Tax preparation is a headache for both individuals and businesses every year. To ease the burden, many companies have developed assistance services to help people navigate the process. A tax preparation affiliate program can help you earn money while promoting diverse services at once, like automation filling tools, e-tax software, or accounting assistance.

In this article, we’ve highlighted the top 15 tax preparation affiliate programs. Let’s dive in to explore how much you can earn from this niche.

TL;DR

You can earn some extra income with your basic tax-related knowledge. Let’s discover some of the top tax preparation affiliate programs below.

- TurboTax (Commission: 5%, Cookie: 30 days)

- TaxAct (Commission: 10%, Cookie: 45 days)

- FreeTaxUSA (Commission: 15%, Cookie: 90 days)

- Taxhub (Commission: $100, Cookie: 45 days)

- Tax Slayer (Commission: 17%, Cookie: 30 days)

- E-file (Commission: 40%, Cookie: 120 days)

- 1-800Accountant (Commission: $100, Cookie: 90 days)

- LibertyTax (Commission: 25%, Cookie: 45 days)

- ezTaxReturn (Commission: 25%, Cookie: 90 days)

- Tax1099 (Commission: 15%)

Recommended for every Shopify merchant, UpPromote affiliate software helps you create programs, set commissions, and manage tracking and payments. We cover everything you need to run successful affiliate campaigns.

With 2500+ positive Shopify reviews, UpPromote boasts as the top trusted affiliate software.

15 Tax Preparation Affiliate Programs You Shouldn’t Miss

Having no time to read through the article? Let’s take a quick look at the leading tax preparation affiliate programs in the table below.

| The best affiliate programs | Program name |

| Affiliate program with the highest commission rates | E-file (40%) |

| Affiliate program with the longest cookie duration | E-file (120 days) |

| Affiliate program with the most payment methods | 1-800Accountant (Check, direct deposit, wire transfer, Payoneer) |

| Affiliate program with the most promotional materials | TurboTax, FreeTaxUSA |

1. TurboTax

TurboTax’s software helps businesses and individuals file their taxes with maximum refunds. They integrate with QuickBooks to simplify expense tracking and tax preparation in complex situations.

Managed by CJ Affiliate, the TurboTax tax preparation affiliate program offers a 5% commission on every purchase. The cookie stays on customers’ devices for 30 days once they click on your affiliate link.

You should utilize their ready-made landing pages and banners to increase engagement. Plus, you can write articles about tips or laws, and naturally embed text links within the content to boost click-through rates.

|

2. TaxAct

TaxAct provides affordable digital and downloadable tax preparation solutions for all American companies. Businesses can also get personalized guidance from industry experts through their Xpert Assist.

After joining their tax preparation affiliate program, you can earn a 10% commission on every order. You’ll get a commission if customers click on your link and purchase within 45 days.

You can access their collection of high-converting banners through your affiliate dashboard. You should display these banners on marketing platforms to increase click-through rates.

|

3. FreeTaxUSA

FreeTaxUSA has filed over 71 million tax returns for American businesses in the past 24 years. They support over 900 tax forms for users to prepare for complex federal returns.

You can join the FreeTaxUSA tax preparation affiliate program via CJ Affiliate. As their affiliate, you can enjoy a 15% commission across all plan subscriptions.. The cookie lasts 90 days from the moment customers click on your affiliate link.

You’ll receive detailed product promotions to create effective marketing campaigns. You can place banners on your websites to increase click-through rates.

|

4. Taxhub

Taxhub connects their users with licensed public accountants to find affordable and customized tax services. Their algorithms can identify deductions and analyze transaction history across all bank accounts.

The Taxhub tax preparation affiliate program allows affiliates to earn a $100 commission on every new qualified user. The cookie remains active for 45 days after customers’ initial click on your link. You’ll receive payouts directly via your bank account on a monthly basis.

Taxhub gives affiliates various content ideas and tips for reference. You can save time with their pre-made content about tax, deadlines, or special tax events.

|

5. Tax Slayer

Established over 50 years ago, Tax Slayer offers accurate cloud-based tax preparation software. Their budget-friendly and self-filed plans cater to freelancers and small business owners.

The Tax Slayer tax preparation affiliate program offers a 17% commission on every completed e-file tax return. If customers only complete a free e-file, you’ll also receive a $3 bonus. The cookie lasts 30 days once customers click on your link.

Tax Slayer designs various ready-to-use landing pages with eye-catching graphics and engaging headers. You can create content like blog posts, videos, or reviews to drive traffic to these landing pages.

|

6. E-file

E-file provides authorized IRS e-file software with fast electronic tax filing for taxpayers. Users can input all of their tax information, income figures, and potential deductions to receive instant tax calculation and preparation.

You’ll receive up to a 40% commission on every qualified e-tax filing subscription when joining the E-file tax preparation affiliate program. You can also receive a $1.4 flat commission for each free tax filing. The cookie stays on customers’ devices for 120 days from their first click on your link.

