While various people invest their savings in bitcoin, forex, and real estate, retiree often spend their retirement savings on precious metals. Since the spot price of gold increases each year, the commission remains top-tier. Therefore, you should take a chance and start doing affiliate marketing in this high-ticket niche.

To help you step closer to success, we’ve handpicked the best 15 gold affiliate programs from top gold dealers. Let’s dive in to see if any of these below programs matches your content.

Quick Comparison

| Program Name | Commission (%) | Cookie Duration (Days) | Niche Suitable |

|---|---|---|---|

| Gold Broker | 0.2% – 0.4% (tiered) | 365 days | Precious metals investing, long-term gold/silver storage |

| Augusta Precious Metals | 8%–10% + $200/lead | 90 days | Gold IRA, retirement investing |

| GoldRepublic | 25% | 60 days | Gold/silver/platinum storage |

| Money Metals Exchange | Fixed $16/sale | Not stated | Physical gold/silver purchases |

| BGASC | $5–$25 per sale | 45 days | Precious metals, coins, bullion |

| reDollar | 30% + $50 bonus | 180 days | Asset buying, gold/silver resale |

| GoldenMine | 5% | 45 days | Jewelry, gold/silver, engagement rings |

| Bullion Director | 3% + 1% sub-affiliates | Not stated | High-value metals investing |

| Bullion Exchanges | $1–$55 per sale (tiered) | 30 days | Bullion, graded coins, collectors |

| Bullion Vault | 25% + sub-affiliate 6.25% | 60 days | Gold/silver trading, global investors |

Affiliate Earnings Calculator

Estimate your affiliate income based on Traffic, CTR, AOV, and Commission rate. Drag the sliders below to explore different scenarios.

Estimated Results

These figures are for illustrative purposes – feel free to adjust them to fit your specific niche.

- Conversion Rate here is defined as the percentage of traffic that buys.

- Does not account for refunds, cancellations, or varying commission rates by product.

Top 15 Gold Affiliate Programs

1. Gold Broker

Gold Broker provides secured gold and silver storage services outside the banking system. They also sell precious metals for long-term investment and savings.

You can join the Gold Broker affiliate program and earn from 0.2% to 0.4% on every sale based on stock value.

- Level 1 ($500,000): 0.2% commission

- Level 2 ($500,000 – $1,000,000): 0.25% commission

- Level 3 ($1,000,000 – $5,000,000): 0.3% commission

- Level 4 (Above $5,000,000): 0.4% commission

The cookie duration lasts up to 1 year, counting from customers’ first click on your link. Gold Broker pays affiliates via PayPal only once their account balance has at least $100.

You can embed smart buttons and widgets in your website to enhance visitors’ experience and boost conversions. Moreover, you should make use of their links and banners to create appealing content.

|

2. Augusta Precious Metals

Augusta Precious Metals helps investors boost their retirement savings with precious metals IRAs. They also create free educational resources and personalized consultations to help users make smart investment choices.

You can join the Augusta Precious Metals affiliate program on their website and earn up to a 10% commission per sale.

- Standard rate: 8% commission

- VIP rate: 10% commission

Notably, Augusta Precious Metals will pay you up to $200 per qualified lead. The cookie duration is 90 days, starting from the moment customers click on your link.

You can receive payouts via direct deposit or PayPal. While other program pays on a regular basis, Augusta Precious Metals pays upon your request.

|

3. GoldRepublic

GoldRepublic helps users store their precious metals like gold, silver, and platinum. They partner with secured vault operators in different locations, such as Amsterdam, Zurich, and Frankfurt.

Once joining their gold affiliate program, you can earn a 25% commission on every qualified purchase. The cookie duration remains active for 60 days, lasting on customers’ devices once they click on your link.

You can customize URL links with suitable keywords to boost clicks and sales. GoldRepublic allows you to change anytime to match market trends and audience intent.

|

4. Money Metals Exchange

Money Metals Exchange is a top dealer in the US for exchanging and selling precious metals. They use advanced encryption technology to secure users’ online transactions and storage.

You must sign up for ShareASale to join their affiliate program. The Money Metals Exchange affiliate program allows affiliates to earn a $16 commission per purchase.

