Maintaining affiliate engagement and fostering lasting relationships are key factors in running a successful affiliate program. But how can you achieve that? Is offering high affiliate commission rates enough? Or is there more to consider?

Initially, publishers join your campaigns to earn commissions from the sales they generate. Of course, they expect to be paid on time for their work. No one wants to feel unsure about when or how much they’ll get paid.

To make your affiliate programs attractive and keep your publishers motivated in promoting your brand, be a trustworthy and reliable partner by making accurate and timely affiliate payments.

In this article, we’ll break down affiliate payouts, making it easier to understand how to compensate your ambassadors properly.

TL;DR

- Learning the affiliate payment meaning to understand its role in affiliate marketing

- Discover 6 popular affiliate payment methods to find the best fit for your business

- 3 key points to set up a smooth and transparent payment process for your affiliate campaigns:

- Consider affiliate payment thresholds

- Set an automated payment schedule

- Manage taxes and invoices with clarity

Potential Revenue with Affiliates (UpPromote)

Estimate the potential revenue when you recruit affiliates: comparing Current Business and Business + UpPromote.

Estimated Impact

Quickly visualize how affiliates can boost your orders and revenue.

Revenue Comparison: Current vs. with UpPromote

The chart illustrates relative revenue growth comparing two scenarios: organic sales vs. organic + affiliate-driven sales.

- Affiliate traffic quality is equal to your current traffic.

- AOV and Conversion Rate remain stable.

- Does not account for churn, refunds, or potential upsell/cross-sell.

Want to make quick and automatic payouts to affiliates? Use UpPromote, the top-rated affiliate software on Shopify, featuring a 4.9/5 rating and over 4,000 reviews, to simplify your payments.

Enable UpPromote’s auto-payout via PayPal for quick and hassle-free affiliate payments with peace of mind.

What Is An Affiliate Payment?

An affiliate payment refers to a financial reward a brand gives to an affiliate marketer for successfully promoting its products or services. In short, the business pays affiliates for their promotional efforts that generate sales or leads.

Simply put, the business compensates affiliates when their promotional efforts lead to a desired action, such as sales or leads.

Affiliate payments can take various forms, including deposits, bonuses, gift cards, or store credit. They are based on predefined criteria, such as a percentage of the sale, a fixed amount per sale or sign-up.

The details, including how and when payments are made, vary by the merchant’s affiliate program and their agreement with the affiliate.

Affiliate payments are more than transactions. They are essential for running effective affiliate campaigns. Timely, accurate payments build trust in your brand and keep affiliates happy and motivated.

6 Common Affiliate Payment Methods

You might wonder how to pay affiliates effectively. If you’re in charge of an affiliate program, whether small or large, you have various ways to pay your partners.

Each affiliate payment solution has its own benefits, and the fees can differ. So, it’s important to find the best option that suits both you and your affiliates, ensuring seamless affiliate payouts.

Let’s explore some affiliate marketing payment methods that suit your business:

PayPal

PayPal is a globally renowned digital payment platform that facilitates online money transfers. Founded in 1998, it became a key e-commerce tool. It enabled secure, easy transactions for millions of users and businesses worldwide.

PayPal now works as a payment processor for online sellers, auction sites, businesses, and, of course, affiliate networks.

If you are considering PayPal as a payment gateway for your affiliate program, here are some great benefits:

- Keep publishers’ banking details confidential. Channel commissions to their PayPal accounts. This reduces the risk of data breaches..

- Be widely accepted worldwide, making it a versatile option for international transactions.

- Have robust security measures, such as encryption and affiliate fraud detection.

- Integrate easily with various websites and e-commerce platforms

- Function as an e-wallet and enable swift international transfers between individuals and businesses

- Provide free peer-to-peer transfer, making it economical for personal use

Despite its popularity, PayPal has some points to note:

- It charges relatively high fees – 2.9% of the total amount plus a fixed $0.3 fee per transaction. For instance, sending $10 would mean the recipient gets $9.41, and 5.90% of the total would go to fees.

- Seller protection is limited in certain situations.

- Accounts may be subject to freezes and holds.

- Currency conversion fees apply to international transactions.

- The PayPal MasterCard is only available to U.S. citizens.

Still, PayPal is the top choice for businesses of all sizes that need to make quick, secure payments to affiliates. This method is best for online services, digital agencies, and firms with global affiliates.

To make things smoother, automating affiliate payments via PayPal is a great strategy. Integrating your affiliate marketing tracking software with this payment processor will save time. It will reduce manual work and ensure on-time payouts for your partners.

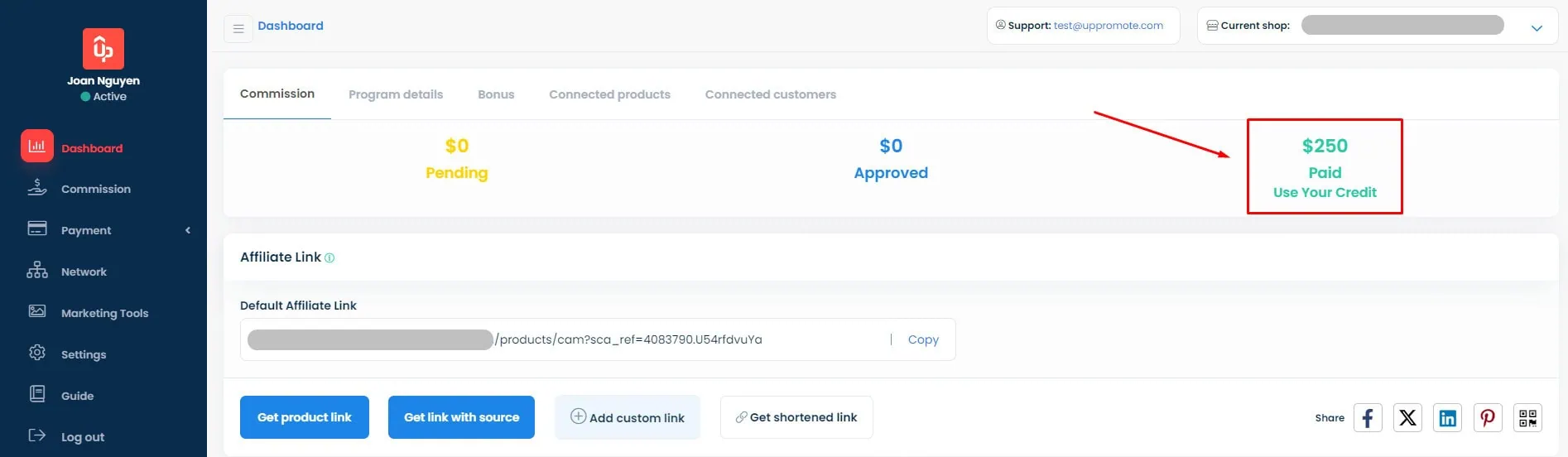

For example, with UpPromote, you can easily enable PayPal integration. It will automate and simplify the affiliate payout process. Our affiliate tracking system ensures quick, accurate, and easy transfers to your partners on a set schedule.

No more manual work! Activate UpPromote’s robust settings to schedule auto-payouts via PayPal & make seamless and timely affiliate payments.

Bank transfer

A bank transfer is a straightforward way to pay affiliates. It means you send money (affiliates’ commissions) directly to their bank account.

You can take into account some benefits of bank transfers:

- Bank transfers are accepted worldwide. So, they suit businesses with international affiliates or large networks that handle big affiliate commissions.

- This method is secure and reliable. Banks use multiple security protocols to protect each transaction between accounts. These include encryption, fraud detection, and secure authentication methods. They also provide clear tracking and records, allowing both you and your affiliates to monitor payments and quickly resolve issues.

However, there are some downsides to consider:

- Bank transfers, especially international ones, can take a few days to process. This may delay affiliate payouts.

- Handling many individual payments is time-consuming.

- Transfer fees may be charged to both you and your affiliates. These fees vary depending on the banks and countries involved. Not all banks support foreign transactions. Some may charge high currency conversion fees.

With this payment method, your affiliates must provide accurate banking details. This includes the bank name, account number, and account holder’s name. Bank transfers are secure but cannot be reversed. So, check all the information carefully before sending it.

Store Credit

Store credit is a payment method where affiliates receive credit to use within your store instead of cash. This credit can be redeemed for your products or services. It is a unique way to reward affiliates and encourage them to reinvest in your business.

Using this payment method can bring several advantages to your brand, including:

- Encouraging affiliates to buy from your store helps build brand loyalty.

- It is more cost-effective than cash payments. It keeps the money within your business and may reduce cash flow issues.

- Driving more traffic and sales to your store, as affiliates are motivated to spend their credit.

Extend lifetime value with UpPromote’s store credit payment. Create repeated purchases and cultivate brand loyalty.

Despite these benefits, there are some limitations. Affiliates are restricted to spending their credit only in your store, which may not always meet their needs or preferences. They may perceive store credit as less valuable than cash, potentially impacting their motivation if they prefer cash payments.

Even so, store credit is ideal for brands. It helps them promote their products and strengthen ties with affiliates. This method suits e-commerce, retail, and businesses that want repeat sales.

If your affiliate program software offers this payment method, utilize it. For instance, UpPromote lets you easily activate Store Credit. This enables more flexible commission payouts for your affiliates. The feature lets your partners redeem their credits for products in your store instead of getting cash.

