A personal loan submission is often referred by close people, so referring your friend would be a great way to boost your earnings. According to The Wall Street survey, borrowers owe up to $245 billion for personal loans in the first quarter of 2024 in the US.

Knowing the potential of this niche, we’ve collected the top 19 personal loan affiliate programs in this article. So, you can consider and choose the best one to become a loan affiliate and make extra income.

In addition to personal loans, we also rounded up other best affiliate programs for business loans and mortgages. These programs can be a lucrative option if you have a connection to business owners or homebuyers.

Quick Comparison

| Program Name | Commission (%) / Payout | Cookie Duration (Days) | Niche Suitable |

|---|---|---|---|

| Ascent Student Loan | $125 per approved loan | 90 days | Student loans, education financing |

| Zippy Loan | $45 per lead | 1 day | Personal loans, emergency loans |

| Vivaloan | $45 per funded loan | 1 day | Personal loans, lending marketplace |

| FairStone | $150–$200 per booked applicant | 30 days | Canadian secured & unsecured loans |

| Lead Stack Media | Up to 90% commission (~$300–$350 per lead) | Not provided | Finance offers marketplace, loan offers |

| MyAutoLoan | $5 per qualified application | 45 days | Auto loan refinancing |

| Upstart | 1% per sale | 15 days | Personal loans, credit alternatives |

| Round Sky | Up to $250 per valid request | Not provided | Payday loans, short-term lenders |

| New Silver | $50 per loan application + 50bps on closed loans | 60 days | Real estate loans, hard money lending |

| BadCreditLoans | Up to 76% commission | 45 days | Bad credit loans, personal loan marketplace |

Affiliate Earnings Calculator

Estimate your affiliate income based on Traffic, CTR, AOV, and Commission rate. Drag the sliders below to explore different scenarios.

Estimated Results

These figures are for illustrative purposes – feel free to adjust them to fit your specific niche.

- Conversion Rate here is defined as the percentage of traffic that buys.

- Does not account for refunds, cancellations, or varying commission rates by product.

Top 19 High-paying Personal Loan Affiliate Programs

1. Ascent Student Loan

Ascent Student Loan is on a mission to help the student achieve their college dream with zero fees for college loans. They provide low rates and bigger discounts for student loans with up to 40 payment options.

The brand’s student loan affiliate program offers up to $125 per approved loan. The cookie duration is tracked for 90 days from the first click of the customer.

Ascent Student Loan has a full selection of custom text links and banners for affiliates to choose from. They even give exclusive offers to your audience to improve subscription rates.

|

2. Zippy Loan

Zippy Loan manages an extensive network of lenders to give you premium access to personal loans.

The platform is particularly popular for individuals seeking unsecured loans, meaning no collateral is required. By filling out a 5-minute online form, borrowers can receive up to $15,000 from Zippy Loan in a day.

This unsecured personal loan affiliate program offers a commission rate of $45 per lead. Notably, the cookie is only tracked for 1 day, so affiliates can only earn a credited commission within 24 hours.

Zippy Loan allows their publishers to promote through content and email marketing. However, any attempt to use coupon codes or discounts will be banned from their program.

|

3. Vivaloan

Vivaloan is a free, no-obligation service that connects potential borrowers with lenders who provide loans. After filling out the online form, loan applicants can apply for up to a $10,000 personal loan.

The Vivaloan affiliate program is run by Awin – a trustworthy affiliate network. Vivaloan allows affiliates to receive up to $45 for a funded loan. The cookie duration is only activated for 24 hours for their partners to earn a commission.

Affiliates can promote Vivaloan products through their content channels and email marketing. However, they should avoid using coupon codes or cashback offers.

|

4. FairStone

FairStone is a leading Canadian lender with over 250 branches nationwide. Similarly, businesses or individuals seeking secured lending options can review habitat secured loans to understand available products and repayment flexibility. They specialize in personal loans and home equity loans that meet the needs of most people today.

