According to Allied Market Research, the global small business loans market is projected to reach $7.2 trillion by 2032. As the market grows, businesses will need help finding the best loan options to support their growth. Affiliates can earn commissions by promoting funding solutions for businesses seeking financial assistance.

We’ve put together 9 top business loan affiliate programs, with information on commissions, cookie durations, and more. Let’s explore which program is the best fit for you!

TL;DR

You can earn by promoting business loan services to small businesses, startups, and entrepreneurs. Let’s see which program offers you the best benefits.

- Sunwise Capital (Commission: $20/lead, $750/deal)

- National Funding (Commission: 3%, Cookie: 60 days)

- Kapitus Business Financing (Commission: $50, Cookie: 45 days)

- Commercial Loan Direct (Commission: $1,250/sale, $250/referral)

- Business Credit Blog (Commission: 50%/sale, 1%/funding referral)

- GoKapital (Commission: 0.25-2%)

- Capalona (Commission: 50%)

- Next-Financing (Commission: 20-50%)

- National Business Capital (Commission: Revealed once registered)

Affiliate marketing allows brands to expand their reach while optimizing their marketing budget. With UpPromote affiliate software, you can set up an affiliate program in under 5 minutes. You can also easily recruit, manage affiliates, and encourage them to drive sales.

With 2500+ positive Shopify reviews, UpPromote boasts as the top trusted affiliate software.

9 Best Business Loan Affiliate Programs You Need to Know About

If you’re short on time, take a look at the table below to find the best business loan affiliate programs.

| The best affiliate programs | Program name |

| Affiliate program with the highest commission rates | Business Credit Blog, Capalona, Next-Financing (50%) |

| Affiliate program with the longest cookie duration | National Funding (60 days) |

| Affiliate program with the most payment methods | Sunwise Capital, National Funding, Commercial Loan Direct, GoKapital |

| Affiliate program with the most promotional materials | Commercial Loan Direct, Business Credit Blog |

1. Sunwise Capital

Sunwise Capital offers quick and flexible financing options to small and medium-sized businesses. They provide different loan options, like short-term, unsecured, and large business loans.

Affiliates can earn a $20 commission for each qualified lead and $750 for each successful deal. The cookie stays active for 90 days from the customer’s initial click on your affiliate link.

The brand manages their business loan affiliate program via the network Impact. You can sign in to the platform and access their tools and resources to enhance your promotions. The brand’s expert team will also offer personal support to help increase your sales.

|

2. National Funding

National Funding provides small business loans and equipment financing. For businesses facing urgent needs, payday loans can provide immediate relief, allowing them to cover operating costs while waiting for more structured financing options. They offer short-term loans, equipment financing, and working capital loans to help businesses cover expenses, grow, or manage cash flow.

Managed through Impact, the National Funding business loan affiliate program offers a 3% commission on all deals you refer. The referral window lasts 60 days from the visitor’s first click on your unique link.

You must sign up for an Impact account before accessing the National Funding business loan affiliate program. Once approved, you’ll get a tracking link through the affiliate dashboard to start promoting on your site.

|

3. Kapitus Business Financing

Kapitus Business Financing offers tailored funding options to small and medium-sized businesses, from working capital loans to equipment and revenue-based financing. They also create personalized loan packages to help customers find the right fit for their financial needs.

With the Kapitus business loan affiliate program, you’ll earn $50 for every approved business lead you refer. The referral window will stay active for 45 days from the visitor’s first click on your affiliate link. Plus, you can earn a $1,000 bonus for every 100th qualified lead you drive.

A qualified lead is a completed form with valid contact info for a U.S.-based business that has been running for at least one year. The business must also have a credit score of 650 or higher and an annual revenue of at least $150,000.

|

4. Commercial Loan Direct

Commercial Loan Direct provides commercial real estate loans and business financing solutions. They help real estate investors, business owners, and entrepreneurs buy, develop, or refinance commercial properties.

You’ll earn a $1,250 commission for every successful sale made through your affiliate link. You can also refer others to join their business loan affiliate program and earn $250 for each sale they make.

The brand pays commissions via PayPal or check, based on your preference. You’ll also receive unique tracking links and eye-catching graphics to use on your website.

|

5. Business Credit Blog

Business Credit Blog offers useful information and tips for small business owners who want to build business credit. They cover topics like why business credit matters, how to get approved for loans and credit cards, and how to improve credit scores.

Business Credit Blog offers useful information and tips for small business owners who want to build business credit. They cover topics like why business credit matters, how to get approved for loans and credit cards, and how to improve credit scores.

You can earn up to 50% commission on each Business Credit Building system sold through your link. You can also invite others to join their affiliate program and earn 1% of their earnings per sale.

