Experian has reported that the average auto loan amount reached $41,086 in the third quarter of 2024. With this thriving number, the average commission payout of this niche is higher than other finance services. If you’re a new affiliate, tapping into this industry doesn’t sound bad at all.

You don’t need to worry about finding a suitable program because we’ve done this step for you. Keep reading this list of the 10 best auto loan affiliate programs, and you might find out the best one.

There are some relevant niches to help you make the most of your earning potential. You can consider personal loans, business loans, payday loans, or financial affiliate programs.

TL;DR

The auto loan niche offers affiliates amazing earning chances. Let’s see how much you can earn from this promising niche.

- Upstart (Commission: 1%, Cookie: 30 days)

- Consumer Credit Union (Commission: 0.5%, Cookie: 30 days)

- Caribou (Commission: $150, Cookie: 30 days)

- myAutoloan (Commission: $15, Cookie: 45 days)

- AAA – Auto Club (Commission: $10, Cookie: 45 days)

- Carmoola (Commission: £300, Cookie: 30 days)

- FairStone (Commission: $150-200, Cookie: 30 days)

- BadCreditLoans (Commission: 76%, Cookie: 45 days)

- Axos Bank(Commission: $100-150, Cookie: 30 days)

- Viva Finance (Commission: $50, Cookie: 60 days)

It can be overwhelming to run programs, manage affiliates, monitor performance, or process payments. However, affiliate software like UpPromote can help handle all these tasks effortlessly. Our app makes it simple for even beginners to grow a successful affiliate marketing program.

115,000+ users worldwide have used UpPromote to start affiliate marketing. Now is your turn.

Top 10 Auto Loan Affiliate Programs to Monetize Your Existing Traffic

Check out the table below to know which auto finance affiliate program offers the most amazing benefits.

| The best affiliate programs | Program name |

| Affiliate program with the highest commission rates | BadCreditLoans (76%) |

| Affiliate program with the longest cookie duration | Viva Finance (60 days) |

| Affiliate program with the most payment methods | BadCreditLoans (ACH, bank transfers, PayPal, checks, wire transfers) |

| Affiliate program with the most promotional materials | myAutoloan (Links, buttons, banners) |

1. Upstart

Upstart applies AI to assess auto loans based on users’ credit scores and employment history. They provide loans of $9,000 to $60,000 for purchasing both new and used cars.

You need to sign up for Impact Radius to join the Upstart auto loan affiliate program. After joining their program, you can earn a 1% commission on every qualified funded loan.

The cookie duration remains active for 30 days from customers’ first click on your link. If they purchase within this time, you’ll earn a commission.

|

2. Consumer Credit Union

Consumer Credit Union provides low-rate auto loans for brand-new cars, classic autos, used cars, motorcycles, and RVs. They also partner with TrueCar to help users buy vehicles at a competitive price.

Managed by Impact Radius, the Consumer Credit Union affiliate program offers a 0.5% commission on every sale. You should note that they only count your commission once customers complete their loan submission.

You’ll have 30 days from customers’ first click to earn a commission. That means you can only get credit for purchases within this period.

|

3. Caribou

Caribou creates refinancing plans to help users save money on their monthly car loan. They offer plans for private vehicles only, such as cars, trucks, and SUVs.

You can join the Caribou auto loans affiliate program and enjoy up to a $150 commission on a qualified funded loan. They’ll upgrade your affiliate tier based on the monthly number of sales.

- 5-9 sales: $200 commission

- 10-19 sales: $250 commission

- 20+ sales: $300 commission

The more sales you generate, the higher commission you can get. The cookie duration lasts 30 days from customers’ first click on your link. If they make a purchase during this time, you’ll get your commission.

|

4. myAutoloan

myAutoloan connects borrowers with various trusted auto loan lenders. Less-than-perfect credit users can compare real-time offers to find budget-friendly loans for their new vehicles.

myAutoloan runs their affiliate program via CJ Affiliate, offering a $15 commission on every qualified subscription. The cookie duration is 45 days, starting from customers’ first click on your link.

