Tax preparation is a headache for both individuals and businesses every year. To ease the burden, many companies have developed assistance services to help people navigate the process. A tax preparation affiliate program can help you earn money while promoting diverse services at once, like automation filling tools, e-tax software, or accounting assistance.

In this article, we’ve highlighted the top 15 tax preparation affiliate programs. Let’s dive in to explore how much you can earn from this niche.

Quick Comparison

| Program Name | Commission (%) | Cookie Duration (Days) | Niche Suitable |

|---|---|---|---|

| TurboTax | 5% | 30 days | Tax software, personal & business tax prep, finance bloggers |

| TaxAct | 10% | 45 days | Tax prep, budget-friendly finance tools |

| FreeTaxUSA | 15% | 90 days | Affordable tax filing, personal finance, small businesses |

| Taxhub | $100 per qualified lead | 45 days | CPA services, premium tax consulting, freelancers |

| TaxSlayer | 17% (+ $3 for free e-file) | 30 days | Cloud tax software, freelancers, small business owners |

| E-file | Up to 40% (+ $1.4 per free file) | 120 days | IRS e-file software, coupon promo niche, personal finance |

| 1-800Accountant | $100 per customer | 90 days | Online accounting, business formation, bookkeeping |

| LibertyTax | 25% (or $2.75 per appointment) | 45 days | Online & offline tax filing services |

| ezTaxReturn | 25% | 90 days | Quick tax filing, beginners, simple W-2 filers |

| Tax1099 | 15% | Not specified by vendor | IRS form filing (1099s), small businesses, HR/payroll |

Affiliate Earnings Calculator

Estimate your affiliate income based on Traffic, CTR, AOV, and Commission rate. Drag the sliders below to explore different scenarios.

Estimated Results

These figures are for illustrative purposes – feel free to adjust them to fit your specific niche.

- Conversion Rate here is defined as the percentage of traffic that buys.

- Does not account for refunds, cancellations, or varying commission rates by product.

15 Tax Preparation Affiliate Programs You Shouldn’t Miss

1. TurboTax

TurboTax’s software helps businesses and individuals file their taxes with maximum refunds. They integrate with QuickBooks to simplify expense tracking and tax preparation in complex situations.

Managed by CJ Affiliate, the TurboTax tax preparation affiliate program offers a 5% commission on every purchase. The cookie stays on customers’ devices for 30 days once they click on your affiliate link.

You should utilize their ready-made landing pages and banners to increase engagement. Plus, you can write articles about tips or laws, and naturally embed text links within the content to boost click-through rates.

|

2. TaxAct

TaxAct provides affordable digital and downloadable tax preparation solutions for all American companies. Businesses can also get personalized guidance from industry experts through their Xpert Assist.

After joining their tax preparation affiliate program, you can earn a 10% commission on every order. You’ll get a commission if customers click on your link and purchase within 45 days.

You can access their collection of high-converting banners through your affiliate dashboard. You should display these banners on marketing platforms to increase click-through rates.

|

3. FreeTaxUSA

FreeTaxUSA has filed over 71 million tax returns for American businesses in the past 24 years. They support over 900 tax forms for users to prepare for complex federal returns.

You can join the FreeTaxUSA tax preparation affiliate program via CJ Affiliate. As their affiliate, you can enjoy a 15% commission across all plan subscriptions.. The cookie lasts 90 days from the moment customers click on your affiliate link.

You’ll receive detailed product promotions to create effective marketing campaigns. You can place banners on your websites to increase click-through rates.

|

4. Taxhub

Taxhub connects their users with licensed public accountants to find affordable and customized tax services. Their algorithms can identify deductions and analyze transaction history across all bank accounts.

The Taxhub tax preparation affiliate program allows affiliates to earn a $100 commission on every new qualified user. The cookie remains active for 45 days after customers’ initial click on your link. You’ll receive payouts directly via your bank account on a monthly basis.

Taxhub gives affiliates various content ideas and tips for reference. You can save time with their pre-made content about tax, deadlines, or special tax events.

|

5. Tax Slayer

Established over 50 years ago, Tax Slayer offers accurate cloud-based tax preparation software. Their budget-friendly and self-filed plans cater to freelancers and small business owners.

The Tax Slayer tax preparation affiliate program offers a 17% commission on every completed e-file tax return. If customers only complete a free e-file, you’ll also receive a $3 bonus. The cookie lasts 30 days once customers click on your link.

