The U.S. mortgage industry is valued at more than $11 trillion in value. There’ll be a lot of earning chances for affiliate marketers, especially those who produce content related to mortgage and home loans.

In this guide, we highlight 15 of the best mortgage affiliate programs to help you get started. Be sure to review each program carefully to find the right fit for your strategy and audience.

If you’re interested in other related niches, take a look at our top-rated affiliate programs for real estate and personal loans.

Quick Comparison

| Program Name | Commission (%) / Amount | Cookie Duration (Days) | Niche Suitable |

|---|---|---|---|

| Affinity Real Estate & Mortgage Services | 15% | – (not specified) | Mortgage training, NMLS prep, education |

| Motley Fool | $24–$480 | 7 days | Personal finance, investments, loans |

| Credit Sesame | 100% commission | 30 days | Credit repair, credit monitoring, mortgage prep |

| Loan.co.uk | £75–£500 | 30 days | Mortgage, loans, UK finance market |

| Ally Bank | $50 | 45 days | Banking, personal finance, mortgage lending |

| CIT Bank | $28–$100 | 30 days | Banking, loans, mortgage, savings |

| BMO Harris Bank | $100–$225 | 30 days | Banking, loans, mortgage |

| Experian | $6–$12 | 10 days | Credit monitoring, loan prep, finance |

| Sky Blue Credit | $80 | 90 days | Credit repair, mortgage improvement |

| USAA Mortgage | $10 | 30 days | Military loans, mortgage |

Affiliate Earnings Calculator

Estimate your affiliate income based on Traffic, CTR, AOV, and Commission rate. Drag the sliders below to explore different scenarios.

Estimated Results

These figures are for illustrative purposes – feel free to adjust them to fit your specific niche.

- Conversion Rate here is defined as the percentage of traffic that buys.

- Does not account for refunds, cancellations, or varying commission rates by product.

15 Best Mortgage Affiliate Programs

1. Affinity Real Estate & Mortgage Services

Affinity Real Estate & Mortgage Services prepares students with every skill needed to pass the MNLS Exam. With Affinity’s NMLS Pre-Licensing courses, students can be qualified to become a Mortgage Loan Originator.

Once joining their affiliate program, you can enjoy a 15% commission rate on each student registration for their courses. Affinity Real Estate & Mortgage Services pays their affiliates only via PayPal, so you must have a PayPal account to receive your payouts monthly.

A dedicated affiliate management team will give you tips and advice on boosting attraction. Plus, you can embed banners and links on your website to promote better.

However, you should notice that they ban every spamming action through email and social media to promote their products.