To join the FairStone affiliate program, you need to sign up through CJ Affiliate. The brand pays commission rates for different target customers:

- $200 per booked homeowner

- $150 per booked non-homeowner

The cookie length remains active for 30 days to earn a credited commission from Fairstone. Fairstone provides dedicated project managers to assist affiliates in maximizing their earning potential.

|

5. Lead Stack Media

Lead Stack Media is among the best marketplaces for personal finance offers in the USA. They give access to more than 20 direct personal loans for affiliates and remarkable traffic for advertisers.

Their affiliate program has one of the highest commission rates in the industry, with up to 90% commission per lead. For every successful application, affiliates could earn about $300-350 payouts.

Lead Stack Media pays their affiliates via various payment methods, including ACH, bank wire, PayPal, or Payoneer. They pay on a weekly basis, but you must exceed a $500 payment threshold to receive your earnings.

|

6. MyAutoLoan

Are you having trouble with personal auto loan payments, interest rates, or loan terms? MyAutoLoan has a solution for you with their auto loan refinancing.

Manage through CJ Affiliate, the MyAutoLoan affiliate program offers a $5 commission for a qualified application. The tracking period for approved commissions is up to 45 days.MyAutoLoan allows affiliates to promote their products only through different social media. They also send out email creatives to help promote more efficiently.

|

7. Upstart

Upstart is an online lending platform with low fixed rates in the market. Upstart considers your school and work information rather than your credit score to give you the right loan offers.

Managed through Impact, the Upstart affiliate program pays a 10% commission rate for their affiliates for each sale. The minimum personal loan at Upstart is from $1,000 to $50,000, so you could earn $3,000 a month with just one sale per day. Note that the cookie duration lasts for only 15 days.

Affiliates can receive promotional tools, including images and text links, to promote Upstart effectively. You can also use email marketing to promote their service to your audience.

|

8. Round Sky

Round Sky works with lenders and loan publishers across the US to offer payday loans. They process over 20,000 personal loans every day.

You can join the Round Sky payday affiliate program directly on their website. Round Sky pays up to $250 commission for every valid loan request form submission. Round Sky makes payout transactions on a weekly and monthly basis for their affiliates to receive money regularly.Round Sky has more than 50 CPA and Revshare offers for affiliates to choose from. Affiliates can also use their diverse templates for their website widgets to fit the promotion campaign.

|

9. New Silver

At New Silver, you can apply for private hard money loans to solve real estate financing concerns. Starting with an easy 5-minute application, you can borrow up to $5,000,000 loans from New Silver.

Based in the USA, this personal loan affiliate program is managed through FlexOffers. Affiliates could earn up to $50 for each completed loan application. For closed loans ranging from $500 to $3000, affiliates will receive 50bps (basis points).

The cookie duration is 60 days. Therefore, publishers only get credited referrals within 2 months of the first affiliate click of followers.

|

10. BadCreditLoans

BadCreditLoans connects lenders and their customers through their lender network. You can select the lender that offers the most suitable personal loan for your needs based on the rate and fee.

The BadCreditLoans affiliate program is managed through FlexOffers. Through their unique link, affiliates can earn up to a 76% commission rate on every subscription at BadCreditLoans.

The cookie period is 45 days, which means your approved commission will only be credited in this tracking time.

|

11. OppLoans

- Commission rate: $150

- Cookie duration: 15 days

OppLoans creates personal loan offers with fixed interest rates for their customers. At OppLoans, you don’t have to charge origination or prepayment fees.

12. Post Office Personal Loan

- Commission rate: £60 (~$78)

- Cookie duration: 30 days

Post Office Personal Loan has been a leading financial service in the UK for over 370 years. You can find any personal loan with more than 11,800 branches in their network.

13. OfferMarket

- Commission rate: $250

- Cookie duration: Not mentioned

OfferMarket is a real estate investing platform and private lender in the US with the highest leverage and lowest fees. Offer Market pays up to $250 for every successful referral to their website.