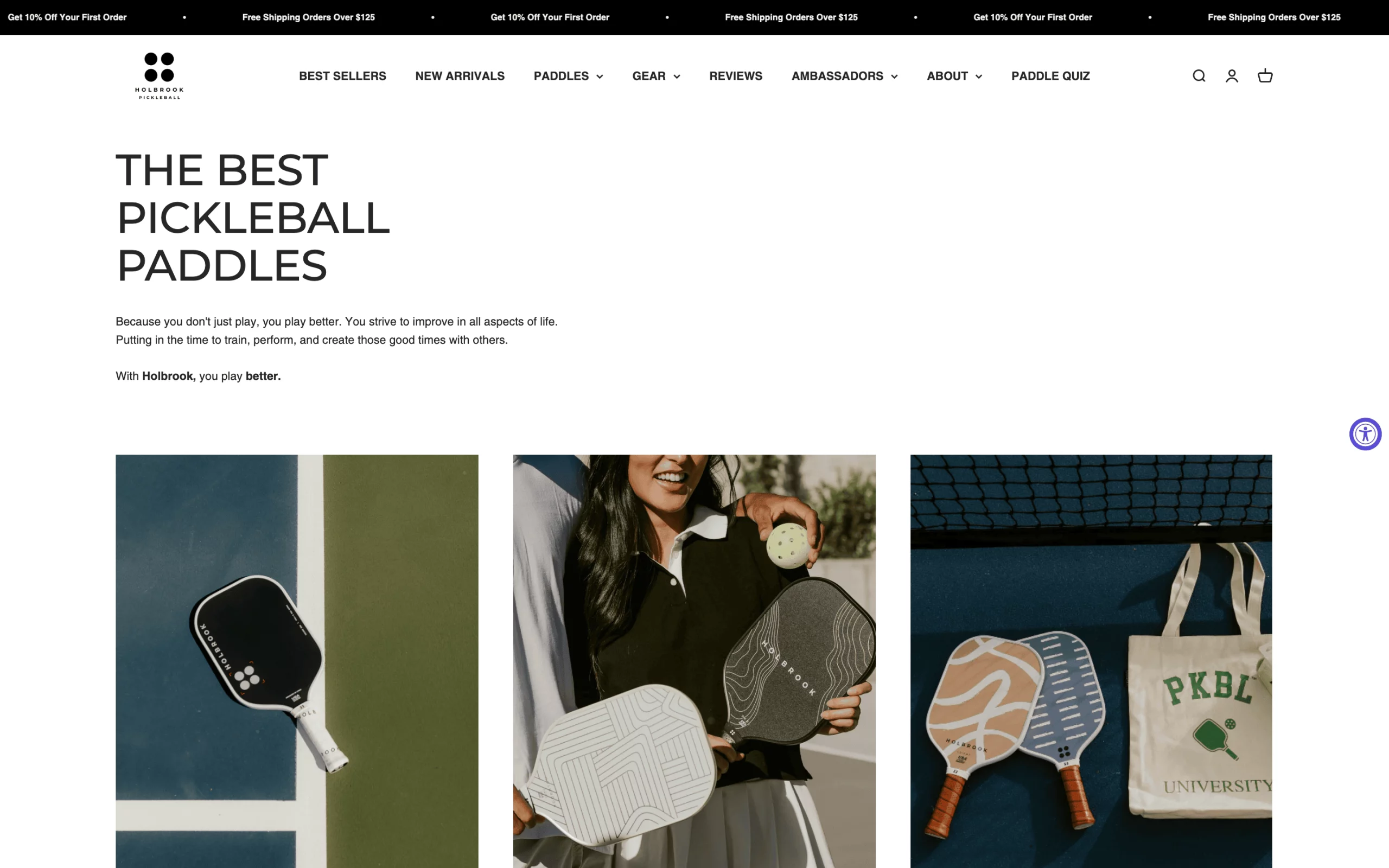

Activating UpPromote’s Store Credit feature as a payment method is part of Holbrook Pickleball’s smart affiliate marketing strategy.

Holbrook Pickleball welcomes pickleball enthusiasts to become their ambassadors. As soon as affiliates join the program, the brand offers them a unique code to share with their friends and followers.

Then, Holbrook Pickleball’s promoters earn a 15% store credit kickback every time someone uses their code, which helps the brand boost repeated purchases and cultivate brand loyalty.

“Store credit processing is easy, and payouts go smoothly within the app. The support team is super helpful. I can’t praise them enough for their promptness and expertise.”

OLIVIA

Holbrook Pickleball Marketing Manager

And the result? By the end of 2023, the brand saw an 87% increase in orders through its ambassador campaign.

Checks

Checks are a traditional way to pay affiliates. They involve mailing a check to the recipient.

Since checks do not require sharing financial information online, they reduce the risk of digital fraud. They also provide a tangible record of payment, which some affiliates or brands may prefer.

However, you can consider some drawbacks of this method:

- Checks can take one to two weeks to arrive and be processed. This delays affiliates who need quick access to their earnings.

- Processing and mailing checks can cost $10 to $20 each. This includes printing, mailing, and handling fees.

- Checks may be lost or delayed in the mail. This can cause payment delays and take longer to resolve.

Checks are particularly suitable for small to medium-sized businesses or traditional retail stores. They are also ideal for affiliates who prefer non-digital payments or operate in regions where digital payment options are limited.

Despite the slower processing times and higher costs, checks remain a viable option for businesses and affiliates valuing tangible records and security.

If you want to use checks as one of your affiliate program payment methods, keep these points in mind:

- Double-check the affiliate’s mailing address to ensure correct delivery.

- Tell your partners the delivery time for their checks. Also, inform them of any fees for receiving and cashing them.

- Keep records of all issued checks. Include their dates, amounts, and recipients. This is for affiliate payment reports. It will help avoid disputes with affiliates.

- What if a check is lost? Have a process for canceling and reissuing lost or stolen checks.

Debit/Credit Card

Debit or credit card payments transfer commissions directly to the affiliate’s card. With this method, ensure you have your partners’ current card info. This avoids transaction failures.

Here’re some pros of this affiliate payment solution:

- Payments via cards are quick and straightforward, allowing for immediate transaction processing. Your publishers get their commissions right away. It is perfect for those who need quick access to their earnings.

- This method is suitable for international transactions, as most affiliates have access to debit or credit cards.

On the other hand, there are cons to using debit or credit card payments:

- Every payment incurs processing fees, often around 2-3% of the transaction amount. For example, a payment of $1,000 could incur a fee of $20 to $30. Your affiliates might face extra fees from their card providers for receiving funds.

- Some affiliates may not have compatible cards. This could limit the use of this payment method.

Debit and credit card payments are ideal for businesses that need to make quick transactions and have tech-savvy affiliates. This method works best for online services, subscription businesses, and firms with international promoters.

Gift cards

Gift cards are prepaid cards that you can give to your affiliates to purchase goods or services from specific retailers or within your own store. They offer a flexible reward option for affiliates. They are an alternative to traditional cash payments.

Using gift cards as a payout benefits both affiliates and your business. Your partners spend their earnings on desired products in your store or network, enjoying great deals. Meanwhile, your company can reduce direct monetary transactions.

One example of a brand using this payment method is Amazon. Amazon Associates offers their promoters commissions in the form of gift certificates.

But, there are some downsides to paying affiliates with gift cards:

- Gift cards, unlike cash, restrict affiliates to specific stores. They may not always match the affiliates’ preferences.

- Gift cards often expire. This is inconvenient if affiliates don’t use them quickly

Gift cards suit retail businesses and e-commerce sites. They’re also good for firms wanting to strengthen ties with affiliates through branded incentives.

Additional tips for choosing the appropriate affiliate payment method:

Picking the right payment solution is essential for running a successful affiliate program. It has to fit all your business needs while ensuring a smooth and transparent payment process for your affiliates.

To find the best affiliate marketing payment method for your brand, consider these factors:

- Cost: Each payment solution has its expenses. High transaction fees can reduce your overall profit, so consider the cost carefully.

- Speed: Of course, speed matters. Quick payments keep your affiliates happy and motivated. Use payment methods that process transactions quickly. This will ensure affiliates get their earnings promptly.

- Security: The payment method must protect against fraud and data breaches. A secure payment system builds trust and protects both parties’ finances.

- Convenience: Make paying and getting paid easy for both you and your affiliates. Consider using automated affiliate payment systems that work with ecommerce affiliate software. These systems cut down on manual work. So, there are fewer mistakes and less hassle for everyone.

- International compatibility: What if you work with affiliates from different countries? In this case, the payout solution’s international compatibility becomes crucial. It also helps reduce hurdles for non-local affiliates to join and earn from your program.

- Affiliate preferences: Some affiliates prefer bank transfers. Others favor digital wallets for quicker access. It’s essential to offer various payment options to ensure your affiliates can select the solution that suits them best.

3 Key Considerations for Setting Affiliate Payments

Besides choosing the right affiliate payment solutions, clarifying payment details is essential when setting up affiliate payments for your programs. This includes defining the payment threshold, arranging frequent payments, and addressing tax and invoice issues.

By doing this, you can avoid possible misunderstandings with your publishers about the payment terms and enhance your reputation as a reliable partner.

Determine affiliate payment thresholds

An affiliate payment threshold is the minimum amount of earnings an affiliate must accumulate to be eligible for a payout. This threshold can vary depending on your affiliate campaigns. For instance, you might set a $30 threshold for one campaign and a $50 threshold for another.

But why is this important? Here are the key benefits:

- Help manage cash flow better: Payments are processed only when affiliates reach a specific commission amount.

- Motivate affiliates: Encourages partners to generate more sales or leads to meet the minimum earnings required for a payout.

- Reduce small transactions: Minimizes the frequency of small transactions, making the payment process easy and stress-free.