You can utilize their eye-catching banners to boost your content attraction among other competitors. Additionally, you should customize links and buttons to align your content with the audience’s preferences.

|

5. AAA – Auto Club

AAA – Auto Club provides auto loans for vehicles of over $5,000 in the US. They also create various refinancing options and insurance to guarantee borrowers’ benefits and financial health.

The brand allows affiliates to earn a $10 commission on each successful purchase. The only way to join the AAA – Auto Club affiliate program is to sign up for CJ Affiliate, their third-party affiliate network.

The cookie duration starts counting once customers click on your affiliate link. If they purchase within 45 days, you’ll earn your approved commission.

|

6. Carmoola

Carmoola offers automotive auto loan offers and car refinancing solutions for UK residents. Borrowers can easily receive budget approval with their driver’s licenses and basic personal information.

Managed through Awin, the Carmoola auto loan affiliate program offers up to £300 for every qualified loan subscription. You’ll receive commission payouts once customers retain their car finance for at least 20 days.

The cookie duration remains active for 30 days once customers click on your link. If they purchase within this time, you’ll earn a credit.

|

7. FairStone

FairStone is a top Canadian lender that provides personal and auto loans of up to $60,000. They develop an automotive calculator to help borrowers estimate the potential impact on their payments.

Once joining this car loan affiliate program, you can earn up to a $200 commission on each purchase based on borrower type.

- Homeowner: $200 commission

- Non-homeowner: $150 commission

The cookie duration lasts 30 days and starts counting once customers click on your link. If they make a purchase during this time, you’ll earn a commission.

The FairStone affiliate manager will give you support and detailed investment information for creating promotional content. You can ask any questions about their program and products to build suitable marketing strategies.

|

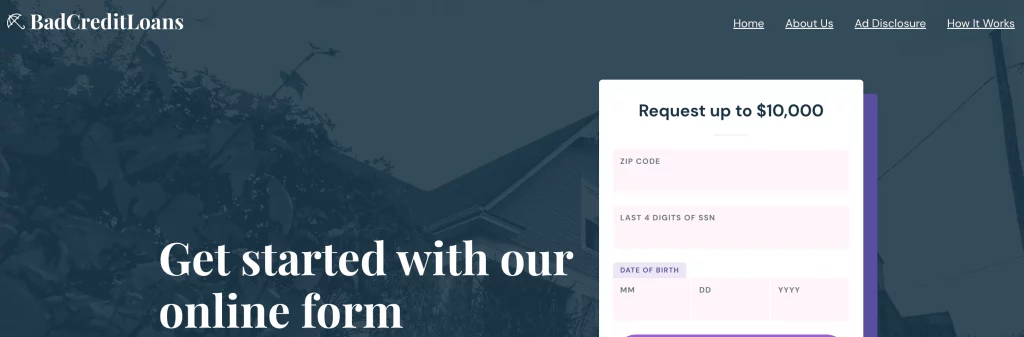

8. BadCreditLoans

BadCreditLoans helps individuals with poor credit histories find suitable personal, home, and auto loans. Their network of state and tribal lenders allows users to borrow up to $10,000 for each loan.

BadCreditLoans runs their auto loan affiliate program via FlexOffers. After joining their affiliate program, you can enjoy up to a 76% commission on every qualified loan subscription.

The cookie duration is 45 days, starting from the moment customers click on your link. Any purchases made during this time will be counted as your qualified commission.

|

9. Axos Bank

Axos Bank helps users manage current auto loans and find suitable refinancing plans to save money. They also offer various auto loan options for all vehicles, except for commercial ones.

You can join the Axos Bank affiliate program via CJ Affiliate, their third-party affiliate network. Axos Bank pays from $100 to $150 for a completed subscription via your link.

The program also offers a 30-day cookie duration starting from customers’ initial click on your link. Therefore, you can earn a credit for any purchases within this time.

|

10. Viva Finance

Viva Finance is a top affordable loan service for low-income employers. They structure repayment plans to fit borrowers’ monthly budgets and support their stable finances.