14. PersonalLoan

- Commission rate: 76%

- Cookie duration: Not mentioned

PersonalLoan gives you access to personal loans with an easy and convenient application. Through their online service, you can get a loan from $250 to $35,000.

15. Laural Road

- Commission rate: $400

- Cookie duration: Not mentioned

Laural Road has helped thousands of students with more than $9 billion in federal and private school loans since 2013. Their referral program allows you to earn up to $400 when your friend applies for a student loan or personal loan.

16. Panacea Financial

- Commission rate: Up to $250

- Cookie duration: Not mentioned

Panacea Financial is designed for physicians, dentists, and veterinarians with financial needs. Their personal loan program is focused on helping doctors throughout their careers. When referring a friend to the program, you can earn up to $250 per lead.

17. LeadScout

- Commission rate: $750

- Cookie duration: Not mentioned

LeadScout is a popular lender platform in Canada with a network of 45+ Canadian lenders. Their loans are diverse, ranging from car loans and personal loans to HELOC’s to title loans.Join the program

18. Lendela

- Commission rate: $100

- Cookie duration: Not mentioned

Lendela is a loan-matching platform for borrowers to find personal loans from banks and over 100 loan providers. In less than 10 years, they have served more than 300,000 satisfied customers.

19. SoFi

- Commission rate: $300

- Cookie duration: Not mentioned

SoFi supports you in achieving independent finance as the first company to launch student loan refinancing. When your friend applies for SoFi’s personal loan through your unique link, you can earn $300 as a reward.

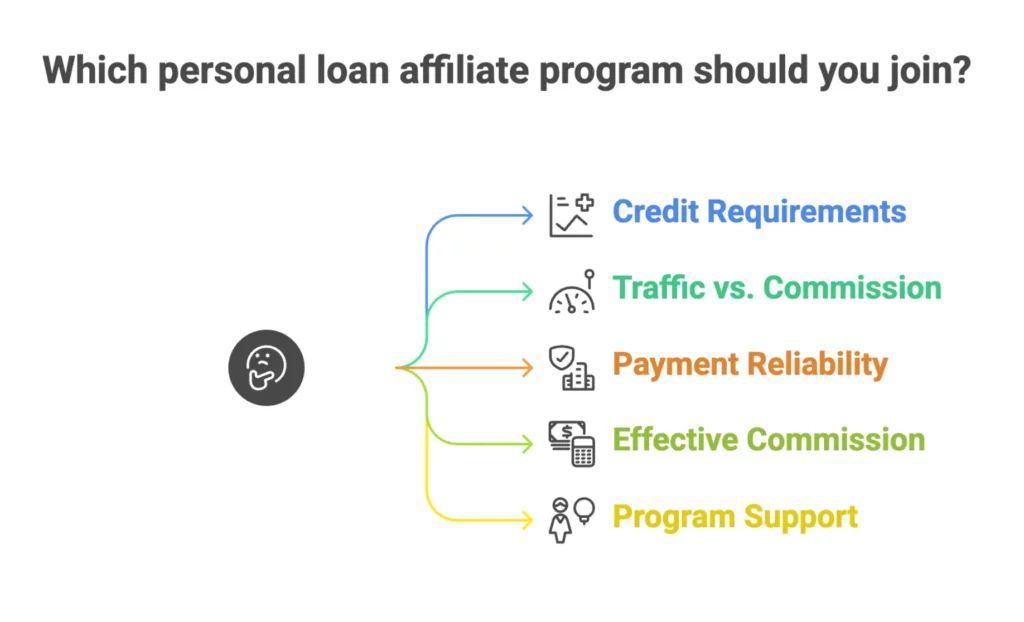

How Do You Choose the Right Personal Loan Affiliate Program to Join?

Choosing a personal loan program is about more than just finding a big paycheck. You need to find a lender that your audience can actually trust and afford.

In this section, we will show you exactly what to look for before you sign up for any program.