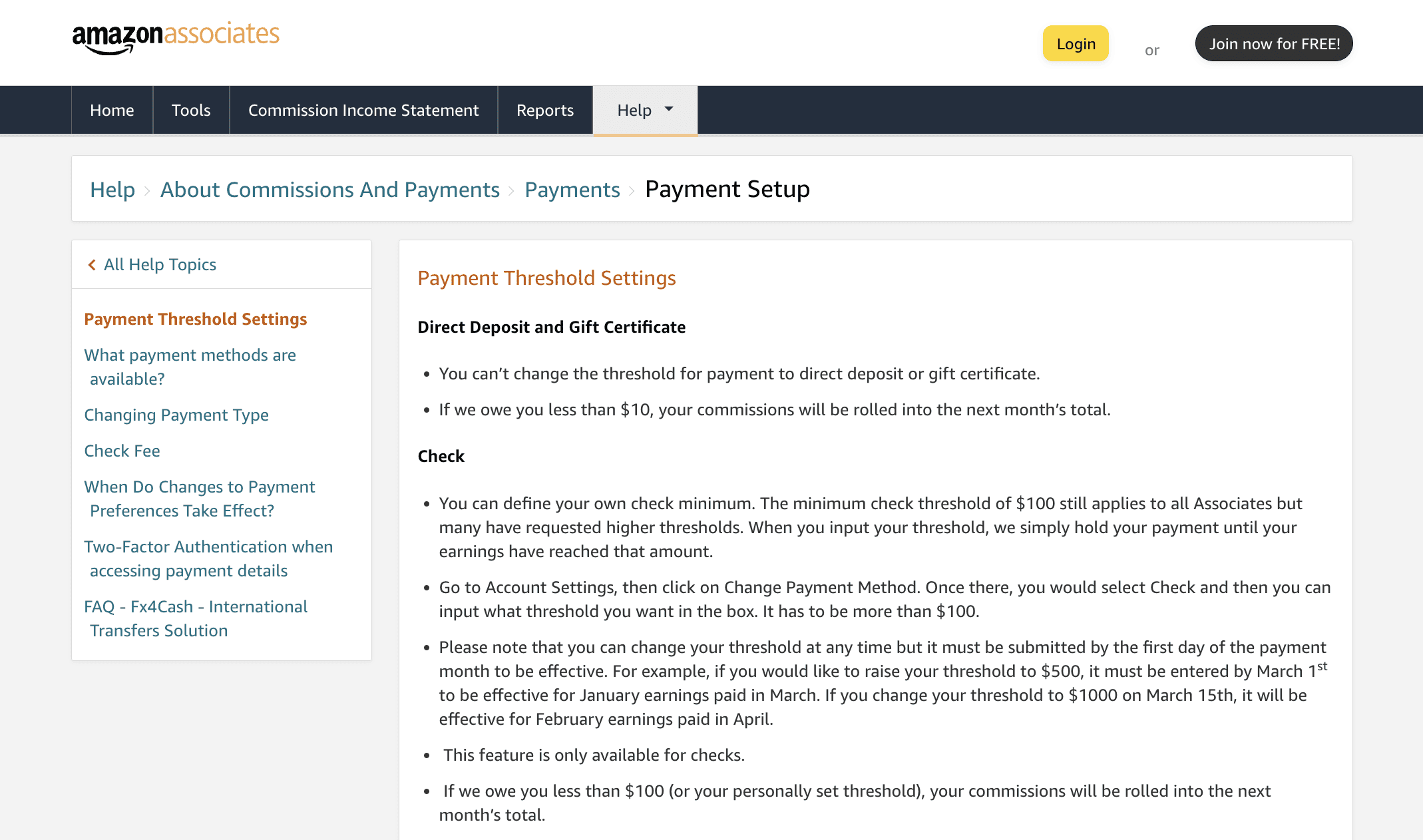

Many brands set a minimum limit for the commissions they pay to their affiliates. For example, Amazon has a $10 minimum for affiliates who want a direct deposit or a gift certificate. The threshold is $100 for checks. Publishers who do not reach the threshold will have their payments rolled over to the following month until they do.

When setting your thresholds, ensure they do not hinder your affiliates from getting paid. Understand your affiliates’ typical earning rates. Then, set thresholds that are achievable but also motivate them to perform better.

Schedule affiliate payment

You might wonder: “How often should my affiliate program pay?”. It’s time to decide on the frequency of affiliate payout.

An affiliate payment schedule is the regular timeline on which you pay your affiliates for their earnings. This could be weekly, bi-weekly, monthly, or another timeframe that suits your business and your affiliates.

Establishing a regular payment schedule helps build trust and reliability with your affiliates. Consistent and timely payouts give your promoters a sense of financial security. This keeps them engaged and satisfied with your program.

A predictable schedule allows publishers to manage their finances better. It also makes your program appealing to potential partners and increases your chances of attracting new affiliates.

Ensure transparency in tax and invoice

Affiliate payment tax and invoice refer to compliance with paying affiliates. This includes clear communication about tax obligations and any necessary deductions. It also includes detailed invoices for each payment made to affiliates. Moon Invoice’s invoice generator simplifies the invoice creation and tracking, ensuring better compliance with affiliate payment regulations.

Proper handling of taxes and accurate invoicing is crucial in affiliate paying for several reasons:

- Comply with local and international tax laws to avoid legal issues.

- Build trust by keeping affiliates confident in the partnership’s finances.

- Assist in financial reporting and audits to ensure all transactions are accurately recorded.

- Reduce disputes with affiliates over payment amounts and tax deductions.

Practical tips:

- Stay current on tax laws in your country and your affiliates’.

- Consider using accounting or affiliate management software. It can save time and avoid mistakes by automating tax calculations and invoicing.

- Collect necessary tax forms from your affiliates, like W-9 forms in the U.S. or the EU-specific format.

How to pay affiliate marketers with UpPromote

Besides offering lucrative commission rates, paying your ambassadors promptly and accurately is crucial for running a successful affiliate marketing campaign. Any errors in tracking and sending commissions to affiliates can harm your partnerships.

So, it’s essential to use a powerful affiliate tracking system. It will let you and your publishers easily update all details about sales, commissions, and affiliate payouts.

UpPromote, the top-favorite affiliate marketing software trusted by experts and 115,000+ global customers, is designed to help you both monitor affiliate performance and manage affiliate payouts better. Its robust tools and features support you in collecting payment details, calculating taxes, and creating invoices to make affiliate payments hassle-free.

Join 115,000+ UpPromote’s users to never miss an affiliate payment with auto-payouts via PayPal.