The only way to join the Viva Finance auto loan affiliate program is by signing up for CJ Affiliate. You can enjoy a $50 commission across all types of loan subscriptions.

You can only earn a commission for purchases within a 60-day cookie duration. You can include promotional codes in your content to attract more attention and drive conversions better.

|

How to Build An Auto Loan Affiliate Program for Your Shopify Store?

Instead of saving enough money to buy a car, more people nowadays often go for an auto loan to get the car they want faster.

This has led to a booming demand for auto loans in the upcoming years. If you want to benefit from the positive trend, having an effective marketing strategy is needed.

While others are still struggling with traditional advertising methods, you should try affiliate marketing instead.

With an auto loan affiliate program, you can effectively broaden your networks within the industry and reach more leads.

Plus, affiliate marketing doesn’t require risk investment and upfront costs, making it an affordable way to promote your Shopify brand.

In the following guide, we’ll show every essential step to build your auto loan affiliate program from the beginning.

Use a comprehensive affiliate management tool

Managing an auto loan affiliate program can be complex and costly, especially if you’re thinking of hiring a tech team. A far better approach is to use the right affiliate management app.

You may be confused with many options on the Shopify App Store, so here are the features a comprehensive app should have.

Above all, your chosen software must support commission tracking across subscription cycles, letting you set distinct rates for initial payments and all subsequent renewal ones.

That’s because you want to reward affiliates forever as long as the customer stays subscribed.

Once commissions are flowing automatically, you need visibility into how they’re performing.

Real-time analytics dashboard will show clicks, conversions, and revenue as they happen. So you can optimize campaigns on the fly rather than discovering issues weeks later.

Moreover, you should go for an app that automates the payout process, helping you pay all affiliates on time and accurately.

The app should also offer robust features like auto-tier commission, bonuses, and gifts to help you boost affiliates’ performance.

When you consider these amazing essentials, UpPromote is your best bet.

You can try out our app with a 14-day free trial available for all plans. You’ll get to experience which plan suits your affiliate program best before committing.

Create a rewarding commission rate

Setting an attractive commission rate is key to attracting affiliates to your auto loan affiliate program.

In the auto loan industry, the flat-rate commission model is the most common and effective approach.

This means you only have to pay a fixed amount for each approved loan application.

Here are our suggestions for setting your rates, based on data from over 135 brands in the industry.

Refinancing and Bad Credit Loans are highly profitable loan types, but they are also the ones customers tend to hesitate with the most.

People often worry about how these loans might affect their credit or long-term finances.

So, you can consider setting the commission rate at $100-250 per application to motivate affiliates to promote harder.

For example, a top auto loan provider like Caribou offers a $150 commission on each successful loan application.

For New Car Loans, you can set the commission rate ranging from $75 to $200.

The market for new car loans has strong demand, but it’s also incredibly competitive.

A lot of other brands also set their commission rate within this range. For example, FairStone offers $150 commission on their homeowner’s new car loan.

If your Shopify business focuses on more specialized areas like used car loans or lease buyouts, a commission in the $50 to $150 range is a wise choice.

These loans often involve smaller amounts and generate lower profit margins for your Shopify store, so the commission needs to align with that reality.

For example, Viva Finance pays their affiliates $50 on every qualified loan subscription.

Set the right cookie duration

Cookie duration is the main factor that can impact whether affiliates earn commissions from the sales they bring in.

Basically, it determines if a sale gets attributed to the affiliate who referred the borrower.

So how do you know which period is right for your program?

Cookie duration often depends on the type of loan and how long borrowers typically take to make a decision.

Refinancing & Bad credit auto loans: 60-90 days

Complex loans like refinancing and bad credit auto loans need a longer cookie duration of 60 to 90 days.

Borrowers take weeks or months to decide whether to get these loans. They compare multiple lenders and deal with extra paperwork.

Moreover, the process of getting these loans is naturally slow, so affiliates need more time to get qualified commissions.

New & Used car loans: 15-30 days

We think that new car loans and used car loans work well with 15 to 30-day cookies.

When it comes to getting these loans, borrowers already want a car and just need more financing. They decide faster than complex loan borrowers.