Match Program Credit Requirements to Your Audience’s Actual Credit Profile

Matching your loan offers to your audience’s credit score is the most important step.

If you get this wrong, you could lose up to 70% of your income. 📉 In the finance world, this is called a “credit mismatch.”

There are two main traps you need to avoid:

The rejection trap

If you promote a bank that requires an “excellent” credit score to people with “poor” credit, they will all be rejected. You did the work to find the customer, but you get paid $0 because they didn’t qualify.

The underearning trap

If you send people with great credit to a “bad credit” lender, you might only earn a $25 fee. If you had sent them to a premium lender, you could have earned $125 for that same person!

Evaluate Traffic Volume vs. Commission Rate Trade-offs

Chasing the highest commission is the quickest way to go broke.

In the loan space, you usually choose between two models.

- CPL (Cost Per Lead): You get paid for a simple form fill

- CPA (Cost Per Acquisition): You only get paid if the loan actually funds.

If you run a high-volume site with 50,000 or more monthly visitors, CPL programs are usually your best bet. These pay between $25 and $50 per lead. Because the user only has to fill out a form, you can expect a solid conversion rate of 0.8% to 1.5%.

The math for high-volume CPL looks like this:

Traffic: 50,000 visitors

Leads (1% conversion): 500 leads

Payout ($40 per lead): $20,000 monthly income

The Perk: You get fast “Net-30” payments (paid within 30 days) and high qualification rates. You actually get paid for most of the work you do.

On the other hand, low-volume quality sites (10,000–30,000 visitors) often do better with CPA programs. These offer much higher commissions—between $75 and $150.

However, they are harder to “win.” Conversion rates drop to 0.4%–0.8% because the user must be approved and actually take the money for you to get a cent.

The math for low-volume CPA looks like this:

Traffic: 25,000 visitors

Raw Leads (1%): 250 leads

Funded Loans (50% funding rate): 125 conversions

Payout ($100 per funding): $12,500 monthly income

Here is the hard truth: A $150 commission means nothing if your audience can’t qualify for the loan.

Always look at your “Earnings Per Click” (EPC) rather than chasing the biggest shiny number. If your audience is just browsing, a $25 lead you actually get paid for is worth more than a $150 funded loan that never happens.

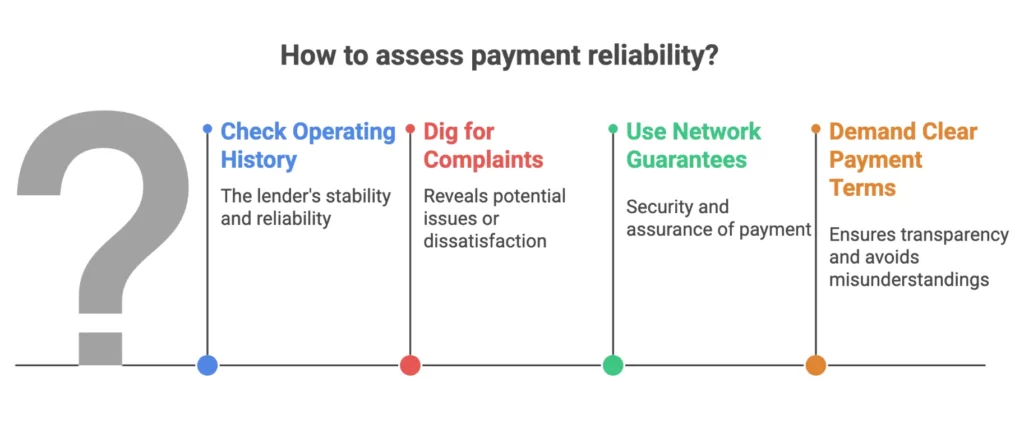

Assess Payment Reliability Through Multi-Source Research

In the affiliate world, profit isn’t real until the money hits your bank account. Some programs “scrub” your leads or shut down without warning.

To protect your hard work, you must vet every program like a detective. The best way to start your investigation is by looking at the company’s track record.