Manage affiliates’ payment details

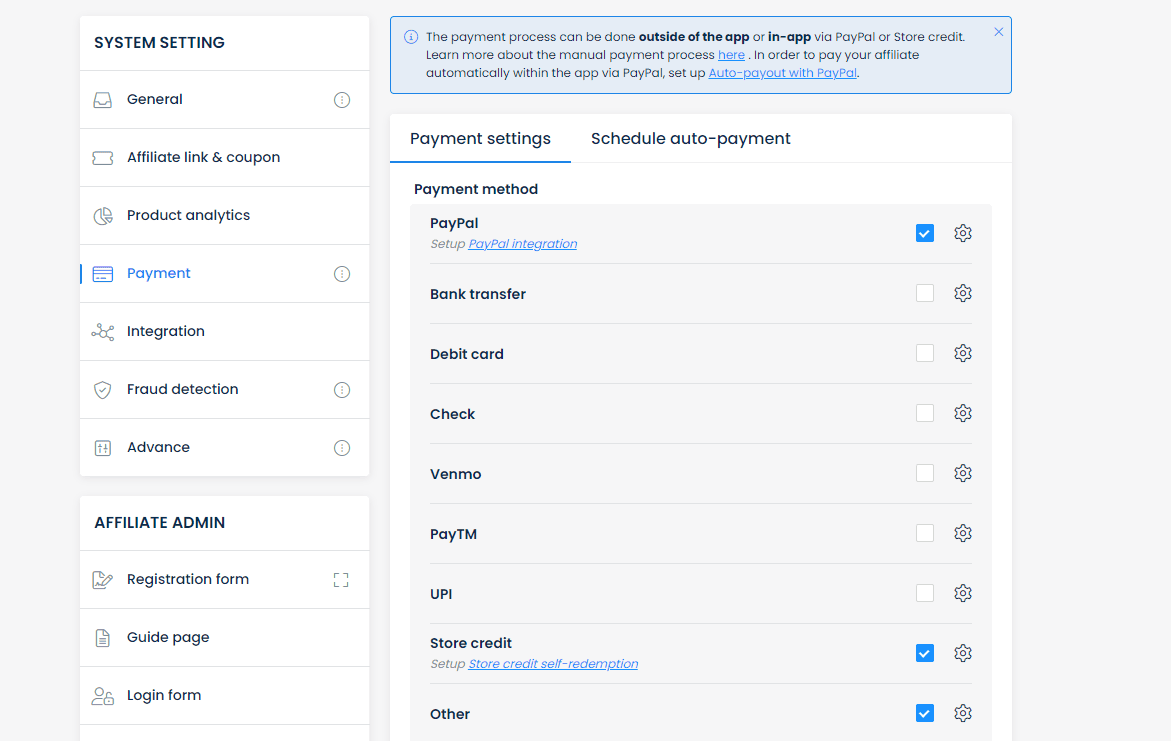

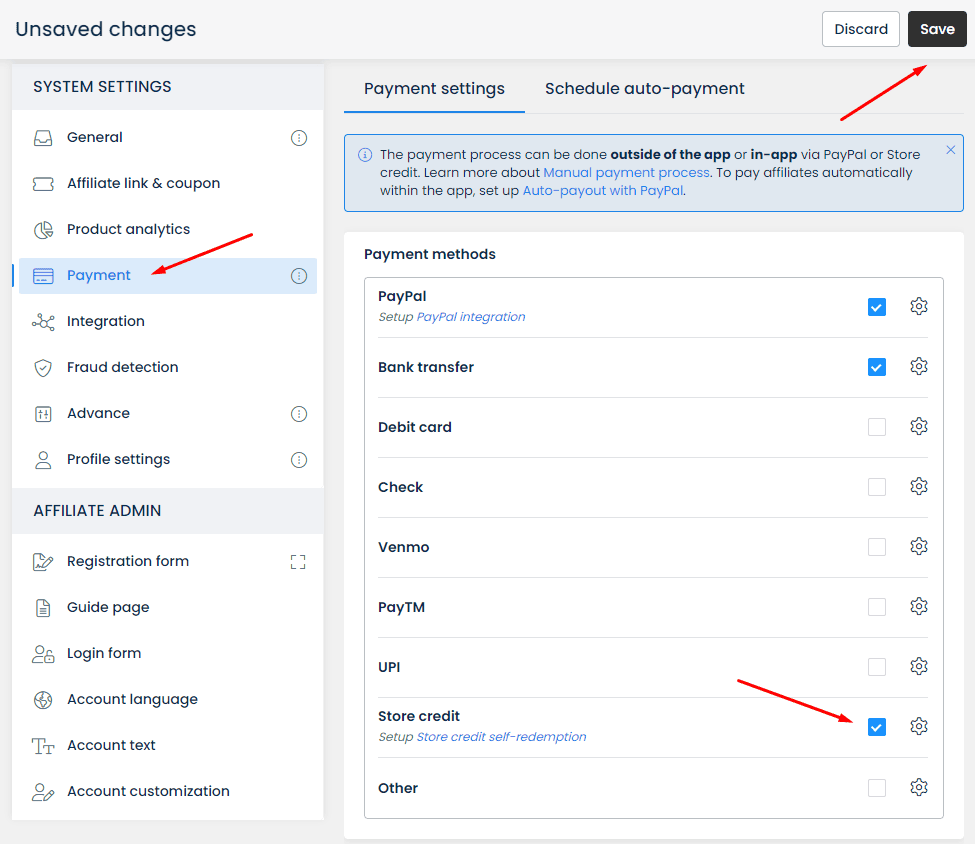

Connect your store with UpPromote. Then, set up payment methods for your programs.

Go to Settings > Payment > Payment Settings. Then, select a payment option: Venmo, bank transfer, or credit. Your affiliates will see the chosen options on their accounts.

By default, all payment methods apply to all campaigns. But you can choose specific methods for each program if needed.

With UpPromote, you won’t worry about taxes or invoices.

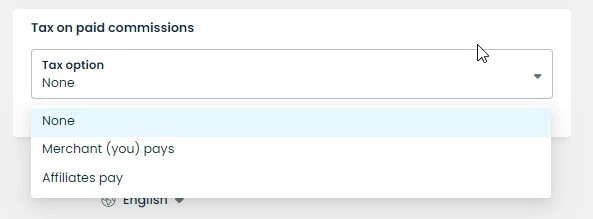

In the Payment settings tab, go to the Advance section. Then, find Tax on paid commission to explore tax settings.

Depending on your situation, decide whether you or your affiliates handle tax payments. Then, enter tax values based on regional regulations. Our affiliate management system will automate tax calculations in payouts. This will reduce errors and manual work.

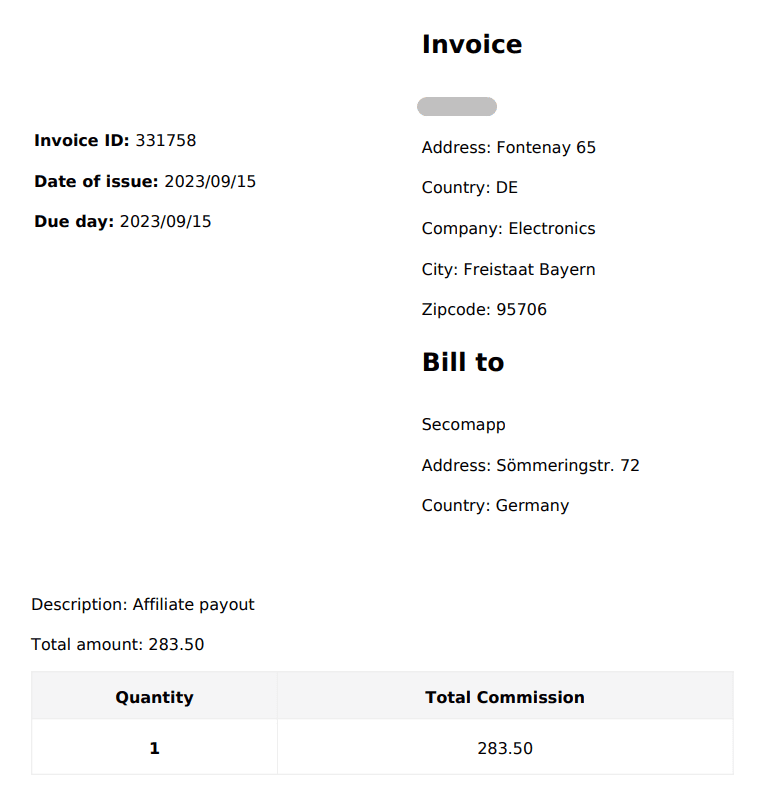

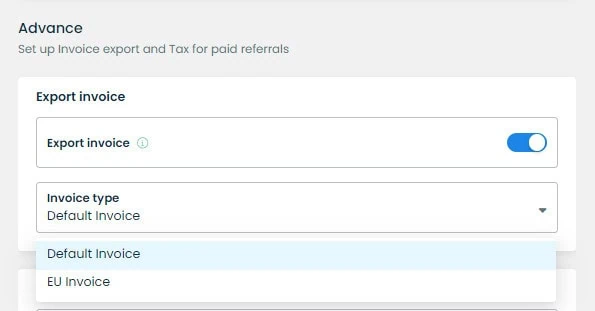

At the same time, you can enable the Export invoice function. You can choose the default invoice or the EU format to meet market requirements. Both you and your affiliate will be able to download invoices for the paid referrals later.

After you finish the setup, our affiliate marketing tracking software will collect all the necessary information to facilitate payouts.