Take a cue from Carmoola, which set a 30-day cookie duration on its loan subscription.

Lease buyouts & Private party loans: 7-15 days

If your company mainly provides simple loans like lease buyouts and private party loans, a short cookie duration of 7 to 15 days is fine.

These deals involve smaller amounts and easy terms. Borrowers act quickly because they have immediate needs.

Identify your right partners

Getting the right affiliates to promote your auto loan services can significantly boost sales and brand awareness.

In the auto loan niche, personal finance bloggers and automotive influencers stand out as the best affiliate choices.

Personal finance bloggers often educate their audience about budgeting, saving, debt reduction, and smart financial decisions.

These bloggers produce different types of content, like industry analysis, loan service reviews, or loan subscription guides.

Their content is practical and relatable, helping readers make informed choices about loans, credit, and investments.

For example, Financial Samurai often writes about topics such as auto loans, student loans, and debt.

Their articles attract a lot of attention from borrowers. They often leave comments to discuss and ask for financial solutions.

Besides bloggers, you can consider working with automotive influencers. These influencers create car-focused content that attracts many car enthusiasts and potential buyers.

This creates a perfect opportunity for them to recommend your Shopify auto loan service naturally.

For their audience, your loan can be the practical solution that helps them turn that dream into a reality.

However, finding the right automotive influencers can be challenging. Many macro-level influencers in this niche are professional racers or work exclusively with big brands.

Instead, focus on micro-influencers who are willing to create relatable content around your auto loan service.

These influencers often put more effort into engaging their audience and can deliver better results for your program.

We also did some research to help you find top micro influencers on Instagram:

- @mechanicshopfemme (142k followers)

- @wholesalechad (102.2k followers)

- @renukakirpalani (84.5k followers)

(@mechanicshopfemme on Instagram)

Once you’ve identified the right influencers, provide them with clear guidance, access to your resources, and attractive commission rates to keep them motivated.

Invite potential affiliates to join your program

You can both actively invite your desired affiliates to join the program and create an easy way for them to apply.

Reach out directly to your desired affiliates

A great way to show your serious commitment is to reach out directly to your desired partners with a personalized offer.

Using email is a professional way to directly contact them. You can provide detailed affiliate program offers and exclusive deals to catch their first attention.

Plus, don’t hesitate to show how you love their content to spark their interest in partnering with your brand.

So, this is how your email should look:

Subject: [Affiliate’s Name], Let’s Team Up: Earn $100 Per Auto Loan Referral!

Email Body:

Hi [Affiliate’s Name],

I hope this email finds you well! I’ve been following your [specific niche, e.g., “personal finance blog” or “automotive content”], and I think you’d be a perfect fit for our Auto Loan Affiliate Program.

This program is a great way to help your audience achieve their dream of owning a car while you earn $100 for every funded auto loan.

Here’s why our program works for partners like you:

- High Commissions: Earn $100 for each successful loan referral.

- Exclusive Marketing Tools: Access banners, calculators, and other resources to promote easily.

- Dedicated Support: We’re here to help you succeed at every step.

If you’re a [personal finance blogger, automotive expert, or digital marketer], this is a great opportunity to monetize your platform while helping others make smart car financing decisions.

Getting started is easy – just click the link below to sign up and start earning:

[Join the Affiliate Program Now]

Have any questions? Feel free to reply to this email, and I’ll personally get back to you as soon as possible.

Looking forward to partnering with you!

Best regards,

[Your Full Name]

[Your Company Name]

Set up the registration page

While you’re actively searching for ideal partners, many affiliates also hear about your program on the internet, through forums, social media, or online groups.

So, having a professional registration page on your site can serve as a perfect front door to welcome them to your affiliate program.

Setting up a registration form is easy with UpPromote since you don’t need any coding skills.

We provide you with 3 beautiful and trendy pre-designed templates, including Basic, Trendy, and Comfort.

Then, you can customize the page with branded colors, logos, and images.

You can also add specific information about your affiliate program, such as commission rate, cookie duration, and other incentives.