The brand supports your promotions with many colorful flyers and professional email templates. Their affiliate managers are ready to guide you in creating content tailored to your audience’s needs.

|

6. GoKapital

GoKapital operates as an alternative lending marketplace offering various business financing solutions. Their platform allows businesses to access quick and easy funding without the traditional barriers of bank loans.

You can earn a commission of 0.25% to 2% when joining the GoKapital business loan affiliate program. You’ll receive different commission rates depending on which funding program you are promoting.

- Revenue-based business loan: 2%

- Business term loan: 0.5%

- Equipment leasing: 1%

- SBA 7A loans: 0.5%

- Personal/Start-up loan: 1%

- Hard money real estate loan: 0.25%

- Commercial mortgages: 0.25%

- Business line of credit: 0.5%

The brand will pay your commissions on the 1st and 15th of each month. As an affiliate, you can get paid by direct deposit, by check, or by a bank letter sent by mail. If you want another payment method, you can talk to the brand about other options.

|

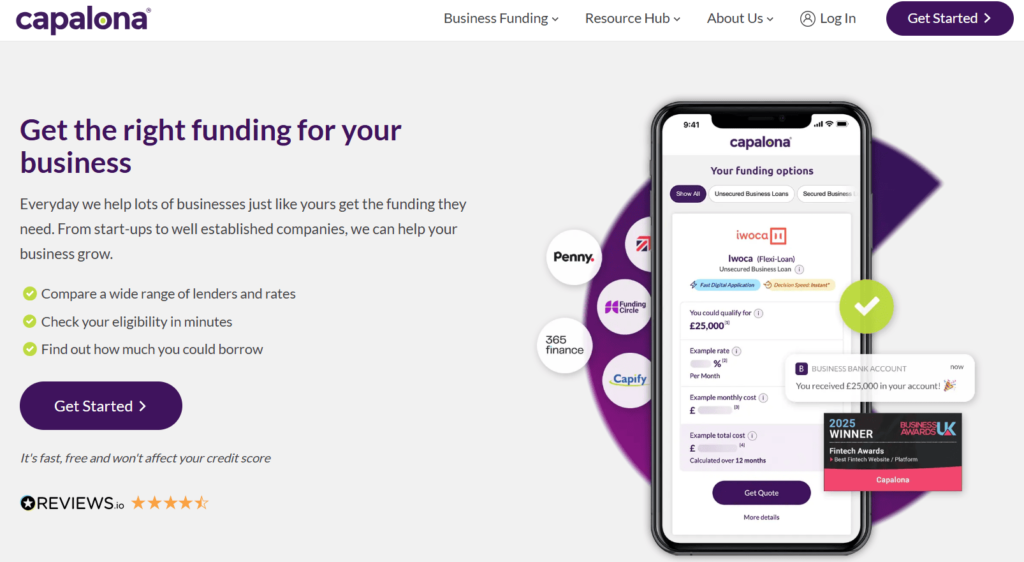

7. Capalona

Capalona develops a free comparison platform for businesses to compare many funding options. Customers can compare different types of funding products, such as business loans, merchant cash advances, invoice finance, and revolving credit facilities.

You can apply for their business loan affiliate program and start referring customers once you’re approved. You’ll receive 50% of the commission on any successfully funded deals.

You can track your clicks, sales, and commissions in real-time from anywhere through the brand’s reporting portal. Moreover, their dedicated partner manager will provide many tips to help you optimize your promotions.

But their services are only available to partners, businesses, and lenders based in the UK. So, if you’re located outside the UK, you won’t be eligible to join their affiliate program.

8. Next-Financing

Next-Financing offers business loans like working capital, equipment financing, and consumer loans. They also help businesses with marketing and payment tools to boost sales.

Affiliates in the Next-Financing business loan program earn commissions between 20% and 50% on deals they generate.

After filling out the registration form, you’ll need to wait 2-3 business days for approval. You can promote the brand’s products through online marketing, link placement, email marketing, and phone marketing.

9. National Business Capital

National Business Capital is a leading alternative lending marketplace in the U.S. They provide businesses with equipment financing, term loans, and asset-based lending.

When joining this business loan affiliate program, you’ll get a custom application page on your website for your audience to apply for financing. You can also track clicks, conversions, and earnings in real-time with a smart dashboard.

Their partner relationship manager is willing to support you in your promotional efforts. You can rely on their guidance to improve your campaigns, track performance, and resolve any challenges.

Conclusion

In conclusion, these 9 business loan affiliate programs are great ways to make money from your platform. Before signing up, make sure to read their terms and conditions carefully. This will help you understand the rules, commission rates, payment methods, and how to promote their services the right way.