Tax Slayer designs various ready-to-use landing pages with eye-catching graphics and engaging headers. You can create content like blog posts, videos, or reviews to drive traffic to these landing pages.

|

6. E-file

E-file provides authorized IRS e-file software with fast electronic tax filing for taxpayers. Users can input all of their tax information, income figures, and potential deductions to receive instant tax calculation and preparation.

You’ll receive up to a 40% commission on every qualified e-tax filing subscription when joining the E-file tax preparation affiliate program. You can also receive a $1.4 flat commission for each free tax filing. The cookie stays on customers’ devices for 120 days from their first click on your link.

You’ll have an exclusive coupon code to encourage more purchases from your followers. You should also make use of their eye-catching landing pages to increase engagement.

|

7. 1-800Accountant

1-800Accountant simplifies online accounting tasks with free consultation from top CPAs. They also help small American businesses handle employee benefits and health insurance programs.

Affiliates will earn $100 after referring new customers to subscribe online tax and accounting service. If a business registers as a legal entity, you’ll also earn a commission. You can negotiate commissions on the formation tax service based on sales volume.

The cookie lasts for exactly 90 days from the moment customers click on your link. Only if customers purchase within this time will you earn a commission.

|

8. LibertyTax

LibertyTax offers DIY online tax preparation services at 1,800 locations in the US. Their mobile app helps taxpayers scan online documents, access records, and contact professionals.

Liberty runs their tax preparation affiliate program via CJ Affiliate. LibertyTax offers a 45% commission on every completed online tax return filing. You can also earn $2.75 if customers request an online appointment with LibertyTax.

You can only earn a commission if customers submit their electronic tax filing within a 45-day cookie duration.

|

9. ezTaxReturn

ezTaxReturn offers free federal tax filing with W-2 income and standard deductions to simplify the return process. Their service ensures data security and the biggest possible refunds, even for taxpayers with poor credits.

As their affiliate, you can enjoy a 25% commission on every federal & state tax return. You’ll earn a commission on customers’ purchases within 90 days from their initial click on your link.

You should note that the best time to earn a commission is between January and April. During these months, you should promote across all marketing channels to direct leads to the pre-made landing pages.

|

10. Tax1099

Tax1099 supports electronic filing for various IRS forms, including 1099-NEC, 1099-MISC, W-2, 940, 941, and ACA forms. Their AI automation can complete forms, perform error checks, and validate data to ensure tax compliance.

You can join their tax preparation affiliate program via PartnerStack and earn a 15% commission on every successful sale. Tax1099 lets PartnerStack handle all affiliate payouts via PayPal and Stripe. You’ll get your earnings 30 days after each qualified purchase, in case of any cancellations.

You can access their authorized logo collection through PartnerStack’s affiliate dashboard. You can also put their appealing banners in high-traffic areas of your website to grab visitors’ attention.

|

11. Tax Extension

- Commission rate: 25%

- Cookie duration: Not mentioned

Tax Extension helps taxpayers submit a Federal tax extension request in 5 minutes. They also offer a large education resource of tax credits, filing requirements, and tax preparation.

12. KeeperTax

- Commission rate: $20

- Cookie duration: Not mentioned

KeeperTax helps freelancers, independent contractors, and small business owners streamline their tax preparation. The software can scan bank accounts and credit cards to identify tax-deductible expenses.

13. Online Taxes

- Commission rate: $2

- Cookie duration: Not mentioned

Online Taxes offers affordable income tax preparation for homeowners, landlords, freelancers, and self-employed individuals. They also have various free tax assistance services via email, phone, or live chat.

14. TaxCE

- Commission rate: 15%

- Cookie duration: Not mentioned

TaxCE launches tax-related online courses for tax professionals of all levels. Their courses teach Circular 230, CE requirements, and related rules about tax preparation.

Ảnh: tax prep

How to Select the Right Tax Preparation Affiliate Program to Join?

You might be tempted to sign up for the program with the highest payout on paper. But that is often a rookie mistake. A $100 CPA sounds great until you realize your specific audience will never convert on a $300 software package.

Selecting the right partner isn’t just about chasing the biggest number. It’s about finding the balance between what your audience needs, what the software delivers, and how the commission model works with your traffic.

In this section, we’ll introduce the step-by-step process for vetting these programs correctly.

Align Product Features with Your Audience’s Tax Complexity

Picking the wrong tax software for your readers will hurt your sales.