If you want to quickly catch high-quality affiliates from a pool of applications, asking auto loan-related questions is a great idea.

We’ve researched the industry, and other Shopify auto loan brands add these questions to filter their matching affiliates:

- How familiar are you with auto loan terms and requirements?

- Who is your target audience (age, income level, location)?

- What’s your monthly website traffic or social media following?

- How do you typically promote financial products to ensure compliance?

- Do you focus on specific loan types (new cars, used cars, refinancing, bad credit)?

Asking these questions can help you identify affiliates with the most suitable profile and content. Plus, you can identify high-quality ones by knowing their main audience and engagement rate across platforms.

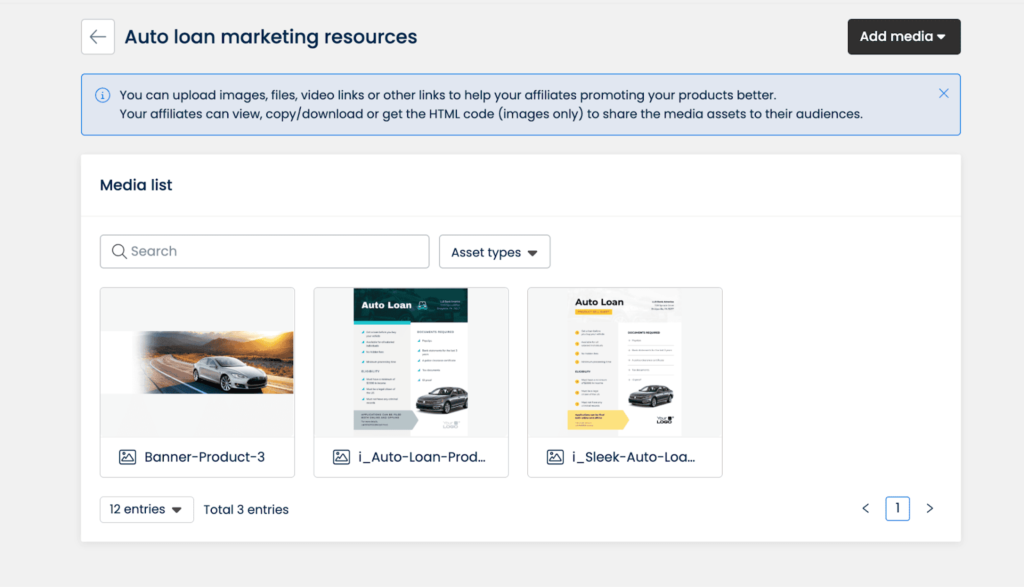

Provide affiliates with pre-made marketing materials

Promoting auto loan services can be challenging for affiliates. It requires effort, deep knowledge, and the right tools.

It’s important to provide them with helpful marketing resources to help them create high-quality and brand-aligned content.

It’s great to share simple guides, FAQs, or key loan details to help them feel confident in promoting your program.

Your affiliates should understand your auto loan terms and requirements to create authentic and accurate content.

However, simply emailing these assets creates chaos. Files get lost, versions become outdated, and affiliates waste time searching for what they need.

To solve these problems, UpPromote Media Gallery lets you upload all of the educational resources, like documents, contracts, or banners, into a centralized place.

You can create dedicated folders for each loan type to help affiliates find the exact banners, guides, and talking points they need.