Money Metals Exchange provides text links and banners to help you improve content quality. If you have a subscriber list via email, you can use pre-made email creatives to encourage purchases.

|

5. BGASC

BGASC is among the largest dealers in the US of precious metals like gold, silver, platinum, and palladium products. Additionally, they provide numismatic coins from both well-known and small mints.

You can join the BGASC affiliate program via ShareASale and enjoy up to a $25 commission on each purchase.

- Under $3,000: $5 commission

- Above $3,000: $25 commission

They double all commissions for new affiliates in their first 90 days. You’ll earn credit if customers make a purchase within a 45-day cookie duration.

BGASC allows you to use all of their pre-made banners, including the high-converting Generic “Buy Gold” & “Buy Silver” ones. You can also use various text links to make your promotions more attractive and increase conversions.

|

6. reDollar

reDollar transforms the US asset-buying industry with their technological innovation in ethical practices. They utilize advanced tools in evaluating asset valuations to give higher payouts than the market.

You can join the reDollar affiliate program and earn up to a 30% commission across all product sales. Additionally, you’ll earn a $50 bonus on your first qualified sale. If customers purchase within 180 days of their first click on your link, you’ll get your commission.

You should use their ready-to-use banners and text links in creating promotional campaigns. They also customize banners upon your request if you’re their premium affiliate.

|

7. GoldenMine

GoldenMine creates high-quality jewelry using handpicked fine metals from top manufacturers. They mainly sell gold and silver chain necklaces, bracelets, wedding bands, and diamond engagement rings.

GoldenMine runs their affiliate program via CJ Affiliate and offers a 5% commission on each product sale. You can earn $25 on every sale with an average order value of up to $500.

The cookie duration lasts 45 days from the customers’ first click on your link. Therefore, you can only earn credit for purchases within this period.

|

8. Bullion Director

Bullion Director publishes the latest news and tips for investing in the precious metals market. They also partner with over 1,700 bullion dealers to help users find the best places to exchange gold and silver.

After joining their precious metal affiliate program, you can earn a 3% commission on purchases over $10,000. You’ll earn around $1,000 on each sale with an average order value of $35,000.

Notably, the brand lets you get a 1% commission for any sale from your sub-affiliates. Bullion Director also pays you $30 on a qualified lead via your affiliate link.

You can put banners and promotional videos in your content to enhance engagement and boost conversions. They give you lead magnets to collect data and convert into conversions in the short-term.

Bullion Director accepts international affiliates to join their program. However, they only approve leads and traffic within the US regions.

|

9. Bullion Exchanges

Bullion Exchanges sells and buys vintage and new emerging metals at low prices. They offer market insights and suitable investment advice for both 1st-time buyers and long-term collectors.

Once joining their affiliate program via ShareASale, you can earn from $1 to $55 commission based on the transaction value.

- Under $50: $1 commission

- $50 – $499: $4 commission

- $500 – $4,999: $20 commission

- $5,000 – $9,999: $35 commission

- Over $10,000: $55 commission

You can earn a commission if customers make a purchase in 30 days from their first click on your link. While using discount codes can encourage more purchases, you’ll only receive 40% of the regular commission per sale.

You should use their pre-made content to save time on creating promotional campaigns. You can also use their banners and text links to enhance content quality and drive more attention.

|

10. Bullion Vault

Bullion Vault is a metals exchange platform for private investors from over 175 countries. Users can instantly settle online bullion transactions in multiple currencies to ensure transparency.

Bullion Vault pays affiliates up to a 25% commission for every completed sale. You can also earn around 6.25% commission on each sale referred by your sub-affiliates. You’ll get your commission if customers make a purchases within 2 months of their first click on your link.

You can embed charts and widgets in your site to increase click-through rates. You can also utilize their appealing banners to enhance website visibility and boost engagement.

|

11. Golden Eagle Coins

- Commission rate: $15

- Cookie duration: Not mentioned

Golden Eagle Coin owns a large inventory of over 5,000 unique precious metals and numismatic items. The company has transitioned to e-commerce, making it more convenient for collectors and investors to access products.