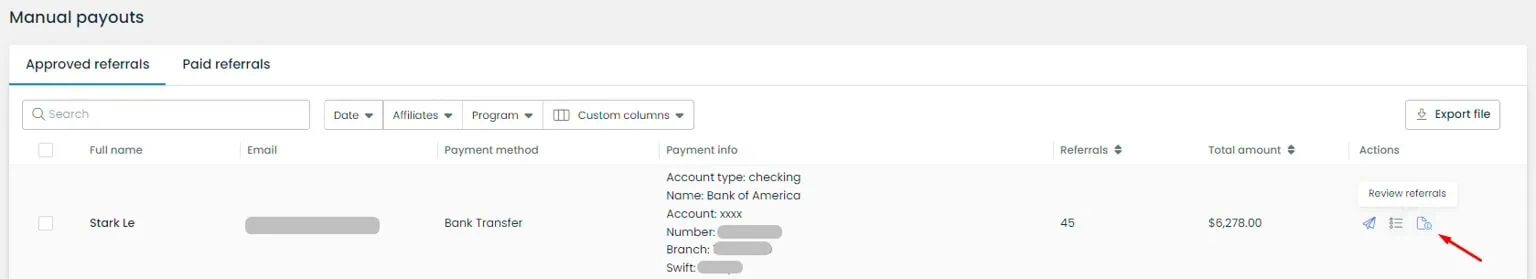

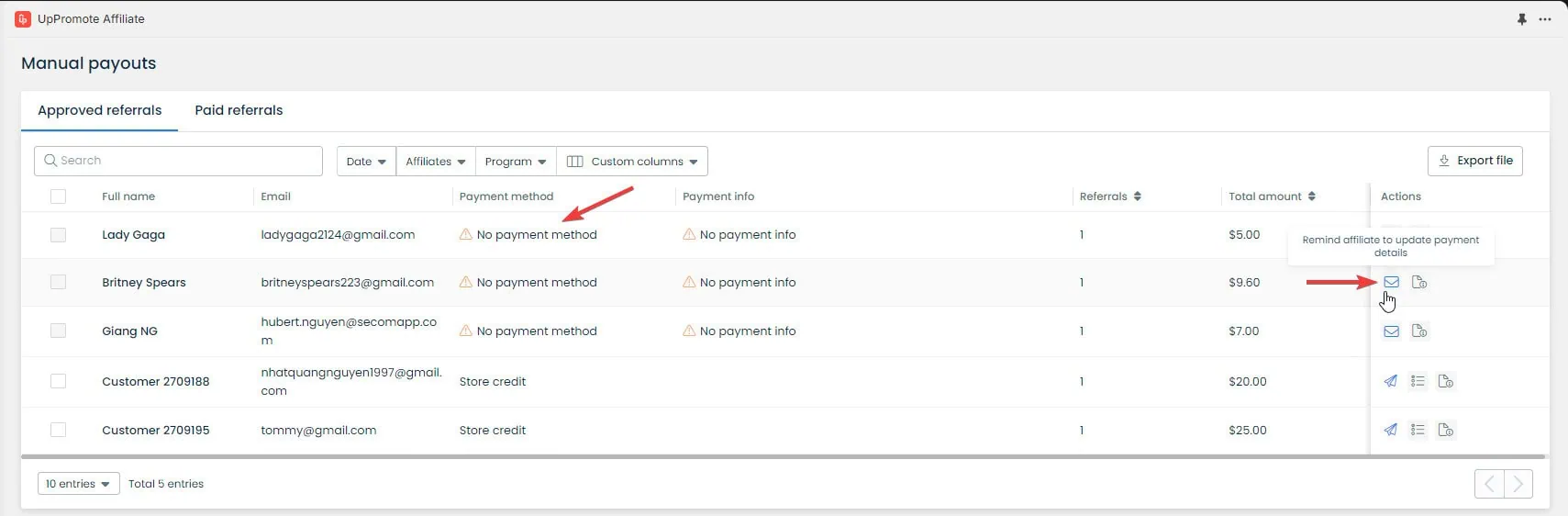

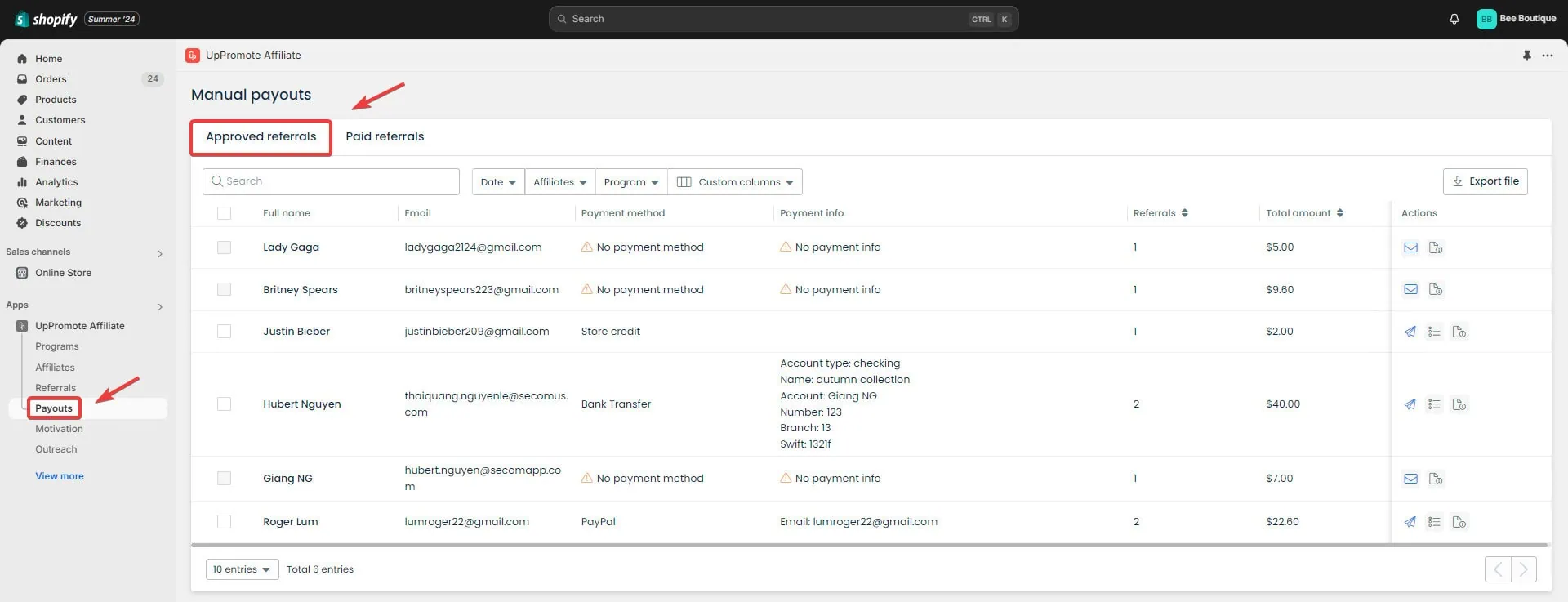

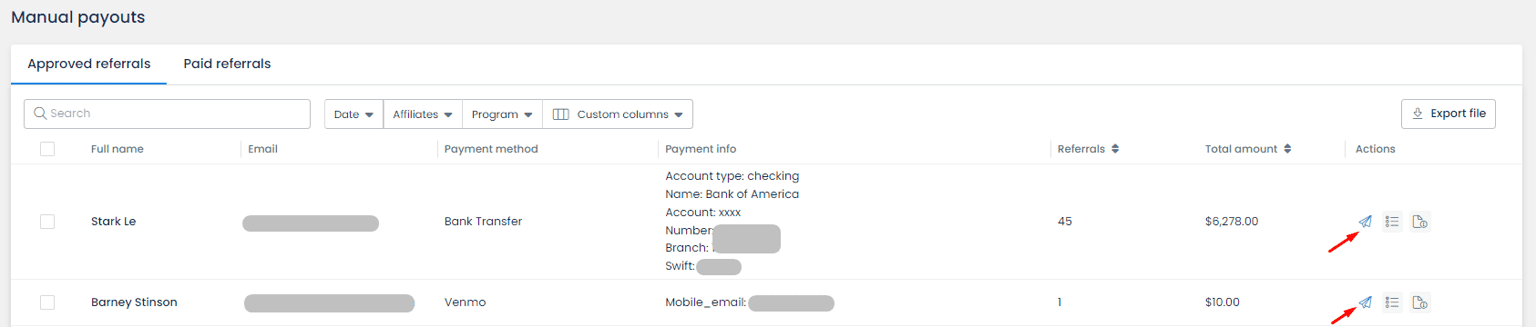

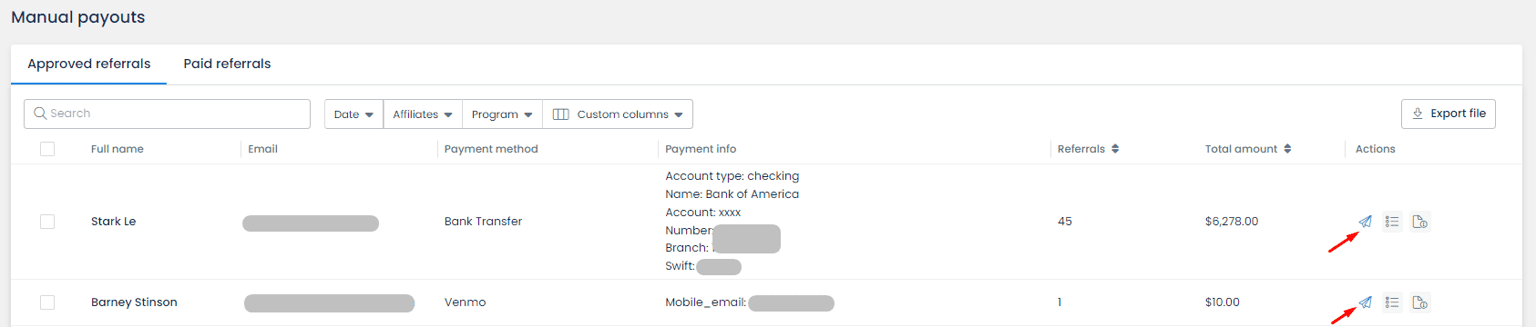

Go to Payouts > Manual Payouts and check the affiliates’ names, their selected payment methods. You also can view referral details before sending commissions. This information will ensure accurate payments, especially if you process them outside our app.

Note:

-

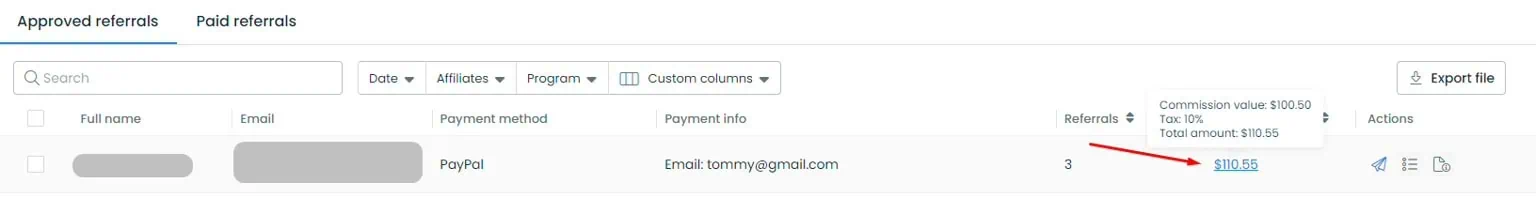

In terms of built-in tax calculation:

-

- If you select the Affiliates pay option, the tax value will be included in the paid commission amount.

- If you choose the Merchant pays, UpPromote will automatically add the tax value to the total commission.

-

In case your partners have not selected a payment method, the UpPromote system will show a message: No payment method. You can contact your affiliates and remind them to enter their payment details. This can be done directly within our app by clicking on the Reminder button in the Payouts tab.

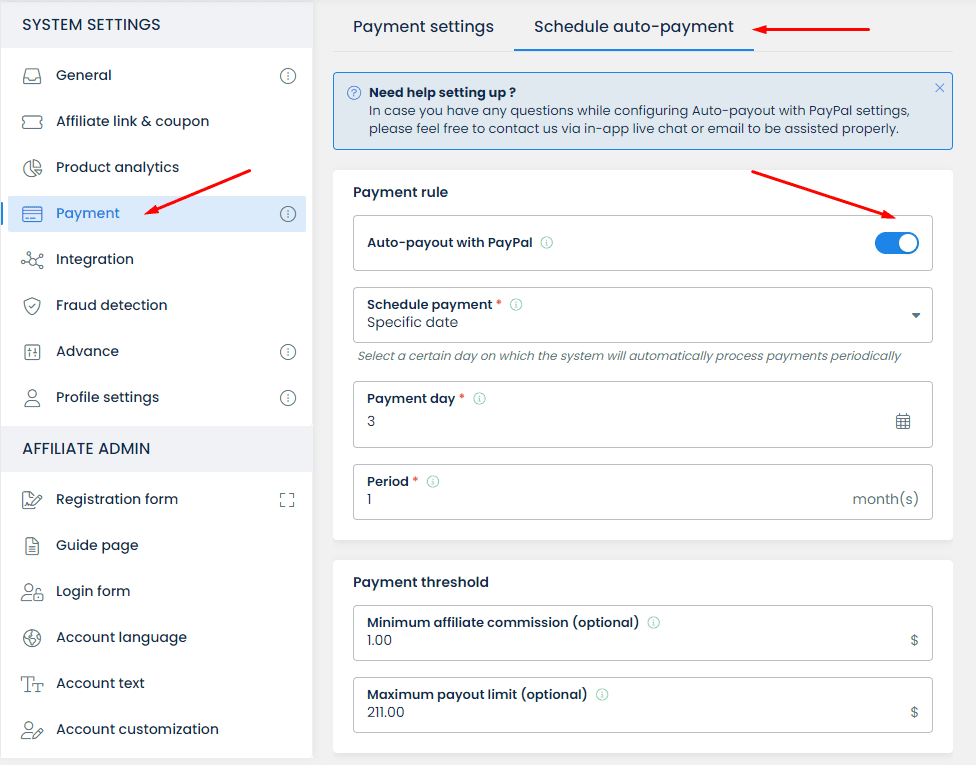

Schedule auto-payments with PayPal

To make things smoother, it’s essential to automate affiliate payments. Enabling the auto-payout feature will reduce manual work and make sure you pay affiliates on time.

