit access.

After joining their payday loans affiliate program via Impact, you can earn a $100 commission on every loan origination. You’ll earn a credit for purchases made within 15 days of customers’ first click on your link.

You need to sign up for Impact to join their affiliate program. When promoting OppLoan, you should note that they accept customers from all states except Hawaii.

|

7. Zappian

Zappian assists affiliates in collecting high-quality leads for financial businesses like insurance, loans, debt, and so on. Their diverse network of 5,000 lead-generation opportunities helps affiliates reach a wider target audience.

Affiliates can earn up to a $250 commission per lead after joining the Zappian payday loans affiliate program. The brand transfers affiliate payouts monthly via wire transfer and PayPal. However, you must reach a $500 payment threshold to withdraw your money.

As their affiliate, you’ll get a personalized dashboard to track all performance data like sales, leads, or traffic. You can also read their insight analysis to create more effective promotions and reach the right audience.

|

8. Credit Clock

Credit Clock helps users with poor credit scores find instant loan options like bad credit loans and no credit check loans. Users can also borrow payday and same-day loans of up to $5,000 with low interest rates.

You can sign up for Lead Stack Media to join the Credit Clock payday loans affiliate program. After joining their program, you can earn up to $350 commission per successful lead.

Lead Stack handles all commission payment processes for Credit Clock affiliates. They pay affiliates on a weekly or monthly basis via bank transfer or PayPal.

|

9. LEAD Network

LEAD Network works with top advertisers in insurance, loans, and legal services. They primarily help affiliates create effective campaigns to generate high-quality leads and phone calls.

Affiliates can choose to join payday loans, personal loans, or car insurance affiliate programs on LEAD Network. Their affiliate team will contact you and negotiate customized commissions based on the types of products. They issue your payouts via PayPal, USDT, and wire transfer if your account balance reaches at least $100.

LEAD Network has a large collection of eye-catching banners for affiliates to choose from for their campaigns. You can also utilize their high-converting email templates to reach your target audience directly via email.

|

10. CashNetUSA

CashNetUSA provides installment loans, payday loans, and credit lines based on users’ overall financial reports. They also help users manage finances with education courses and interactive tools.

After joining this payday loans affiliate program, you can earn a commission on different loan products. Their team will give a detailed commission plan after you select your promotional product. They’ll make transactions for affiliate payouts via bank transfer.

As their affiliate, you’ll have unique coupon codes to drive more conversions. They also create different landing pages to support and boost your marketing efforts.

|

How Do You Choose the Right Payday Loan Affiliate Program?

Most beginners judge a program solely by the payout. They see “$200 per lead” and sign up immediately. However, they ignore the fine print that makes earning that money almost impossible.

You must look past the headline number to be profitable. The right partner is not the one with the highest offer. It is the program that puts the most money in your bank account for every click you send.

Here is what you actually need to look for to avoid “dead” offers and find the ones that pay.

Commission Structure

The biggest trap in the payday loan niche is looking at the advertised price instead of the real value. A program might promise a massive $200 CPA, but if their approval rules are too strict, your revenue will be zero.

Instead of getting blinded by flashy numbers, you should evaluate the program based on these three practical factors:

- The Offer Price: The number they promise to pay you (e.g., $100 – $300).

- The True Conversion Rate: This is the real value. It depends on how many customers get approved and how many actually receive the funds.

- Volume Bonuses: Extra cash rewards that kick in once you reach a certain number of customers.

To help you visualize why the highest commission is often a trap, let’s look at the comparison table below showing two hypothetical programs (assuming 100 clicks and 10 registrations):

| Comparison Factors | Program A (The Trap) | Program B (The Winner) |

| Advertised Payout | $200 CPA | $140 CPA |

| Strictness | Very Strict (High credit score required) | Flexible (Wide lending network) |

| Approval Rate | 20% (2 leads approved) | 35% (3.5 leads approved) |

| Funding Rate | 50% (1 person funded) | 70% (2.5 people funded) |

| Total revenue | $200 | $350 |

As you can see in the table, Program B generates 75% more revenue despite having a much lower advertised price. This happens because Program B has a wider lending network and says “yes” to more customers.

Before sending traffic, always ask your affiliate manager for the network’s average Earnings Per Click (EPC). This number reveals the truth that the payout price hides.

💡Pro Tip:

Once you understand the math, don’t ignore the potential for bonuses. A program starting at $120 might increase to $180 once you start sending consistent volume.

When you are generating around 50 conversions a month, you should email your manager immediately. Ask for a rate review. You can use your quality traffic as leverage to unlock a 15-25% pay raise.