You wouldn’t sell a complex truck to someone who only needs a bike. You have to match the tool’s features to how your audience lives and works. 🎯

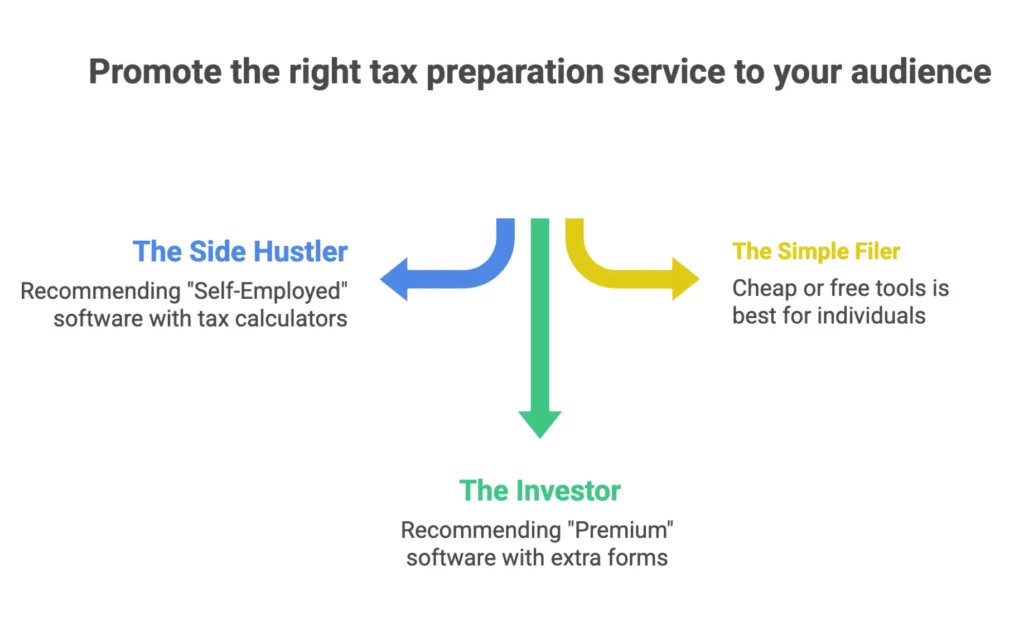

🚗 The Side Hustler

If your readers drive for Uber or work as freelancers, they have special needs. They want tools that help them find business deductions, such as “Self-Employed” versions that include tax calculators.

📈 The Investor

People who trade crypto or own rental houses need “Premium” software. These users require extra forms for their assets.

So, recommending a “free” tool that lacks these forms will make you look like you don’t understand their needs.

💰 The Simple Filer

For people with one job who just want to save money, price is the most important factor.

Cheap or free tools will sell best here. You might make less money per sale, but you will get many more sales.

Once you know your audience, you should verify that the software has the right tools.

- Schedule C Support: Does it handle 1099 income easily?

- Asset Logic: Does it include rental property depreciation calculators?

- Safety Net: Does the offer include “Audit Defense” (a high-value upsell for nervous filers)?

- Geography: Does it support multi-state filing for remote workers?

Compare Commission Structures and Calculate Earning Potential

After you find a product that fits your readers, you must look at the money. Different programs pay their partners in different ways. 💸

Be careful when comparing “Flat Rate” and “Tiered” commissions.

A flat rate pays you the same amount, like $50, for every sale.

However, a tiered program pays different amounts based on what the user buys. It might pay $15 for a basic tax return but $120 for a business owner.

If most of your audience are freelancers, the tiered model will earn you much more money.

Don’t guess how much you will make. You can this simple formula to compare your top choices:

Monthly Visitors × Conversion Rate × Average Commission = Total Revenue

If the math does not work on paper, it will not work in your bank account. Always run these numbers before you sign up for any program.

Double-Check on Payment Terms

As an affiliate, you need cash in your bank account quickly. If your cash flow stops, your business can fail before the season even ends.

This timing issue is why you must watch out for “The Net-30 Trap.”

Most major programs use “Net-30” or “Net-60” terms. This means they wait 30 or 60 days to pay you after you earn a commission.

For instance, you spend $5,000 on ads in January to get customers. However, your January earnings often lock in late February. You might not get paid until March 20th.

As a result, you have to cover your costs for nearly 60 days out of your own pocket.

Since these delays can stall your growth, you should look for partners who pay more often. Getting paid weekly or monthly lets you put that money back into ads while the season is still hot.

Besides payment speed, you must also check the minimum amount required to get a check.