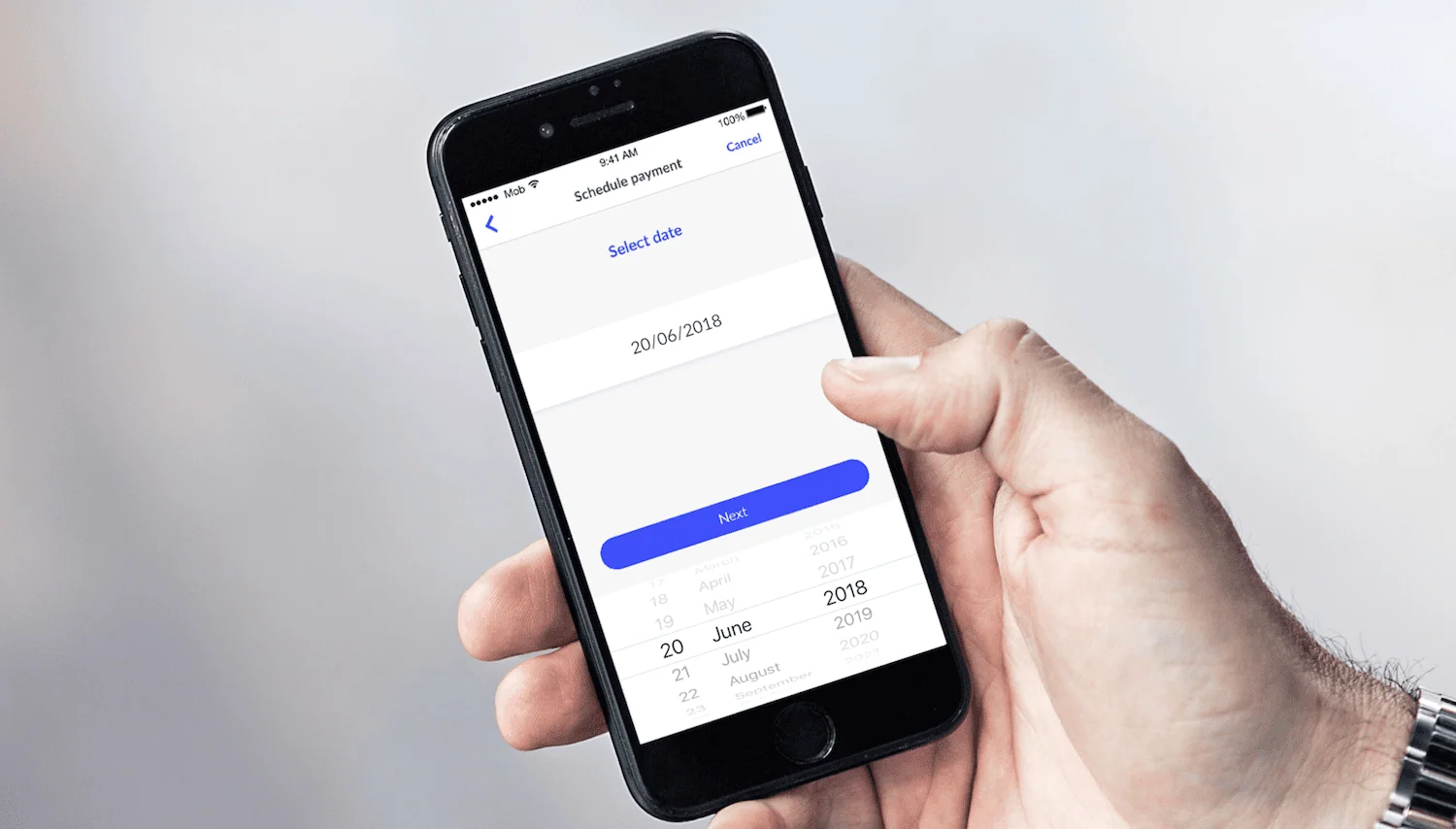

With UpPromote, you can schedule automatic payouts for partners via PayPal.

To enable this feature, go to Settings > Payment > Schedule payment. Next, turn on the Auto-payout with PayPal toggle.

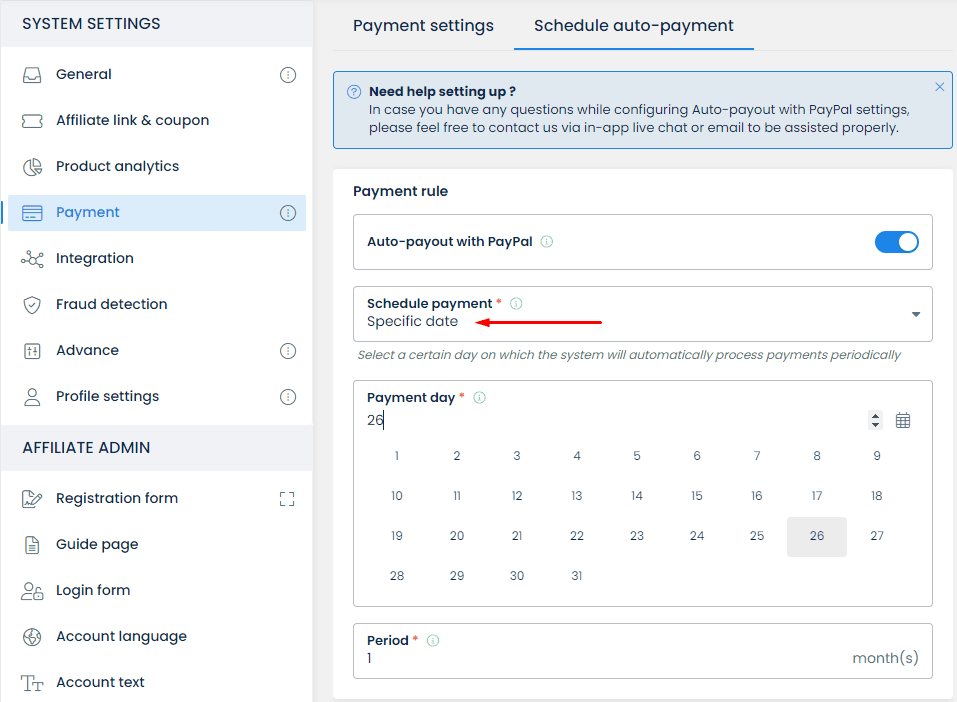

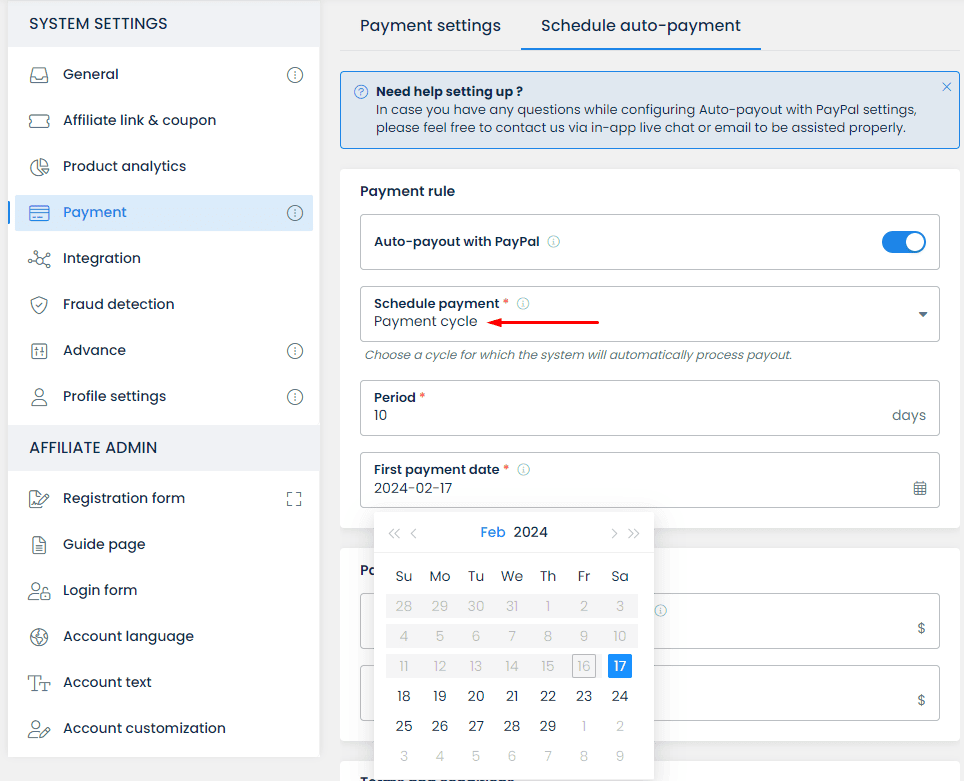

From there, you can customize payment schedules that fit your needs. There are 2 options for your consideration: a specific date or payment cycle. Our system will automatically pay your affiliates accordingly:

-

Choosing a Specific date means picking a certain day on which UpPromote will handle payments. You select a payment day from the calendar and specify the payout period. For example, if you choose the 26th as the payment day and 1 month as the period, our app will auto-pay affiliates on the 26th of every month.