Cookie Duration and Tracking

In many niches, a 90-day cookie is a major selling point. In the payday loan vertical, it is almost useless.

The reason: Urgency

Data shows that 89% of loan applications happen within 72 hours of the initial click. People searching for “emergency cash” have a flat tire or a medical bill today. They aren’t browsing for next month.

This means a program bragging about a “Lifetime Cookie” gives you zero extra value if their tracking technology is outdated. You should stop worrying about cookie duration and look for these three technical must-haves:

Server-to-Server (S2S) Tracking: This feature is essential. Privacy updates now block standard cookies after just 7 days. If you rely on pixels, you will lose money. S2S technology solves this and captures 20-35% more commissions.

Cross-Device Attribution: A user might click your ad on their phone during their commute, but fill out the long form on their desktop at home. If the program can’t track across devices, you lose that sale.

Attribution Model: Always check if the program uses “Last Click” or “First Click.” In a competitive market where users compare multiple lenders, “Last Click” is standard. Just make sure you know the rules upfront.

If you have to choose between a program with a 90-day cookie using standard pixels and a program with a 30-day cookie using S2S tracking, choose the S2S option every time. It is the only way to ensure you get paid for every valid lead you generate.

Payment Terms

In affiliate marketing, having consistent cash flow is critical. If you are buying traffic on Google or Facebook today but waiting 90 days to get paid, your campaign will run out of money before it ever has a chance to grow.

Understanding payment terms isn’t just paperwork—it is the most important part of your financial strategy.

Most programs operate on a “NET” schedule. This defines how long the network holds your money after the month ends. The difference between NET-30 and NET-15 might look small on paper, but in reality, it changes everything.

Here is a breakdown of the wait times:

| Payment Schedule | When You Get Paid | Who Is This For? |

| NET-30 | 30 days after month-end

(Total wait: ~60 days) |

Standard for most beginners |

| NET-15 | 15 days after month-end

(Total wait: ~45 days) |

The preferred standard (Look for this) |

| Weekly / Bi-Weekly | Every 7 or 14 days | Usually reserved for VIP affiliates generating high volume ($10k+) |

Beyond the schedule, there are three specific rules that can freeze your funds. Check the fine print for these:

💸 Minimum Payout Thresholds

This is the amount you must earn before they cut a check. If a program has a $500 minimum and you are earning $50 a week, you won’t see a dime for 2.5 months. Always look for programs with a low $50 or $100 threshold so you get your first check quickly.

🔒 Rolling Reserves

Some networks keep 10-20% of your earnings for 60-90 days to cover potential refunds. If you are running on a tight budget, this “safety deposit” can make it impossible to reinvest in ads.

↩️ Clawback Periods

Check the rules regarding “clawbacks”—the period where they can take back a commission if a lead turns out to be fraudulent. A 30-45 day window is a normal risk. However, a 90-day clawback window creates massive uncertainty because your income is never truly safe for three months.

💡Pro Tip: Prioritize Speed Over Size

Cash flow is often more valuable than the highest possible payout.

Choosing a NET-15 program paying $90 CPA is generally a better strategy than a NET-30 program paying $100 CPA.

The ability to reinvest in ads sooner typically outweighs the benefit of a slightly larger paycheck that takes months to arrive.

Promotional Resources Provided

Building a high-converting funnel from scratch is a massive undertaking. The best affiliate programs act like a “business in a box,” providing you with proven assets to help you launch faster.

A program with high-quality resources can cut your setup time significantly. Instead of doing all the heavy lifting yourself, look for a partner that provides these five essential tools:

📱 Mobile-First Landing Pages

Since over 80% of payday loan traffic comes from mobile devices, desktop-only designs are useless. You need fast, clean pages that look perfect on a phone and have already been tested for conversions.

📩 Compliant Email Templates

Financial marketing has strict legal rules. Quality programs provide approved email copy to keep you safe from legal risks.

🖼️Diverse Banner Libraries

Look for a wide variety of marketing angles (e.g., “Emergency Cash,” “Bad Credit OK,” “Fast Approval”) available in all standard image sizes.

⚖️ Comparison Widgets

These are tools that let users calculate rates or compare lenders directly on your site. They are excellent for keeping users engaged and boosting trust.

📢 Social Media Content

Running ads on Facebook or TikTok is difficult due to strict policies. Good programs provide pre-approved posts designed to pass these checks.

You should verify the quality yourself instead of assuming the resources are good. During the application process, ask the manager to show you their top-performing landing pages from last month.