Check the Operating History ⏳

You can trust the “old guards” like LendingTree or SoFi as they have survived for many years.

A program less than two years old is a gamble because if the brand goes out of business, your unpaid commissions vanish with them.

However, a long history isn’t enough; you also need to see what people are saying right now.

Dig for Complaints 🚩

You can go to forums like Reddit or AffiliateFix to do some “complaint mining.” Then, search for the program name plus the word “payment” to see their reputation.

A few complaints about strict quality rules are normal, but reports of “ghosting” or “technical delays” are huge red flags. If these reviews make you nervous, you can find safety by using a middleman.

Use Network Guarantees 🛡️

If you are a beginner, avoid “direct” programs and use a big network like CJ Affiliate or Impact instead. These networks act as a shield and often have payment guarantees.

Even if a brand fails to pay, the network may pay you themselves to keep their own reputation clean. But whether you use a network or go direct, you must always demand clear rules.

Demand Clear Payment Terms 💰

Real programs are very clear about when you get paid. Look for specific terms like “Net-30,” which means you get paid 30 days after the month ends.

You should avoid any program that has “monthly-ish” schedules, high withdrawal minimums, or a support team that stays silent.

Calculate Effective Commission Beyond Published Base Rates

Most people make a big mistake. They only look at the “headline rate.” They see a program offering $100 and ignore one offering $80.

However, in the finance world, that big number is just a starting point. To find your real profit, you need to calculate your “Effective Commission.”

The biggest “silent killers” of your profit are rejection rates. This is when a company refuses to pay for a lead.

If a program offers a $100 payout but rejects 30% of your leads, you don’t actually make $100. You only make $70.

Let’s compare these two programs:

| Program | Base payout | Rejection rate | Real Payout (After rejections) |

| Program A | $50.00 | 18% | $41.00 (82% kept) |

| Program B | $45.00 | 8% | $41.40 (92% kept) |

In this case, the “cheaper” program actually puts more money in your pocket!

You should also look for “Performance Tiers.” Many programs reward you for sending a lot of business. For example, if you earn over $10,000 in a month, they might give you a 30% bonus.

Furthermore, don’t forget about seasonal bonuses. Some loan programs offer extra cash during tax season or the holidays. These “kickers” can add thousands of dollars to your yearly total.

Evaluate Program Support Quality and Available Resources

You need a partner who helps you grow instead of a company that ignores you.

High-quality support is often the only difference between a project that fails and one that makes money for a long time.

A great partner will do more than just pay you. They will give you the tools you need to win. You can identify a high-quality program by finding these four specific signs:

A dedicated manager 📞

A dedicated manager is a real person you can reach quickly on Slack or email. If you are spending $500 a day on ads, you cannot wait three days for a “help ticket” reply. This person provides the fast answers you need to save money.

Ready-to-use marketing tools 🎨

Marketing tools like free banners and email templates are often called “swipes.” These resources save you thousands of dollars. You won’t have to hire your own designer or writer when the company provides them for free.

A heads-up on changes 🗓️

A promotional calendar keeps you informed about upcoming news. Good programs tell you about interest rate changes before they happen. This notice gives you enough time to update your ads so your information is always correct.

Useful data and tips 📊

Expert data is a sign that the company wants you to succeed. The best programs share which platforms, like YouTube or Facebook, are currently performing well.

What Are the Best Platforms to Promote Personal Loan Affiliate Programs?

You have the affiliate programs. Now you need people to see them. In the loan niche, trust is everything, but not every platform helps you build it.

Here are the top four platforms for promoting loans, ranked by how well they convert visitors into customers.

WordPress Self-Hosted Blogs

WordPress is the most popular choice for affiliate marketing. It is the engine behind about 70% of the world’s successful loan websites.

A self-hosted WordPress site gives you total control, whereas sites like Wix or Medium feel more like “rented” space.

This high level of freedom is the reason most successful professionals prefer this platform over any other.