12. Bullion Star

- Commission rate: 0.3-1%

- Cookie duration: Not mentioned

Bullion Star is a Singaporean-based bullion dealer selling precious metals from Singapore’s Goods and Services Tax (GST). They support international assets by placing storage worldwide, such as in Singapore, New Zealand, and Texas.

13. RC Bullion

- Commission rate: 3%

- Cookie duration: Not mentioned

RC Bullion helps users add precious metals to their investment accounts safely and securely. They offer from popular bullion like Gold American Eagles and Silver Canadian Maple Leafs to hard-to-find metals.

14. Royal Canadian Mint

- Commission rate: 2-5%

- Cookie duration: Not mentioned

Royal Canadian Mint produces all of Canada’s circulation coins and other coinages. They also design special edition collector coins, medals, and medallions.

15. CBMint

- Commission rate: 10%

- Cookie duration: Not mentioned

CBMint is a leading online dealer and retailer of gold, silver, platinum, palladium, and rhodium. They offer secured investments for both new investors and those looking for self-directed IRAs.

How Do You Choose the Right Gold Affiliate Programs?

Finding the right gold affiliate program is a big decision for your business. You must look at commission rates and the company’s reputation before you sign up.

This guide will help you pick the best partner to grow your income.

Match Programs to Your Audience’s Financial Profile

The fastest way to kill your conversion rate is a financial mismatch. You cannot sell a high-minimum investment service to an audience living paycheck to paycheck.

Likewise, you shouldn’t pitch a low-margin coin dealer to a wealthy investor looking to protect a million-dollar retirement account.

You must audit your traffic source and put your audience into one of three buckets:

| Investor segment | Goal | Best programs | Requirements |

| High-net-worth ($100K+ Assets) | Wealth protection & tax-advantaged accounts | Augusta Precious Metals, Goldco | $25k–$50k minimums; “white-glove” service; high-commission IRA rollovers. |

| Middle-market ($25K–$100K) | Portfolio diversification | American Hartford Gold, Birch Gold Group | $10k–$25k entry thresholds; provides educational support for rollovers. |

| Budget-conscious (<$25K) | Direct physical metal (bullion/coins) purchase | APMEX, JM Bullion, SD Bullion | No minimums; fast e-commerce sales; lower payouts per transaction. |

Analyze Commission Structure Beyond Headline Percentages

Don’t let big percentages fool you. A high rate does not always mean a bigger paycheck.

To find your true earnings, you must look at the Average Order Value (AOV). This tells you how much a normal customer actually spends. 📊

Most gold programs use one of three pay structures. Each one fits a different type of marketer:

The Percentage-Based Model (High Ticket)

This is common in the Gold IRA space. You might earn 3–5% of the total transaction.

- A 4% commission on a $50,000 IRA rollover = $2,000 in your pocket.

- A 4% commission on a $200 coin purchase = $8 in your pocket.

This model is where the “big money” lives. Just be patient. These large deals involve a lot of money and can take weeks to close.

The Flat-Rate Model (Bounty)

Some programs pay a fixed fee (e.g., $200–$1,000) for every qualified lead or funded account, regardless of the deposit size.

You’ll earn the same $500 whether the client invests $10,000 or $1 million.

It is a great choice if your readers have smaller budgets. Just check if the program pays for simple leads or only for funded accounts.

The Tiered/Volume Model

Programs often reward high-volume affiliates with higher rates (e.g., 3% for the first 10 sales, 4% for 11–25).

This structure is perfect if you run paid ads and drive a lot of traffic. It helps you grow your profit margins over time.

Evaluate Your Promotion Method’s Compatibility

You might find a program with great pay and a perfect audience, but it can still fail if the technology doesn’t match your strategy.

A program that works for a blogger might be a disaster for someone running paid ads. You must check whether the company’s tools align with how you find customers.

For SEO & Content Marketers

If you write articles, your readers are likely in “research mode.” They might read your post today but wait weeks to buy.

That’s why you need a long “cookie window” of 30 to 90 days to ensure you still get paid if they return later.

You should also look for programs that provide gold price charts or calculators. These tools keep people on your site longer.