If the designs look outdated, it is a major red flag. Modern assets can significantly boost your conversion rate. This efficiency is worth far more than a slightly higher payout from a program that forces you to build everything yourself.

How Do You Promote Payday Loan Offers Effectively?

Promoting payday loans is tricky. Major platforms like Google Ads and Facebook have strict policies that often block direct lending ads. If you try to run a standard “Get Cash Now” campaign, your account will likely be suspended within 24 hours.

To succeed, you must shift your strategy. Instead of forcing ads onto social feeds, you need to build traffic sources where users are actively looking for solutions.

SEO Content Marketing

Organic search is the lifeblood of this niche because it captures users at the exact moment they need money. However, you cannot simply rank for the keyword “payday loans.” The competition from billion-dollar lenders is too high.

Instead, you should follow these three specific strategies to win:

✅ Target “Problem” Keywords

Users rarely search for the product first; they search for the solution to their emergency. Build your content around specific situations:

- Comparison: “Payday loans vs. personal loans” or “Bad credit loan alternatives.”

- Urgency: “Emergency cash for rent” or “How to get $500 today.”

- Location: “Cash advance in [City Name]” (Always verify local laws first).

✅ Write Complete, Deep Guides

Google rewards depth. A short 500-word post will not work. You should create comprehensive guides (2,000–3,500 words) that cover the full journey. Your content should explain the problem, compare options, walk through the application, and offer advice on repayment.

✅ The “Mobile-First” Rule

In this industry, desktop SEO is secondary. Data shows that 89% of payday loan searches happen on mobile devices. If your mobile page takes longer than 2.5 seconds to load, you have lost the lead. A user with a flat tire on the side of the road will not wait for a heavy website to load.

💡 Pro Tip: Keep your content fresh. Interest rates and laws change often. You should schedule a content refresh every 90-120 days. Having a title like “Best Loans for 2024” when it is already 2026 will ruin your click-through rate.

YouTube Video Content

YouTube is arguably the most overlooked channel in this space. Payday loan terms can be confusing and scary for many people. Seeing a real person explain the process builds a level of trust that text alone cannot match.

Create Educational Videos, Not Ads

You should avoid making generic commercials. Instead, produce content that solves specific problems for the viewer.

You can film lender reviews, step-by-step application tutorials, or personal stories about getting approved with a low credit score. This approach helps viewers feel confident enough to apply.

Optimizing for Clicks

Since YouTube generally does not allow ad revenue on payday loan content, your income comes 100% from affiliate commissions. You must ensure viewers can find your link easily.

You should place your affiliate link in the very first sentence of the video description (the first 150 characters) so users do not have to click “Show More” to find it.

Additionally, you should always pin a comment at the top with your direct link and a clear call to action. Finally, use thumbnails with contrasting colors and expressive faces to grab attention.

Engagement and Growth

You should treat your comment section like a customer support desk. Responding to viewer questions quickly proves that you are active and trustworthy.

If you can keep viewers watching for about 40% of the video (Average View Duration), the YouTube algorithm will aggressively promote your content to new users.

Social Media Influence (Instagram, TikTok, Twitter/X)

Social media platforms are tough on direct payday loan advertising. If you try to run paid ads, you will likely get banned. Instead, you should focus on organic content that educates rather than sells.

Your goal is to become a trusted source of information. When your followers eventually face a cash crunch, they will turn to you first.

🎵 TikTok: You should use this platform for quick, educational videos. Try creating “Storytime” clips about borrowing mistakes or debunking credit myths. Since you cannot put clickable links in video captions, you must use a “Link in Bio” tool to drive traffic to your landing page.

📸 Instagram: You should use Instagram to build deeper trust with your audience. Posting educational carousels and hosting daily Q&A sessions in Stories works best here. You should also mix broad hashtags like #personalfinance with specific ones like #badcredithelp to reach people who actually need your advice.

🐦 Twitter/X: You should focus on real-time engagement here. Share daily financial tips or write threads that explain lending news. Instead of just spamming links, you should share your blog content a few times a week to see what resonates.

Transparency is your best defense on any of these platforms. You must clearly disclose your affiliate relationship (using #ad or #affiliate) in every promotional post.

You should also follow the 80/20 rule: provide 80% educational value and only 20% promotional offers. A small, engaged audience that trusts you will always convert better than a large, passive following.

Email Marketing Campaigns

Email is the only channel where you have 100% control over your reach. In affiliate marketing, it is your most valuable asset. Data shows that email generates huge returns, but only if you treat your subscribers like people, not ATMs.