-

If you select Payment cycle, you will choose the period and decide on the first payment date. For instance, when you set the period as 10 days, and the first payment date is 17th February 2024, UpPromote will pay out affiliates on 17th Feb first. Then, 10 days later, on 27th February 2024, affiliates will continue to be paid automatically.

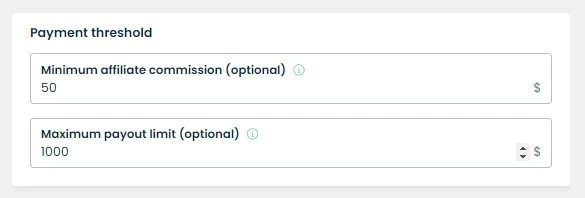

At the same time, you can set flexible payment thresholds for publishers with UpPromote. Our affiliate tracking system lets you define the payout limits to match your financial goals.

You also have two optional settings to choose from in the Payment threshold section:

-

Set a minimum affiliate commission: Ensure your partners reach a specific threshold before receiving payouts. For example, if you set this to $50, all affiliates who have earned $50 or more in commissions will be paid automatically on the payment date.

Affiliates with commissions under $50 can be paid manually. Or they can wait for the next auto-payout period when their total reaches $50.

-

Choose a maximum payout limit: Help you stay within budget. For example, if you set this field to $1000 and the total payout needed for affiliates this month is $1500, the Auto-payout function will be automatically postponed. You will then need to pay affiliates manually for that month.

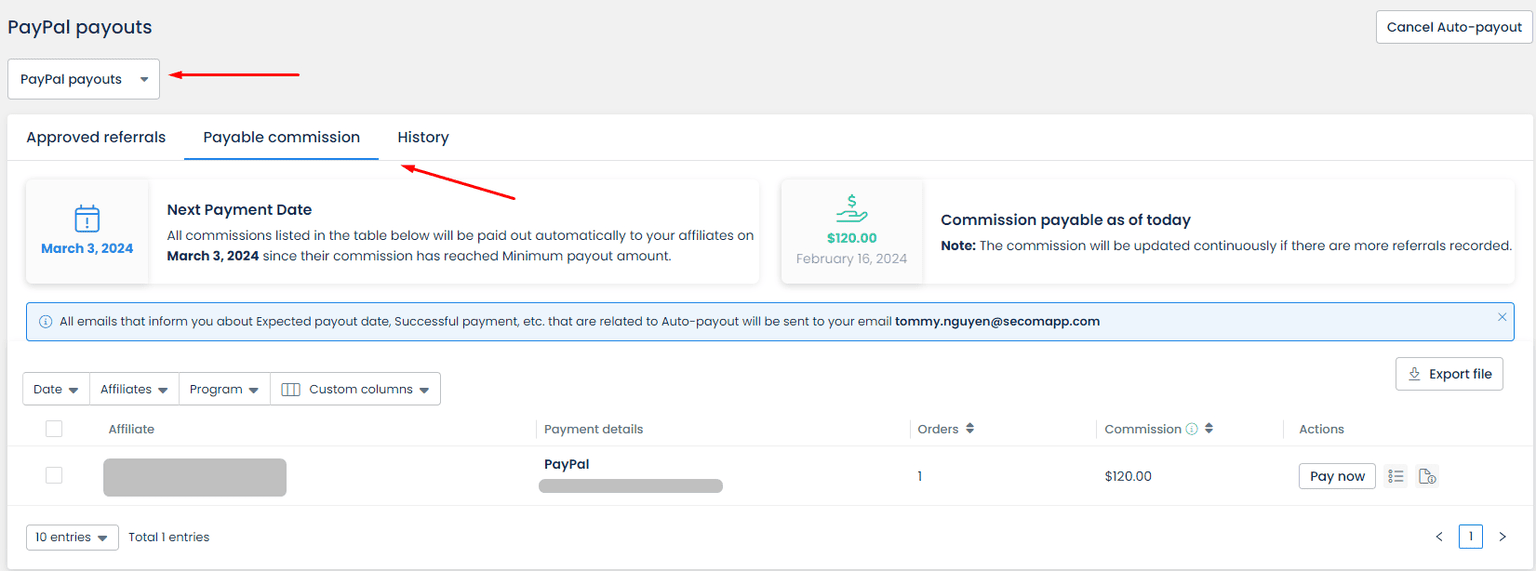

After you enable auto-payout with PayPal, navigate to the Payouts tab. Then, select PayPal Payouts to see all related info. This includes the total payable commission and the next payment date.

UpPromote will keep you informed about the payment process, no matter the time zones. Our system will send you automated notifications about:

- The total payable commission

- Expected payout dates

- Successful or failed payments

- Exceeded payout limits

Activate store credit

Another affiliate payment method that UpPromote assists you with is Store Credit.

This solution lets you send commissions to promoters in the form of store discount codes. Your affiliates can only use these discounts to purchase products in your own shop.

To activate Store Credit as a payment method, go to Settings > Payment > Payment settings > Select Store Credit. You can choose specific programs that offer this payment option.

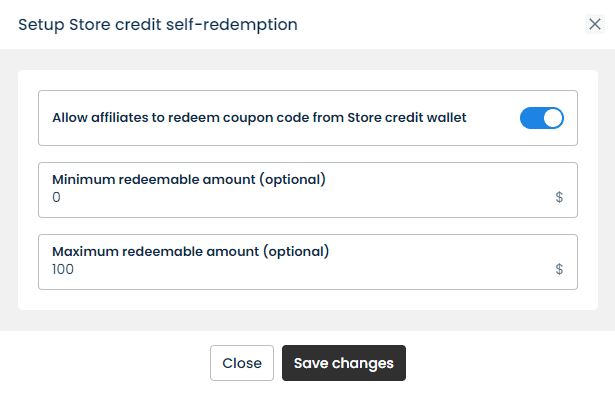

If you allow your partners to generate their own affiliate discount coupons, you enable Store Credit self-redemption while setting up. You can enter the maximum and minimum redeemable amount of a coupon an affiliate can create.

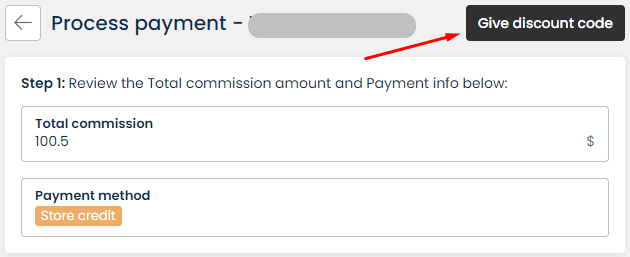

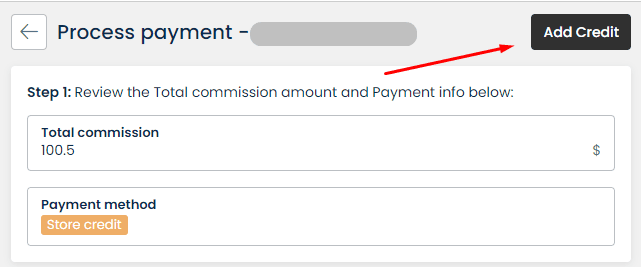

To send a payment to an affiliate using Store credit, go to Payouts > Locate the payment you want to process > click Mark as paid.

From there, be aware of 2 possible scenarios:

-

Store Credit self-redemption disabled: You will select Give discount code to the affiliate. The UpPromote system will then create a random discount code. It will have the exact commission amount to pay your affiliate.

-

Store Credit self-redemption enabled: You will add some credits to the affiliate’s store credit wallet. Your affiliate can freely generate discount codes from the store credit balance with any value they want.

Once you finish paying, your partners can check the details in their admin account. They can then decide when to use the credits.

Track and report affiliate payment

Trust and transparency are the foundation of all lasting, healthy relationships. This includes the one between you and your publishers. Any errors in the workflow, especially in payments, can cause conflicts and end the collaboration.

Arguments over payouts occur when there is a discrepancy between the sales affiliates claim to have referred and the amount you pay them.

How can you avoid disputes with your affiliates? To prevent issues, it’s crucial to track and record all transactions accurately. This documentation will help verify and reconcile information with partners later on.