This is the minimum amount you must earn before the company sends your payment. 💰

A low threshold ($50) is ideal to get your money. Meanwhile, some brands require you to earn a large amount before they pay. If you earn $400 but the limit is $500, your money is “stranded.”

Evaluate Affiliate Support Quality and Available Resources

Once you know the money is safe, you need to see if the program actually helps you earn it. The difference usually comes down to the support team.

A dedicated affiliate manager is your best friend.

They can give you special discount codes for your audience. They can also raise your pay if you send them a lot of customers. Most importantly, they can tell you which pages are making the most money right now.

Before you sign up, you should test them to see how fast they respond. You can send a simple email with these two questions:

“How well do your pages work for self-employed customers?”

“Do you have any special deals for new partners?”

If they reply within 24 hours with real data, they are pros. If you get a generic auto-reply or silence, you will be on your own when the busy tax season starts.

Along with good support, you also need the right tools to sell. 🎨

Scroll through their website and find their “Creative Assets,” such as banner ads and images. You want to ensure their marketing looks professional and up to date.

✅ The green flag: They have banners updated for the current year (like “File your 2024 Return”). This shows they are ready for business.

🚩 The red flag: The ads still mention old tax years or look messy. Using old ads is a fast way to lose clicks and trust.

Who Should You Target with Tax Affiliate Promotions?

You cannot sell tax software to everyone. Instead, you need to find a specific group of people who need help with their forms.

Choosing the right audience makes your promotions more effective and grows your earnings. Let’s see who you should target.

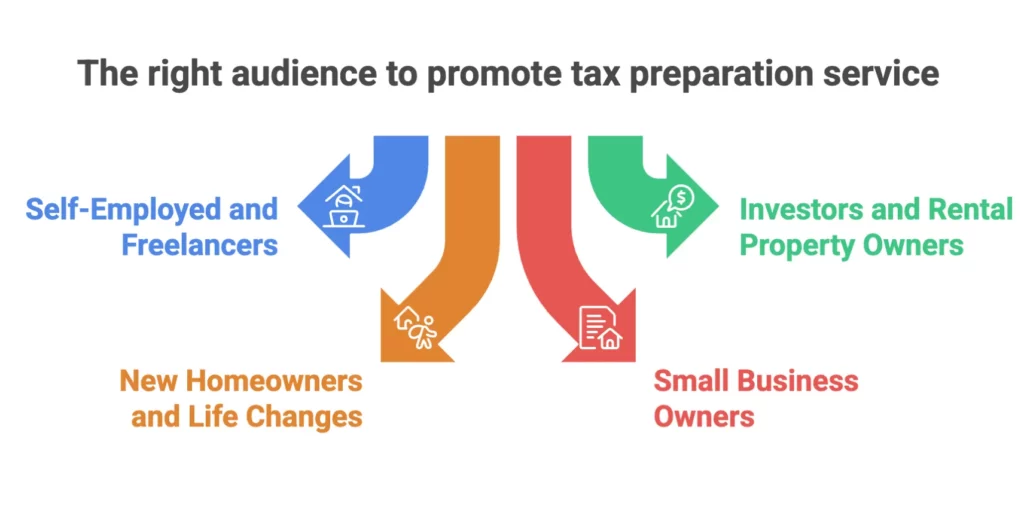

Self-Employed and Freelancers

Freelancers and self-employed workers are the “Holy Grail” of tax marketing. They are your most valuable audience because they have the most work to do.

The reason they are so valuable is that their taxes are complicated.

A regular employee can often file for free in just ten minutes.

A freelancer cannot do that. They have to deal with a mountain of forms, business expenses, and the fear of a tax audit.

Therefore, they have to buy a “Self-Employed” or “Premium” plan, which costs between $65 and $120. 💳

You will often see high conversion rates with this group. In fact, about 8% to 12% of people who click your link will likely make a purchase. 📈

Here is the math on why targeting freelancers pays off:

Higher spending: Customers spend $90 to $120 on premium tools.

Bigger commissions: You can earn $20 to $30 per sale instead of just $5 for a basic return.

High motivation: These users are driven by two things: the fear of making a mistake and the desire to save money on tax breaks.

Investors and Rental Property Owners

While freelancers worry about making mistakes, investors care about efficiency. This group includes people who trade stocks, buy crypto, or own rental properties.

As their income comes from many places, their taxes are very complex.These users have to report specific details like capital gains and rental earnings.