For Paid Media Buyers (PPC/Social)

When you pay for clicks, you need people to take action fast. Do not send traffic to a generic homepage.

Instead, you’d better look for programs with high-converting landing pages. You must also check the rules for ad copy.

This industry has strict laws. Using the wrong words could get your ad account banned, so use pre-approved templates.

For Email and Newsletters

Email marketing relies on trust. Your readers might click a link on their phone but sign up later on a computer.

Therefore, you need “cross-device tracking” to capture every sale.

If you have a large list, do not accept the standard offer. You can ask for an exclusive deal, like a fee waiver for your subscribers.

Assess Payment Terms and Reliability Factors

The final check is the most important: Will the company actually pay you on time?

Imagine you earn $10,000 in commissions in January. You might feel successful, but some programs use “Net-60” terms.

This means they wait 60 days before they send your money. If they also hold funds for refunds, you might not see a cent until April or May.

To avoid these traps, you need to look closer at the company’s rules.

Analyze the Payment Schedule 📅

Always look at the timing. If you are just starting, prioritize programs that pay quickly.

A “Net-15” program pays you 15 days after the end of each month. Meanwhile, a “Net-60” program makes you wait two full months.

If you are bootstrapping, prioritize faster payment terms over slightly higher commissions.

Additionally, some high-ticket programs won’t cut a check until you hit $500 or $1,000 in earnings. This is fine for veterans, but for a beginner, getting stuck at $400 in “locked” earnings is demoralizing.

Verify Program Stability & Reputation 🏛️

Gold affiliate programs come and go. When the economy shifts, smaller dealers often shut down their affiliate tiers to save cash.

You should stick to established players. A dealer that has been around for 20 years is a safe bet. Be careful with new startups that offer huge rates, as they might vanish overnight.

Furthermore, you must keep an eye out for these serious danger signs.

- Vague commission terms (e.g., “up to 5%” without defining the tiers).

- Negative reviews on affiliate forums regarding “shaving” (merchants deleting leads to avoid paying).

- Programs that still pay exclusively by paper check (slow and unreliable).

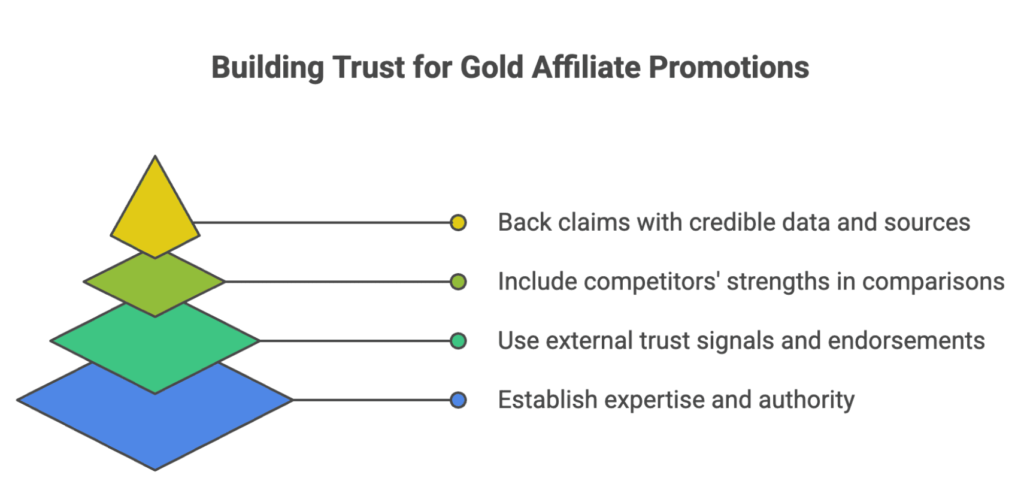

How Do You Build Trust for Gold Affiliate Promotions?

You are not selling a $20 t-shirt; you are asking someone to move $50,000 of their retirement savings into an asset class they might not fully understand.

To convert high-ticket leads, you must stop acting like a promoter and start acting like an advisor. Here are four strategies to build that credibility before you ever ask for a click.