To build a campaign that actually converts, you should follow this three-step process:

Step 1: The Capture (List Building)

You should not just ask people to “subscribe to a newsletter.” Instead, offer value in exchange for their email using these methods:

- Lead Magnets: Offer an “Emergency Fund Guide” or a “Loan Approval Checklist.”

- Quiz Funnels: A quiz like “What Loan Are You Eligible For?” captures the email while learning exactly what the user needs.

- Exit-Intent Popups: Use these to catch visitors who are about to leave your site without applying.

Step 2: The Nurture (The Welcome Sequence)

Once they subscribe, you should not blast them with offers immediately. Send a helpful sequence over the first 14 days:

- Day 0: Deliver the free guide and say welcome.

- Days 2-4: Share a personal story to build connection and educate them on loan types.

- Day 7: Address common problems, like how to get approved with bad credit.

- Day 10: Finally, introduce your top recommended lender.

Step 3: The Routine (Segmentation & Compliance)

Sending the same email to your whole list rarely works. You need to group your users based on their specific needs (e.g., “Bad Credit” vs. “Small Loans”) and follow these rules:

- Subject Lines: Keep them personal. Lines like “Question about your loan request” often get high open rates.

- Legal Rules: You must follow CAN-SPAM law. Include a clear unsubscribe link, your physical address, and honest subject lines.

💡 Pro Tip: You need to keep your list clean. If a subscriber hasn’t opened an email in 60 days, send a “Do you still need help?” message. If they don’t respond, remove them. A small, active list ensures your emails actually land in the inbox rather than the spam folder.

What Are the Legal and Compliance Requirements for Promoting Payday Loans?

Compliance is about survival in this industry. Unlike selling shoes, promoting loans involves strict laws. One mistake can lead to banned accounts, huge fines, or even lawsuits.

You must understand the rules before you launch. This starts with knowing the federal agency that monitors every claim you make.

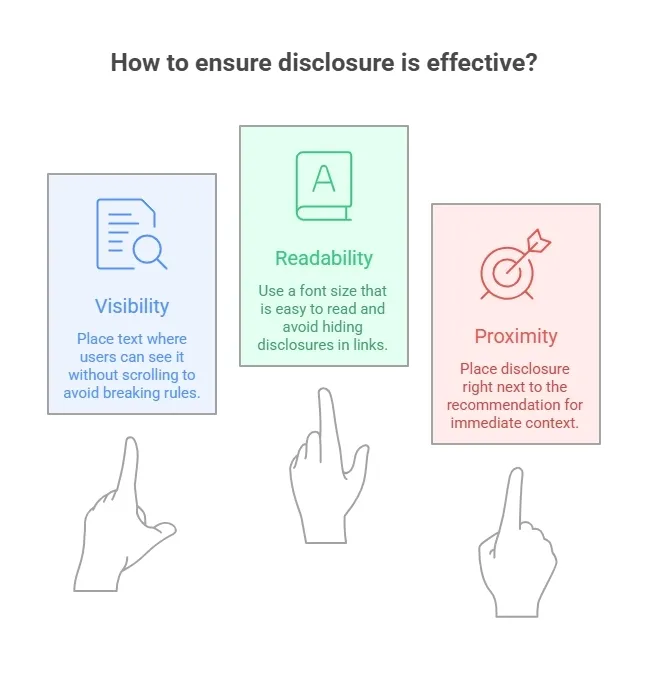

FTC Disclosure Requirements

The Federal Trade Commission (FTC) has a simple rule for marketers: You cannot hide your financial relationship. If you get paid to recommend a lender, the consumer has a right to know before they click.

To follow the law, your disclosure must meet three specific standards:

Visibility: You must place the text where users can see it without scrolling. If a user has to go all the way to the footer to find it, you are breaking the rules.

Readability: You must use a font size that is easy to read. You cannot hide the disclosure inside a link simply labeled “Disclaimer.”

Proximity: You must place the disclosure right next to your recommendation. For example, if you tweet a link, the #ad disclosure must appear in that exact same tweet.

You do not need complex legal language to comply. A simple statement works best: “Transparency Disclosure: We may receive a commission if you apply for a loan through the links on this page. This does not affect your loan terms or interest rates.”

Ignoring these rules is dangerous. The FTC does not just issue warnings; they issue fines of over $50,000 per violation. The government actively watches affiliate sites, so you should never take the risk of hiding your disclosure.

State Lending Regulations

The United States has a patchwork of 50 different regulatory environments. Currently, over 15 states (plus D.C.) ban high-interest payday lending entirely. If you send traffic from these areas to a lender, you are wasting money and potentially breaking the law.