☑️ The rules are yours

Platforms like Substack often ban affiliate links. On WordPress, you decide what to post and how to link.

☑️ The system is built for sales

The software allows you to create loan comparison tables easily. These tables guide your readers’ eyes straight to the “Apply” button.

☑️ The search power is unmatched

WordPress is designed to work well with Google. It helps your articles show up when people search for specific terms like “best loans for debt.”

☑️ You own the business

You are not at the mercy of a social media company. Your content and your traffic belong entirely to you.

So how can you build your site the right way?

The first thing is good hosting. You can use WPEngine ($30/mo) for speed or SiteGround ($15/mo) if you are just starting.

Additionally, themes like Astra, GeneratePress, or Kadence keep your site from slowing down. In the loan world, a slow website is a dead website.

You can also use Yoast SEO to help with rankings and WP Rocket to keep the site fast.

Email Marketing Platforms (Highest Conversion Rate)

Email marketing can convert 2% to 5% of readers into customers. In comparison, regular search traffic only converts at about 0.8%. This high success rate is why every top professional builds an email list.

Choosing the right tool is the first step toward building your list.

ConvertKit ($29/mo+): This is a great choice for creators. It makes it easy to send bonus guides or checklists to your readers.

ActiveCampaign ($29/mo+): This software works best for advanced users. It can group people based on what they click, such as “bad credit” or “savings.”

Mailchimp: This platform is the perfect starting point for beginners. It is easy to use, and you can even start for free.

After you pick a tool, you must give people a good reason to sign up.

You should not just ask them to “join a newsletter.” Most people do not want more junk mail.

A “Lead Magnet” is a much better way to attract subscribers. Some great examples include a debt calculator, a credit score guide, or a loan checklist.

Once people are on your list, you need a smart plan to keep them interested.

Sending ads immediately is usually a bad idea. Instead, you can use a “Welcome Sequence” of five to seven emails.

These emails should provide helpful advice and build trust first. Later, you can send specific loan offers to the groups that need them most. A list with 10,000 subscribers will usually generate thousands of email opens every month.

At a 3% conversion rate, that list yields about 75-100 extra leads. These lead may result in $3,000 to $4,000 of extra income without spending any more money on ads.

Reddit and Finance Forums (High-Intent Community Traffic)

Reddit and specialized forums are gold mines for “active” traffic. These communities are filled with people asking, “Should I consolidate my debt?” or “Which lender is best for my credit score?”

You can find these motivated buyers by visiting the specific places where they gather to discuss money.

- Reddit: Check out r/personalfinance (23 million members), r/debtfree, and r/debt.

- Specialized Forums: Bogleheads for conservative advice or MyFICO for credit-specific questions.

If you go into these groups and just post your affiliate link, you will be banned in minutes. Instead, you’d better explain how debt-to-income ratios work or how a loan might affect their credit score.

Once you have helped them, you can say: “I wrote a deeper guide on this with a comparison of the top lenders here: [link to your blog].” As you have already proven you know your stuff, the click-through rate is very high.

How Much Can You Earn from Personal Loan Affiliate Marketing?

Personal loan marketing is one of the most profitable ways to make money online.

Depending on your traffic, you can earn anything from a small side income to a massive monthly check. This section will break down the numbers so you can see your true earning potential.

Program Selection Creates 200–400% Earnings Differences

Choosing the right affiliate program can boost your income by up to 400%. Even if your traffic stays exactly the same, picking the right partner changes everything. 📈

Many beginners make the mistake of only joining “lending networks” because they are easy to access.

These networks usually pay the lowest rates, often between $15 and $35 per lead.

In contrast, “premium direct lenders” pay much more for the same amount of work. Brands like SoFi or Best Egg often offer between $65 and $95 for every sale.

Switching to these high-paying offers is the best way to stop leaving money on the table.

You do not have to choose just one type of program. The secret to high earnings is to mix your offers.