Establish Author Credentials and Demonstrated Expertise

The days of anonymous, faceless finance blogs are over. In the eyes of Google (and your readers), who wrote the content matters just as much as what is written.

You need to prove you are a real person with skin in the game.

You should begin by updating your profile and your author biography.

✅Use a clear, professional headshot. No avatars, no logos.

✅If you have a background in finance, banking, or commodities, state it clearly.

However, you do not need a college degree to be an expert in the eyes of your readers. You can still showcase your expertise by discussing your personal journey as an investor.

Instead of saying “APMEX is reliable,” say: “I’ve placed 12 orders with APMEX over the last five years. My average shipping time has been 3 days, and I’ve only had one issue with a damaged capsule, which they resolved in 48 hours.”

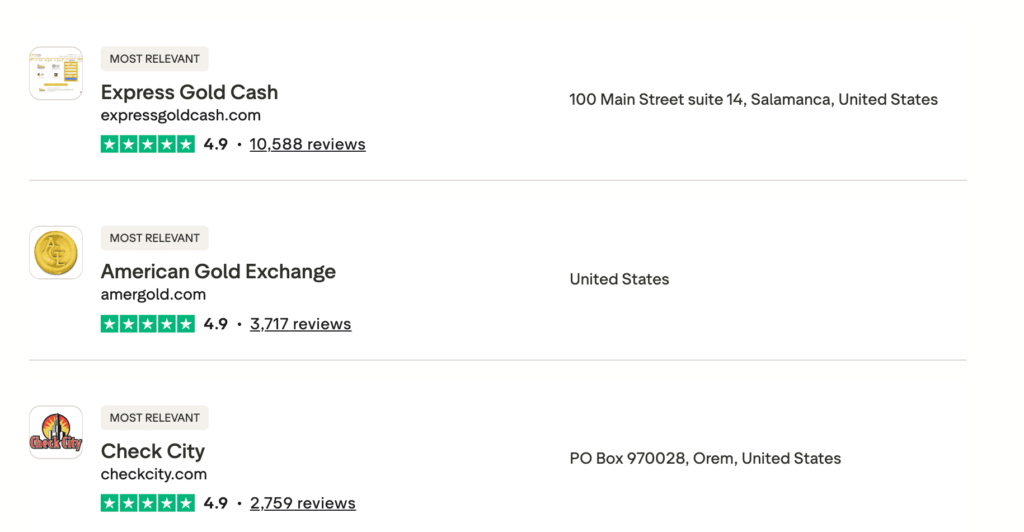

Incorporate Third-Party Verification and External Trust Signals

Your opinion is valuable, but objective data is undeniable.

When you praise a company, you must back it up with proof from neutral, third-party sources. That shows you have done your homework and aren’t just copying the company’s brochure.

Every time you review a gold dealer, you should reference at least three of these signals:

BBB Ratings

Don’t just list the letter grade (A+). Summarize the complaint history. “They have an A+ rating, but there are 3 recent complaints regarding delayed shipping during the holiday rush.”

Trustpilot/Consumer Affairs

Cite the score and the sample size. A 5-star rating from 4 reviews is meaningless. A 4.8-star rating from 2,000 reviews is powerful.

Industry Memberships

Are they members of the ANA (American Numismatic Association) or ICTA? Scammers rarely pay for these memberships.

Longevity

“Founded in 2008” carries more weight than “Founded in 2023.”

The Power of “Balanced Presentation

Trust is built in the margins. If you only share the positives, you sound like a paid shill. To prove your editorial independence, you must highlight the negatives.

In the meantime, you should also be willing to share the bad news along with the good. For instance:

❌ “Company X is perfect and has the best prices!”

✅ “Company X maintains a 4.9/5 rating on Trustpilot. However, my analysis shows their premiums on silver eagles are roughly $1.50 higher than competitors. You are paying extra for their faster shipping speed and customer service.”

Provide Honest Comparative Analysis Including Competitors’ Strengths

The quickest way to lose a reader is to pretend your recommended partner is perfect. When every review on your site says “10/10, No Cons,” you look like a salesperson, not an analyst.

To build real trust, you must be willing to praise the competition—even the ones you don’t earn money from.