You generally cannot promote payday loans to residents in these specific regions:

- East Coast: Connecticut, Maryland, Massachusetts, New Jersey, New York, Pennsylvania, Vermont, West Virginia.

- South: Arkansas, Georgia, North Carolina.

- West: Arizona, New Mexico.

- Other: District of Columbia.

Ignorance is not a defense, so you must implement geo-targeting to block traffic from these banned states:

👉Paid Ads: You should exclude these states in your Google or Facebook location settings.

👉SEO/Organic: You should use a plugin or script on your site to detect the user’s IP address. If a visitor comes from New York, for example, show a message saying “Service Unavailable” instead of sending them a loan offer.

Even states that allow payday loans have specific rules you need to watch out for:

- Loan Amounts: Every state has different limits. California caps loans at $300, while others allow up to $1,000.

- Cooling-Off Periods: Some states require a mandatory waiting period between paying off one loan and taking another.

You should never blindly send traffic. Always verify your lender’s license in the states you are targeting and use technology to filter out the rest.

Truth in Lending Act (TILA) Requirements

The Truth in Lending Act ensures that consumers understand the true cost of borrowing before they sign. You might think this law only applies to the direct lender, but you would be wrong.

The Consumer Financial Protection Bureau holds marketing partners liable for misleading claims. If your ad promises something the loan agreement contradicts, you are responsible.

Payday loans are expensive, often carrying an APR between 300% and 600%. You cannot hide this fact while splashing “Low Rates” across your banner. You must be accurate.

For example, marketing a loan as costing “only $15 for every $100” might be true regarding the fee, but it equals a massive 391% APR. If you advertise a product with a 391% APR as “Cheap” or “Low Cost,” you are engaging in deceptive marketing.

To stay compliant, you should replace misleading marketing terms with accurate alternatives. Here is a quick guide on what to say:

| Avoid This Phrase ❌ | Why? | Use This Instead ✅ |

| Instant Approval | Implies no checks happen | Instant Decision |

| No Credit Check | Most lenders do soft pulls | Bad Credit OK |

| Fee-Free | Almost non-existent in this niche | (Do not use this claim) |

Platform Advertising Policies

Just because payday loans are legal doesn’t mean ad networks want your money. Major platforms have strict rules against high-interest lending. You must understand these policies to keep your account safe.

Google Ads has essentially banned payday loans in the US. They prohibit loans with terms under 60 days or APRs above 36%. Since most payday loans break these rules, paid ads here are dangerous. You should rely on SEO instead.

Facebook (Meta) allows these ads, but only with written approval. You must submit your license and landing pages for manual review. However, the rejection rate is over 80%. Unless you are a large lender, getting approved is nearly impossible.

Bing (Microsoft Ads) is more lenient. They allow payday ads if you follow local laws and disclose terms clearly. While traffic is lower than Google, the competition is also much weaker.

Native Advertising platforms (like Taboola) generally allow these ads but label them “high risk.” You will likely pay higher costs per click than standard news content. Review times are also strict, so plan ahead.

FAQs

What is a payday loan affiliate program?

A payday loan affiliate program allows publishers to earn commissions by referring users to lenders that offer short-term, high-interest loans. Affiliates are typically paid per lead, per application, or per funded loan.

How much can you earn with payday loan affiliate marketing?

Earnings vary widely, but commissions are often high compared to other niches, ranging from $20 to $200+ per qualified lead, depending on the country, traffic quality, and payout model.

Is payday loan affiliate marketing legal?

Yes, but legality depends on local regulations. Many countries and U.S. states impose strict rules on payday lending, advertising disclosures, and APR limits. Affiliates must comply with both lender policies and regional laws.

Do payday loan affiliate programs accept beginners?

Some networks do, but many prefer experienced affiliates due to compliance risks. Beginners may be required to submit traffic samples, marketing methods, or undergo manual approval.

Do payday loan affiliate programs allow incentives?

Usually no. Incentivized traffic (cashbacks, rewards, misleading promises) is often prohibited and can result in account termination.

Are payday loan affiliate programs suitable for long-term income?

They can be, but stability is lower than evergreen niches. Regulations change frequently, offers come and go, and affiliates must adapt quickly.

Is pay-per-call better than pay-per-lead for payday loans?

Pay-per-call often converts better and pays higher per action, but it requires call-qualified traffic and strict call-duration rules.

Conclusion

It might be hard to join a payday loan affiliate program at first, as you need to check all the information carefully. However, you’ll have all the necessary marketing tools and immediate support from the brands to achieve your goals. Let’s start with your most suitable program and monetize your content today.