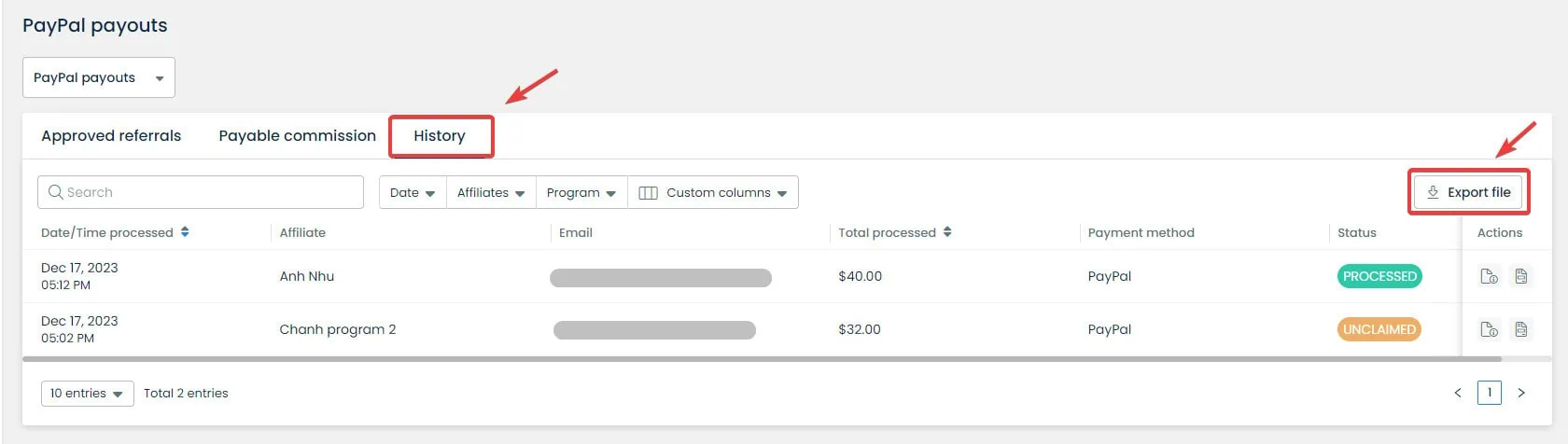

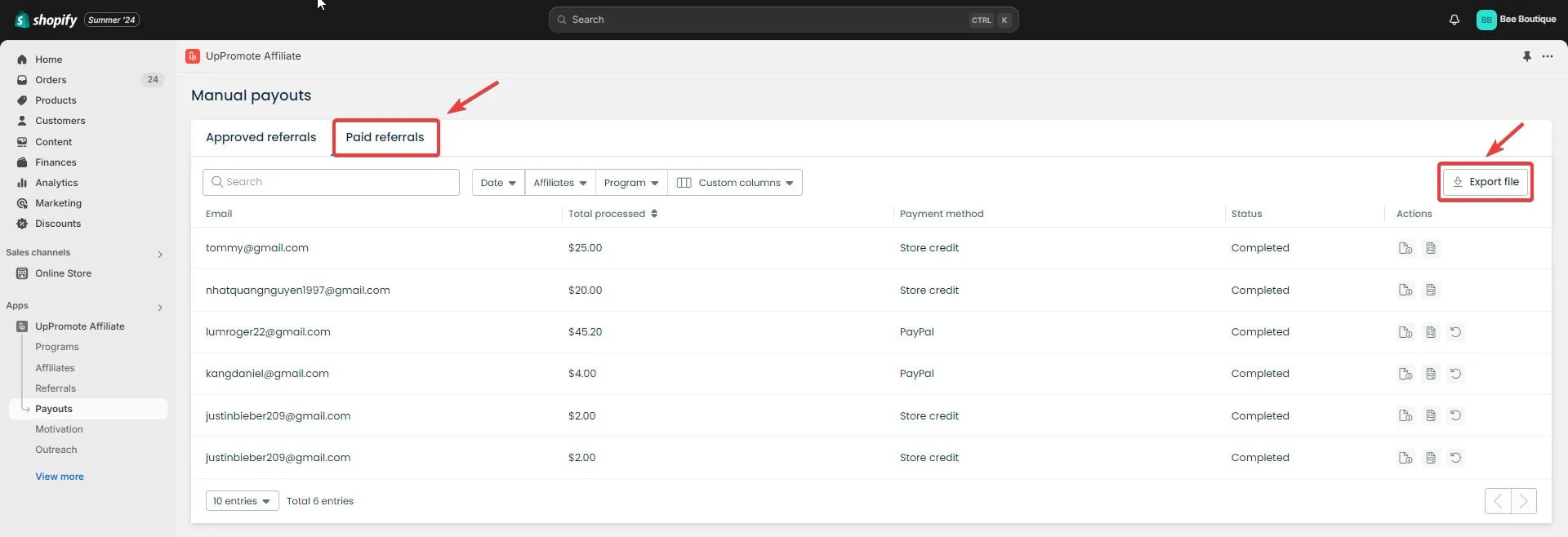

With UpPromote, navigate to the Payouts tab to easily track whether payments have been completed. Our affiliate management tool lets you export files in various formats, no matter the payment method you choose.

-

If you process automated payments via PayPal: Select PayPal Payouts > choose the History tab.

You can review if the transaction is Processing, Processed, Unclaimed, or Failed.

-

If you process affiliate payouts with other methods: Select Manual Payouts.

All payments that have not been handled will be listed on the Approved Referrals page.

When you have successfully sent commissions to your partners, click Mark as paid (the airplane icon) for easier management.

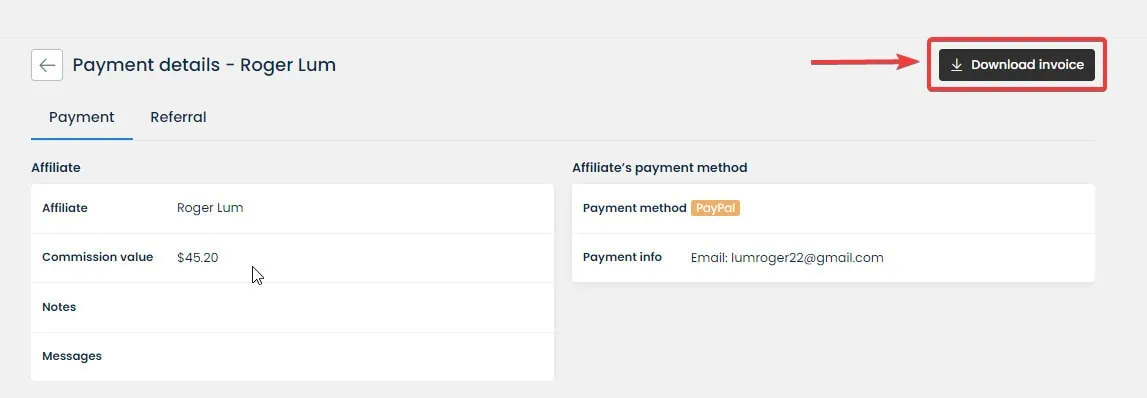

You can then review and download reports of all paid transactions on the Paid referrals page.

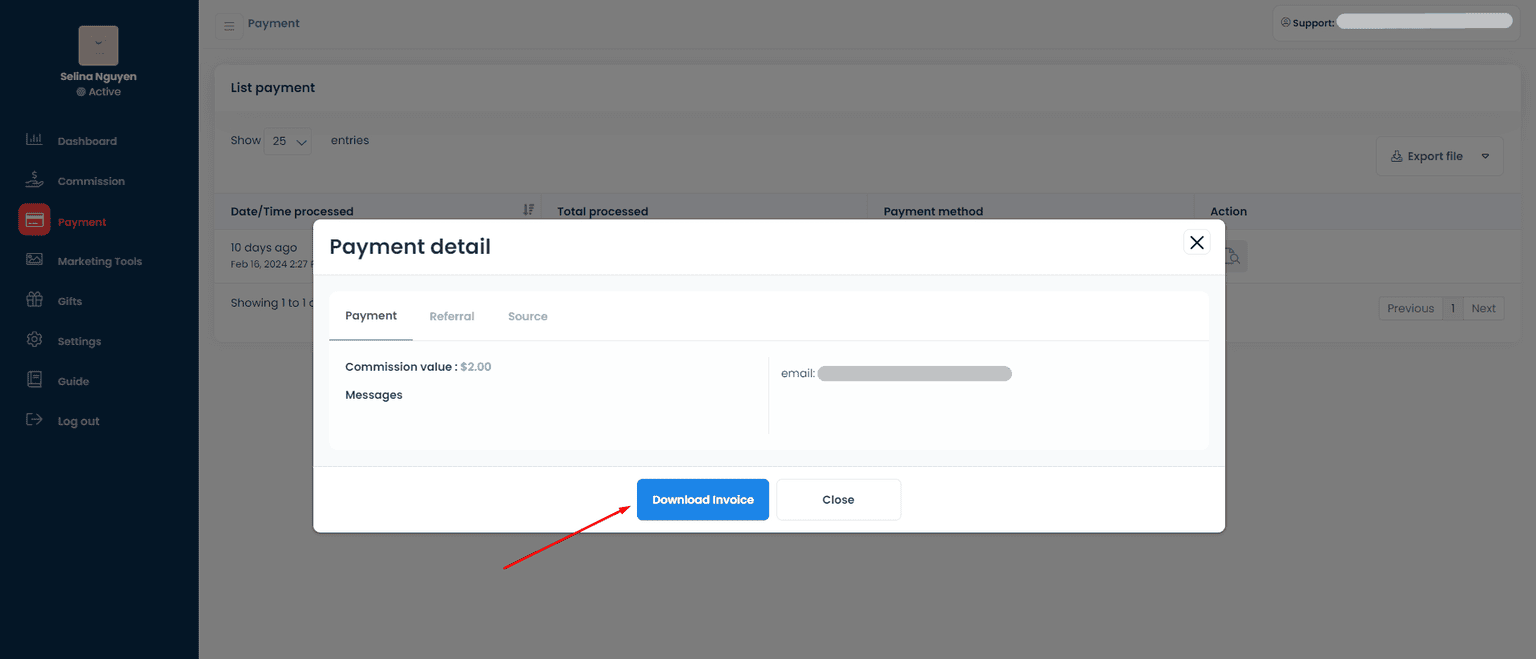

UpPromote enables both you and your affiliates to download invoices for all paid referrals. It helps you meet legal and tax obligations and also eases the reconciliation of payments between parties.

Within the Paid referrals page, navigate to Payment details and then click Download invoice.

The exported invoice will contain: Invoice ID, Payment information, Payment amount, Payment method, Affiliate name, and Referral details.

Also, your affiliates can view their referral details and export invoices with the same info via their affiliate account. Navigate to the Payment tab > Detail > click Download Invoice.

Final words

To run a successful affiliate program, it’s crucial to choose the right payment method. However, not all payout solutions are the same. You need to think about your business model, the affiliate platform you use, and the kind of affiliates you want to attract to find the best option.

No matter which payment methods you select, make sure they allow for accurate and prompt payments to your affiliates. It will motivate your publishers and boost your reputation as a partner.