Every company has a flaw. If you don’t mention it, the reader will assume you are hiding it.

“Goldco is the best choice for everyone!” sounds like a sales pitch.

Meanwhile, you can create an honest review like “Goldco offers exceptional white-glove service, but they require a $25,000 minimum investment. If you are looking to roll over a smaller 401(k), this is not the right fit for you.”

In addition, don’t be afraid to say that a competitor is cheaper or faster. You can phrase like this:

“While we love APMEX for their selection, if your only goal is paying the absolute lowest premium over spot price, SD Bullion or Money Metals Exchange often beat them by 0.5% to 1%.”

In case you rank a company #1, you need to explain why, and don’t hide the financial incentive.

“We rank Augusta Precious Metals first because of their zero-complaint history with the BBB and their lifetime support guarantee. We do earn a commission if you sign up, but we also recommend other dealers if you don’t meet their minimum requirements.”

Support All Claims with Credible Data Citations and Source Links

In the finance niche, vague claims like “experts say” or “studies show” are red flags. If you want to be treated as an authority, you must show your work.

Every major claim you make should have a digital paper trail leading back to a primary source.

Use Government Sources 🏛️

Government data is the gold standard for trust.

When you explain IRA rules, link directly to the official IRS website instead of another blog. This proves you have read the actual laws yourself and are not just repeating what others say.

Cite Market Authorities 📈

Use data from world-class organizations to back up your trends. Reference the World Gold Council or the Federal Reserve when you discuss gold demand.

For example, if you say central banks are buying more gold, link to a specific report that proves it.

Be Specific with Prices 💰

Do not just say that costs are low. Instead, you should give the exact percentage a dealer charges over the “spot” price for the current month.

Using live data shows your readers that your information is fresh and accurate.

What Are the Promotional Restrictions for Gold Affiliate Programs?

Gold affiliate programs have strict rules you must follow to keep your account safe. Breaking these guidelines can lead to lost commissions or a permanent ban from the program.

In the following section, we’ll explain the common traps to avoid so you can protect your business and your income.

Paid Search Brand Term Bidding Restrictions

If you are a PPC (Pay-Per-Click) marketer, read this carefully: You almost certainly cannot bid on the brand name.

Most gold affiliate programs strictly prohibit bidding on their trademarked terms on Google Ads or Bing Ads.

If you bid on their trademarked name, you drive up their costs and take away their direct customers.

The company will not pay you a commission for stealing traffic they were already going to get. They want you to find new customers, not bid on people who are already looking for them.

These companies check reports every day to see exactly who is bidding on their brand names.

If you get caught “brand poaching,” the results are fast and painful.

The company will likely cancel all your unpaid commissions and ban you from the program forever.

We have seen marketers lose $15,000 in a single day for trying to cheat the system. It is never worth the risk of losing your entire business just to get a few extra clicks.

While you cannot use brand names, you are still free to use general terms to find new customers. 🗺️

You can use terms such as “Best Gold IRA Companies,” “How to Buy Gold,” “Silver Price Today.” These generic terms allow you to reach a wide audience without breaking any rules.

FTC Disclosure Requirements and Placement Rules

In the United States, the Federal Trade Commission (FTC) has strict rules about being honest with your audience.

You must disclose any financial relationship you have with the brands you recommend. Being open about your pay helps build trust and keeps you out of legal trouble.

To stay safe and follow these laws, you need to understand the three main rules for your website.

📍 Put your disclosure where people will see it first. It must appear before any affiliate links.

Do not hide it at the bottom of the page or in “Terms of Service.” It should be at the very top so readers see it without scrolling.

👀 Do not use tiny fonts or light gray colors that blend into the background. It needs to stand out.

✍️ Avoid “lawyer talk” like “material connection.” Just use plain English so everyone understands.

Here are simple templates to share the truth with your audience.

Short (Top of Article): “Disclosure: We may earn a commission if you click links on this page. This helps support our research.”

Long (Sidebar/About): “Transparency is important to us. Some of the links in this article are affiliate links, meaning we receive a commission at no extra cost to you if you make a purchase. We only recommend companies we trust.”