By matching the right loan to the right reader, you create a higher “average” payout for your entire website. 🤝💸

Let’s see the difference that a better choice makes for 200 monthly sales:

Poor selection: 200 monthly sales at a $30 average = $6,000 monthly income.

Optimized selection: 200 sales at a $55 average = $11,000 monthly income.

That is an 83% increase in profit without finding a single new visitor. Before you try to grow your traffic, make sure you are getting the most value out of the audience you already have.

Credit Tier Specialization and Income Ceilings

In the loan world, your “income ceiling” – the most you can possibly earn -is set by the credit scores of your audience. Different credit levels require different strategies.

| Tier (Credit score) | Payout & Lenders | Conversion reality | Revenue ceiling |

| Prime (680+) | $75–$150 (SoFi, LendingClub) | 0.4%–0.8% completion. Users are picky; requires high-trust, expert content. | $100,000+/mo |

| Near-Prime (620–679) | $35–$70 (Upstart, Best Egg) | 55%–70% approval. The affiliate “sweet spot” for traffic and conversions. | $15,000–$40,000/mo |

| Subprime (580–619) | $15–$35 (Lending Networks) | 1.2%–2% application. High-volume lane for users needing fast cash. | $15,000–$30,000/mo |

If you are a great writer who can build deep trust, go for the Prime tier. If you are better at “scrappy” marketing and getting lots of traffic quickly (like on Reddit), the Subprime or Near-Prime tiers will be better for you.

The Conversion Optimization Multiplier Effect on Income

If you want to double your income, you have two choices. You can find twice as much traffic, or you can get twice as much money from the people already visiting your site.

The second choice is much faster and completely free. This is called “conversion optimization.”

Small changes to your website can create massive jumps in your bank balance.

Let’s look at two websites that both get 100 visitors.

The basic site: converts 1% of its visitors and makes about $26.

The optimized site: makes it easy to click. It converts 2% of its visitors and makes $60.

By making a few smart changes, the second site makes 130% more money from the exact same amount of traffic! 💰

You do not need to be a computer expert to get these results.

You just need to remove “friction.” Friction refers to any annoying factors that prevent people from applying for a loan. Here are four easy ways to smooth out the process:

Use a quick quiz 📝

Instead of a basic link, ask the user three simple questions first. People love quizzes. This helps them feel like the loan was hand-picked just for them.

Shorten your forms ✂️

Have you ever quit a form because it asked too many questions? Cutting a long form in half can increase your sales by 50% instantly.

Add trust badges 🔒

In the loan world, people are terrified of scams. Adding a simple lock icon or a “Secure” label makes people feel safe enough to click.

Fix your mobile site 📱

Over 65% of loan searches happen on smartphones. If your site is hard to read on a small screen, you are losing more than half of your potential money.

FAQs

What is a personal loan affiliate program?

A personal loan affiliate program allows publishers to earn commissions by referring users to lenders offering unsecured personal loans. Affiliates are paid per lead, per approved application, or per funded loan, depending on the program’s payout model.

Are personal loan affiliate programs profitable?

Yes—personal loan affiliates are among the highest-earning finance niches. With commissions ranging from $40 to $300+ per conversion, profitability depends on traffic quality, geographic targeting, and user intent.

Do personal loan affiliate programs require credit approval?

No. Affiliates are not responsible for credit decisions. Lenders handle underwriting, approval, and compliance. Affiliates only focus on driving qualified traffic.

Do personal loan affiliate programs have cookie tracking?

Some do, but many finance offers rely on session-based or call-based tracking instead of traditional cookies—especially for pay-per-call models.

With paid traffic, results can appear within days. With SEO, it typically takes 3–6 months to see consistent conversions—but long-term ROI is significantly higher.

Conclusion

So, it’s actually easy to earn money by simply referring a friend to these personal loan affiliate programs. Whether it is a personal loan, payday loan, or student affiliate program, we’ve listed the top choices in 2026.With the right program, you can enjoy the benefits of flexible work hours, passive income, and the satisfaction of helping others achieve their financial goals.