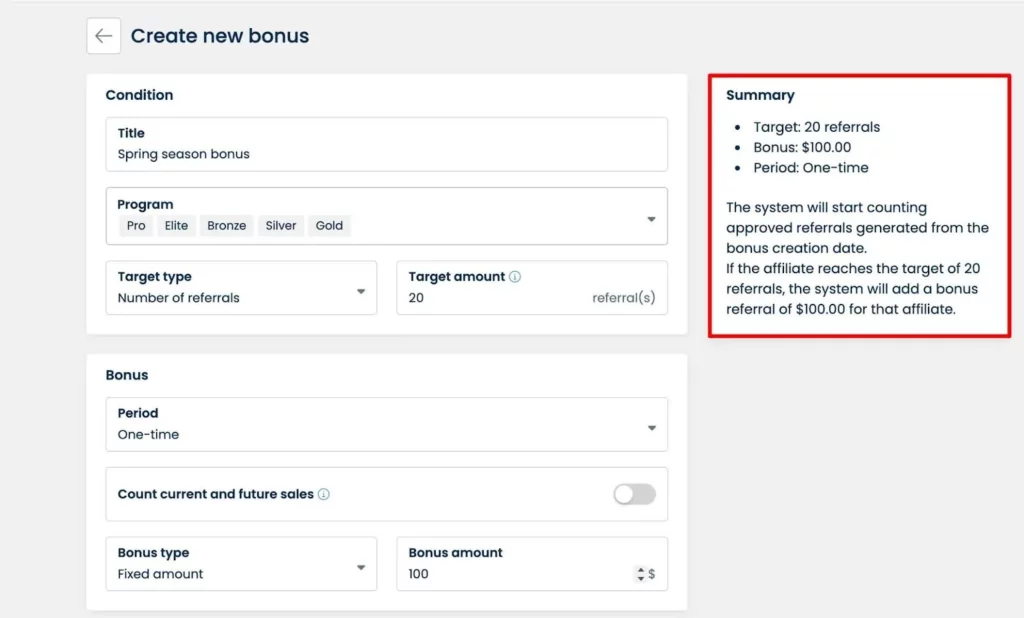

Boost affiliates’ performance with amazing bonuses

You can sometimes offer bonuses to reward top-performing affiliates during sales events or holiday seasons.

With the UpPromote app, you can set the rule for a specific bonus within a few minutes.

You can set the target type based on the total affiliates’ sales value or number of sales. Then, you can choose the target amount following the bonus type.

For example, the goal can be “Refer 10 successful loans”.

Next, you can set the bonus amount to $50, $100, $150, or any cash amount.

Finally, don’t forget about the bonus period. You can choose one-time, monthly, quarterly, or even yearly.

Let’s say you want to create an “End-of-Quarter Push” to boost your refinancing loan numbers in March.

You then introduce a $200 bonus for any affiliate who successfully refers 5 refinancing loans in March.

Conclusion

Ultimately, an affiliate program opens a powerful new door for your Shopify auto loan business.

You can build credibility and reach a wider audience through trusted partners in the community.

With UpPromote, launching and managing that program becomes simple and efficient. We make it easy for you to reap the rewards of affiliate marketing without the operational headaches.

Don’t hesitate, and look at our pricing plans to take the first step in your affiliate marketing journey today.

FAQs

1. What is an auto loan affiliate program?

An auto loan affiliate program is a partnership where publishers (affiliates) promote lenders, refinancing services, or car financing platforms. Affiliates earn commissions whenever their referrals generate qualified leads, applications, or loan approvals.

2. How do auto loan affiliate programs work?

Affiliates sign up with a lender’s program or via an affiliate network. They receive unique tracking links or coupon codes to promote loan offers. When potential customers click through and submit loan applications, affiliates earn payouts—often on a per-lead (CPL) or per-approved-loan (CPA) basis.

3. Who can join an auto loan affiliate program?

Anyone with relevant traffic sources—such as finance blogs, car dealership websites, auto review channels, or personal finance influencers—can join. Approval usually depends on niche fit, traffic quality, and compliance with financial promotion guidelines.

4. Can auto loan businesses run affiliate programs on Shopify or WordPress?

Yes. While auto loans aren’t physical products, lenders using websites built on WordPress or Shopify can integrate affiliate plugins or third-party apps. Many affiliate apps (like UpPromote or Post Affiliate Pro) allow tracking even for service-based businesses, as long as lead forms or conversions are correctly tagged.

5. Are auto loan affiliate programs profitable for affiliates?

Yes, if affiliates target the right audience. Auto loans often have high payout ranges ($20–$150 per lead, sometimes more for approvals). However, competition is stiff, so affiliates need strong SEO, PPC campaigns, or niche-focused content to stand out.