Basic free software simply cannot handle these forms. Instead, they need “Premier” or “Investor” editions. These versions are powerful enough to pull data directly from apps like Robinhood or E*TRADE. 💻

This group converts at a solid rate of 5% to 8%. Most of these investors do not worry about the price of the software. They are happy to pay over $100 if it saves them hours of hand-typing numbers.

Here is why targeting investors is a smart move for your business:

High order value: Most customers spend between $80 and $120 for the tools they need. 💰

Bigger payouts: These expensive “Premier” plans usually trigger much higher commissions for you.

A focus on automation: These users want accuracy and tools that do the hard work for them. 🤖

New Homeowners and Life Changes

While freelancers and investors face complex taxes every year, this group is experiencing them for the first time. Their confusion is your opportunity to help.

This audience is usually motivated by big life events.

A person might use a free tax app for years without any issues. However, once they buy a house, get married, or have a baby, their old way of filing feels risky. They start looking for better tools because they do not want to miss out on new tax breaks or credits.

The biggest draw for this specific group is the mortgage interest deduction.

For instance, a new homeowner might pay $12,000 in interest during their first year.

The high cost usually forces them to “itemize” their deductions rather than take the standard rate. Therefore, they need to move away from basic filing and use more advanced software. 📉

This group has a solid conversion rate of 4% to 6%. When you promote to them, you are selling the peace of mind that comes with knowing they claimed every dollar they deserved.

Small Business Owners (Complex Needs)

Small business owners have the most money to spend, but they are also the hardest group to convince. Their taxes are much more complicated than a standard return.

The stakes are very high for these owners, as their mistakes can be costly.

They have to manage complex tasks like payroll, sales tax, and partner forms. Because one error can lead to serious trouble, many business owners skip software entirely and hire a professional accountant instead.

You will likely see lower conversion rates of about 3% to 5% with this group.

However, even though you might make fewer sales, the money you earn from each one is much higher.

When a business owner does buy, they are looking for professional-grade tools.

They usually buy expensive bundles, such as QuickBooks paired with TurboTax Business.

These packages often cost between $200 and $400, resulting in a high commission for you.

How Do You Promote Tax Preparation Affiliate Programs?

You can have the best affiliate offer in the world. But if you promote it to an empty room, you earn zero.

Data shows that content marketing drives 60-70% of tax affiliate sales. But email and paid channels act as powerful boosters. You need a mix of organic search (for trust) and direct promotion (for urgency).

Here are the four most effective methods to drive sales during tax season.

SEO Content Marketing (Year-Round + Seasonal)

SEO is the base of your business. Since buying tax software requires research, most people start their journey by searching on Google.

To capture these searches, you should release your content in two waves.

| Phase (Timing) | Strategy | Example content |

| Foundational (Sept–Nov) | Build authority with “evergreen” guides to capture Tier 1 audiences before the rush. | “Freelancer filing guides,” “Small business tax deduction lists.” |

| Seasonal (Dec–Jan) | Target 110k+ monthly search volume via high-intent reviews and affiliate tables. | “TurboTax vs. H&R Block,” “Best software for crypto investors.” |

While your content brings people in, you shouldn’t let them leave empty-handed. 📧

You’d better use the “Content Upgrade” trick to grow your business. It’s good to offer them a free gift in exchange for their email address, like a downloadable “Tax Write-Off Checklist.”

That way, you can build a list of people you can message later during the final, high-sales weeks in April.

Email Marketing (Seasonal Campaigns)

Email marketing helps you sell to people who already know and trust you. During the busy tax season, your email list is your most valuable tool for making sales. 📧

To get the best results, you should group your subscribers based on their specific needs. By sending the right message to the right person, you make more money. 📁

Group A (Freelancers): Send them reviews of self-employed software. Focus on how the tools protect them if they get audited.

Group B (Investors): Send them reviews of premium software editions. Focus on how the tools automatically track stocks and crypto.

Once your groups are set, you need a schedule for when to hit “send.”

You should aim to send 8 to 12 emails between January and April. Here is a winning schedule to follow: 📅

Jan 2 (The Early Bird): Announce that tax season is open and share what is new this year.

Jan 15 (The Teacher): Share a list of the top five tax breaks that freelancers often miss.

Jan 30 (The Advice): Explain why you recommend one specific software over its competitors.

April 1 (The Warning): Remind them that time is running out and they should file before websites get too busy.

April 14 (The Final Call): Give a last-minute reminder to file today to avoid expensive government fines.

Following a plan like this is much more profitable than sending random updates.

A generic newsletter usually has a very low success rate. However, a targeted tax campaign can have a high conversion rate of 8% to 15%.