You’ll have an exclusive coupon code to encourage more purchases from your followers. You should also make use of their eye-catching landing pages to increase engagement.

|

7. 1-800Accountant

1-800Accountant simplifies online accounting tasks with free consultation from top CPAs. They also help small American businesses handle employee benefits and health insurance programs.

Affiliates will earn $100 after referring new customers to subscribe online tax and accounting service. If a business registers as a legal entity, you’ll also earn a commission. You can negotiate commissions on the formation tax service based on sales volume.

The cookie lasts for exactly 90 days from the moment customers click on your link. Only if customers purchase within this time will you earn a commission.

|

8. LibertyTax

LibertyTax offers DIY online tax preparation services at 1,800 locations in the US. Their mobile app helps taxpayers scan online documents, access records, and contact professionals.

Liberty runs their tax preparation affiliate program via CJ Affiliate. LibertyTax offers a 45% commission on every completed online tax return filing. You can also earn $2.75 if customers request an online appointment with LibertyTax.

You can only earn a commission if customers submit their electronic tax filing within a 45-day cookie duration.

|

9. ezTaxReturn

ezTaxReturn offers free federal tax filing with W-2 income and standard deductions to simplify the return process. Their service ensures data security and the biggest possible refunds, even for taxpayers with poor credits.

As their affiliate, you can enjoy a 25% commission on every federal & state tax return. You’ll earn a commission on customers’ purchases within 90 days from their initial click on your link.

You should note that the best time to earn a commission is between January and April. During these months, you should promote across all marketing channels to direct leads to the pre-made landing pages.

|

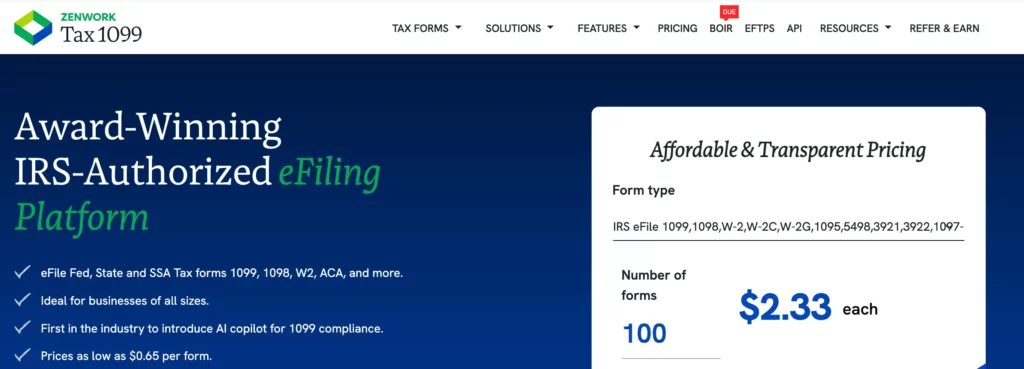

10. Tax1099

Tax1099 supports electronic filing for various IRS forms, including 1099-NEC, 1099-MISC, W-2, 940, 941, and ACA forms. Their AI automation can complete forms, perform error checks, and validate data to ensure tax compliance.

You can join their tax preparation affiliate program via PartnerStack and earn a 15% commission on every successful sale. Tax1099 lets PartnerStack handle all affiliate payouts via PayPal and Stripe. You’ll get your earnings 30 days after each qualified purchase, in case of any cancellations.

You can access their authorized logo collection through PartnerStack’s affiliate dashboard. You can also put their appealing banners in high-traffic areas of your website to grab visitors’ attention.

|

11. TaxPro

- Commission rate: 30%

- Cookie duration: Not mentioned

TaxPro helps tax businesses streamline operations, automate tax preparation, and handle payment processes. They integrate with third-party tax software to easily share data within a single tax account.

12. Tax Extension

- Commission rate: 25%

- Cookie duration: Not mentioned

Tax Extension helps taxpayers submit a Federal tax extension request in 5 minutes. They also offer a large education resource of tax credits, filing requirements, and tax preparation.

13. KeeperTax

- Commission rate: $20

- Cookie duration: Not mentioned

KeeperTax helps freelancers, independent contractors, and small business owners streamline their tax preparation. The software can scan bank accounts and credit cards to identify tax-deductible expenses.

14. Online Taxes

- Commission rate: $2

- Cookie duration: Not mentioned

Online Taxes offers affordable income tax preparation for homeowners, landlords, freelancers, and self-employed individuals. They also have various free tax assistance services via email, phone, or live chat.

15. TaxCE

- Commission rate: 15%

- Cookie duration: Not mentioned

TaxCE launches tax-related online courses for tax professionals of all levels. Their courses teach Circular 230, CE requirements, and related rules about tax preparation.

Conclusion

Promoting a tax preparation service can earn you big, as some of them pay affiliates from 30% to 40% commission per subscription. You can create educational blogs, tutorial videos, or firsthand reviews to engage your followers. With an effective marketing strategy and the right tax preparation affiliate program, you can strengthen your brand and earn your audience’s trust.