Even you promote gold on Youtube or social media, you still must follow the rule

YouTube/Video

You must state the disclosure verbally or have it appear on screen within the first 30 seconds. Putting it in the description box alone is not sufficient.

Social Media

You must use clear hashtags like #ad or #affiliate in the first three lines of the caption. #collab or #partner are often considered too vague by the FTC.

Financial Advice Limitations and Permissible Language

Just as you must be transparent about who pays you (FTC rules), you must be incredibly careful about what you tell people to do with their money (SEC and FINRA rules).

Unless you hold a Series 65 license or are a Registered Investment Advisor (RIA), you cannot give personalized investment advice.

The distinction here is between “General Education” and “Specific Recommendation.” As an affiliate, you are an educator, not an advisor. Crossing this line is the fastest way to get sued or banned.

You must frame every statement as an observation of the market, not a directive to the reader.

| ❌ Prohibited (Personalized Advice) | ✅ Permitted (General Education) |

| “Move 20% of your 401(k) to gold now.” | “Experts suggest 5–10% for diversification.” |

| “A Gold IRA is perfect for your retirement.” | “Gold IRAs are often used to hedge inflation.” |

| “Now is the right time for you to buy.” | “Historically, gold rises during downturns.” |

| “This will lower your tax bill.” | “Consult a professional for tax-specific advice.” |

Every page that discusses investment strategies must have a clear disclaimer. You can copy this template:

Disclaimer: The content on this site is for educational purposes only and is not intended as personalized financial advice. I am not a financial advisor. You should consult with a licensed financial professional before making any investment decisions.

Return Guarantee and Performance Claim Prohibitions

The biggest mistake you can make is making false promises. The most dangerous sentence in marketing is: “Gold is guaranteed to go up.”

Most programs have a “zero-tolerance” rule for this. If you promise a profit, the government sees it as fraud.

You cannot predict the future. You can only report on what has already happened in the past.

| ❌ Prohibited (Future Promise) | ✅ Permitted (Historical Context) |

| “Gold will increase 20% next year.” | “Gold has averaged X% annual returns over 20 years.” |

| “Precious metals never lose value.” | “Historically, gold tends to hold value during high inflation.” |

| “Guaranteed returns for your retirement.” | “Data shows gold prices rose during the 2008 recession.” |

Whenever you show a chart or quote a return percentage, you must immediately follow it with: “Past performance does not guarantee future results.” This is a shield that protects you from liability if the market turns.

FAQs

What is a gold affiliate program?

A gold affiliate program allows affiliates to earn commissions by referring customers to companies that sell physical gold, gold bullion, gold coins, or gold-backed investment products. Commissions are typically earned per sale, per lead, or per qualified investor.

How much commission do gold affiliate programs pay?

Most gold affiliate programs pay between 1% and 8% per sale for physical gold. Some investment-focused programs offer fixed CPA payouts, often ranging from $50 to $300 per qualified lead, depending on deposit size and customer verification.

Are gold affiliate programs profitable?

Yes—gold affiliate programs can be highly profitable due to high order values. A single transaction can range from $1,000 to $50,000+, meaning even low commission percentages can generate substantial earnings.

Can beginners join gold affiliate programs?

Beginners can join, but success requires trust-building content. Educational articles, comparison guides, and risk explanations perform better than direct sales pages. Beginners often start with content SEO before scaling into paid ads.

Do gold affiliate programs support international traffic?

Some programs accept global traffic, while others are limited to specific countries such as the US, Canada, UK, or Australia. Gold IRA offers, in particular, are usually country-specific.

Conclusion

We have walked through the entire journey, from laying the strategic foundation and building the gold affiliate program’s infrastructure to recruiting top talent and optimizing for long-term growth.

Plus, you have 15+ blueprints from the top brands on the market to spy on and copy.

By following this framework, you are not just launching a marketing campaign; you are building a powerful business asset.

Remember, a truly successful affiliate program is more than just a sales channel—it is a network of genuine partnerships.

Fostering strong, mutually beneficial relationships with your affiliates is the ultimate key to sustained growth.

By empowering them to succeed, you will establish your Shopify store as a trusted authority in the gold market and unlock a new, scalable stream of revenue for years to come.