If you manage your list correctly, even a small group of subscribers can lead to a big payday.

For example, a list of 5,000 people can generate between $2,700 and $13,500 in a single season. 💰

YouTube Tax Tutorials

YouTube is where they go to see the software in action. Tax forms can feel scary and complicated to most people. A video that shows exactly which buttons to click removes that fear.

The best way to drive sales on YouTube is through an “Over-the-Shoulder” walkthrough.

In this type of video, you record your screen while you fill out a sample tax return. So viewers can follow along with you step-by-step.

It’s also crucial to show them exactly where to enter freelance income or how to claim a home office deduction. You should highlight how the “refund meter” goes up as you add information.

A 15 to 30-minute video can see a conversion rate of 5% to 8%. When people see that they can handle their own taxes with your help, they are much more likely to click your link. ✅

To make the most money from your channel, you must optimize your videos for search.

Use year-specific titles 📅

Always include the current tax year, such as “TurboTax Walkthrough 2024-2025.” People will avoid old videos because tax laws change every year.

The “first two lines” rule 🔗

Put your affiliate link in the very first line of your video description. Do not make people click “Show More” to find the link they need.

Use pinned comments 📌

Post your affiliate link in a pinned comment at the top of the comment section. This helps mobile users find the software quickly without scrolling.

Social Media Tax Tips (Instagram, Twitter, TikTok)

Social media is the final piece of your plan. However, it is rarely the place where people make a final purchase.

Trying to sell tax software directly from a short video usually fails.

A 30-second TikTok is too short for such a complex decision. As a result, direct sales from social media are very low. Instead, you should use these platforms to lead people toward your more detailed guides.

The best approach is to use a “Two-Step” strategy. You can use your social posts to offer something helpful for free.

Step 1 (The Hook): Post a video about a big topic, like “The $12,000 tax break new homeowners often miss.”

Step 2 (The Bridge): Tell viewers to click the link in your bio to download a free “Tax Checklist.” This allows you to collect their email address.

Step 3 (The Sale): Once you have their email, you can send them your software reviews and affiliate links through your newsletter.

Moreover, you should change your content to fit each specific platform.

📸 Instagram: Use “Carousels” (posts with multiple images) to list deductions freelancers often forget. These visual lists are perfect for stopping people as they scroll.

🐦 Twitter/X: Use “Threads” to count down to tax deadlines. These short, connected posts help build a sense of urgency as April 15th gets closer.

🤳 TikTok: Post quick, face-to-camera tips about tax moves people should make in December. Keep these videos fast, personal, and helpful.

FAQs

What is a tax preparation affiliate program?

A tax preparation affiliate program allows you to earn commissions by referring users to tax-related services such as online tax filing software, professional tax preparers, or bookkeeping solutions. You earn when a user files taxes, books a consultation, or purchases a service through your referral link.

How much can you earn from tax preparation affiliate programs?

Earnings vary widely depending on the program and traffic quality. Typical commissions range from $10–$50 per completed tax return, while premium or CPA-based programs can pay $50–$200+ per qualified lead, especially for business or self-employed tax services.

Are tax affiliate programs good for beginners?

Yes, many tax affiliate programs are beginner-friendly. Online tax software brands usually provide ready-made landing pages, tracking dashboards, and long cookie durations. The key challenge is timing—tax offers perform best during tax season.

When is the best time to promote tax preparation affiliate offers?

The peak season is January to April (U.S. tax season). However, some niches—such as bookkeeping, IRS debt relief, and business tax services—convert year-round, especially for freelancers and small business owners.

Is tax affiliate marketing competitive?

Yes, it is competitive—especially for major brands. However, long-tail keywords, niche audiences (self-employed, expats, gig workers), and localized content (state-specific tax rules) still offer strong opportunities.

Do you need tax expertise to promote these programs?

Formal certification is not required, but basic tax knowledge significantly improves trust and conversions. Most successful affiliates focus on education-first content, clearly stating that they are not providing legal or tax advice.

Can you promote multiple tax affiliate programs on one site?

Yes—and this is often recommended. Comparison tables, “best tax software for X” articles, and decision guides convert well and allow you to diversify income rather than relying on a single provider.

Conclusion

Promoting a tax preparation service can earn you big, as some of them pay affiliates from 30% to 40% commission per subscription. You can create educational blogs, tutorial videos, or firsthand reviews to engage your followers. With an effective marketing strategy and the right tax preparation affiliate program, you can strengthen your brand and earn your audience’s trust.