|

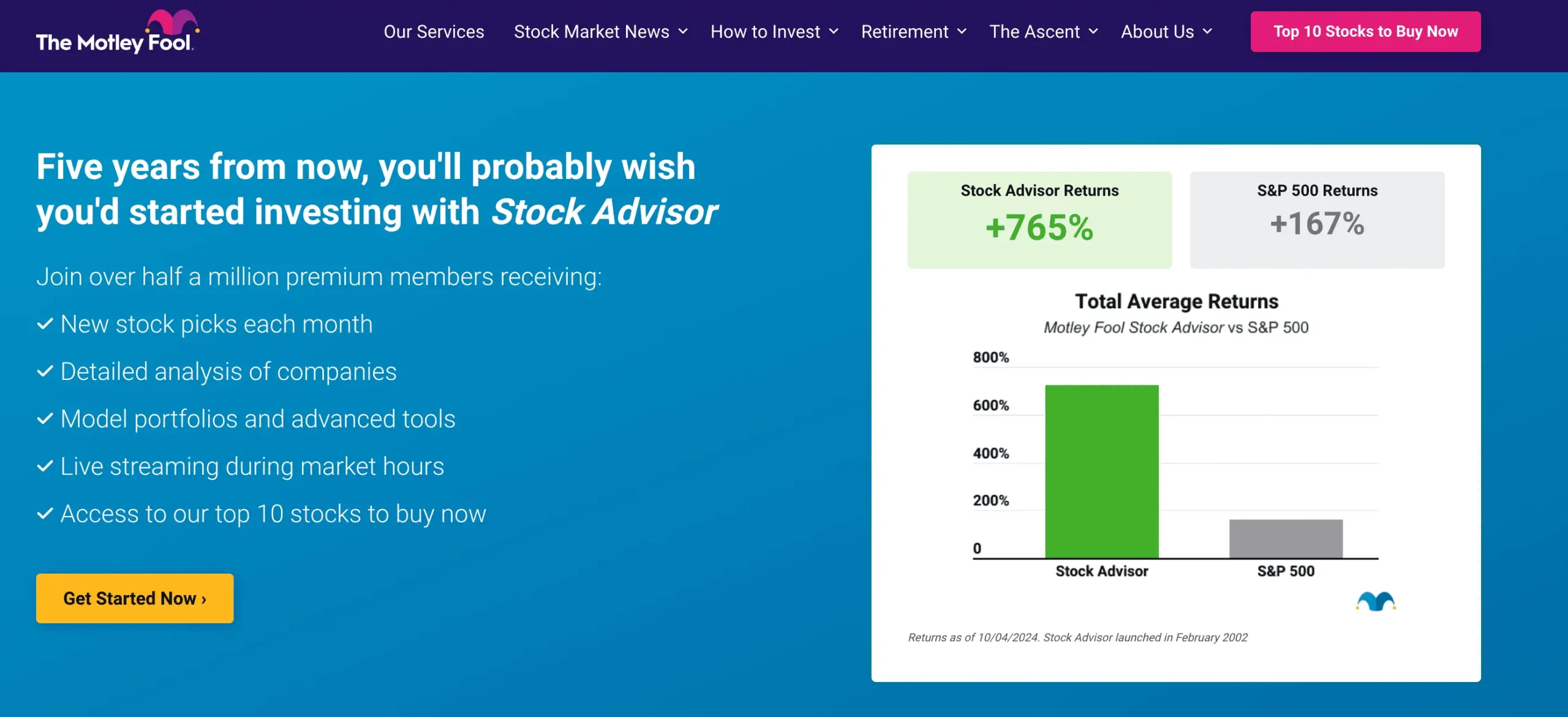

2. Motley Fool

Motley Fool is a private finance company that offers personal advice on financial investments. They have developed The Ascent service to analyze loan and mortgage rates for users before making financial decisions.

You can join the Motley Fool affiliate program via the FlexOffers affiliate network. You can earn a commission ranging from $24 to $480, depending on the type of service your customers choose.

The cookie duration lasts 7 days. Therefore, as long as your customers click and buy products from Motley Fool through your link within a week, you can get your commission.

|

3. Credit Sesame

Credit Sesame manages and updates credit scores and reports for their clients to control financing. With great credit scores, users can choose better mortgage offers to have their dream house.

The Credit Sesame affiliate program is run by Impact, a top affiliate network. What sets this program apart from others is the 100% commission rate across all qualified subscriptions.

Credit Sesame allows their affiliate to earn a credit commission within a 30-day cookie duration. Plus, They will process your payout transaction on a monthly basis.

You can create your own promotional materials following the brand guidelines and wait for their approval before using. Otherwise, you can make use of their landing pages and digital ads to drive more audiences to your promotions.

|

4. Loan.co.uk

Loan.co.uk uses AI-generated calculators to help customers find suitable mortgage deals in the UK. Users can receive guidance on mortgages, remortgages, second-charge mortgages, and buy-to-let mortgages.

Managed through Awin, the Loan.co.uk offers commission tiers based on the homeowner loan value:

- £10,000 – £24,999 loan value: £75

- £25,000 – £49,999 loan value: £200

- £50,000 – £99,999 loan value: £300

- £100,000+ loan value: £500

The tracking period for the approved commission is 30 days, counting from the first click of customers.

Loan.co.uk has a library of banners and adverts for you to promote their services. Plus, if you have any concerns about the program, feel free to ask the brand for solutions and advice.

|

5. Ally Bank

Ally Bank offers a comprehensive range of digital banking, investment, and lending services. Their mortgage division offers fixed and adjustable-rate loans and refinancing options.

After joining the Ally Bank affiliate program via CJ Affiliate, you can enjoy a $50 commission rate across all subscriptions. However, you can only receive commission only when your customer completes their application to Ally Bank.

The cookie duration is 45 days, so you can earn your commission from customer’s purchases within this period.

|

6. CIT Bank

CIT Bank serves people across the US with attractive rates on savings products, loans, mortgages, and more. They offer relationship pricing on mortgage loans to customers who hold or open a qualifying account.

Affiliates can apply for the CIT Bank affiliate program via FlexOffers. CIT Bank pays a commission rate depending on application types:

- Approved eChecking application: $28

- Other applications: $100

The cookie lasts 30 days before expiring. Therefore, you can earn a commission only within a month after your followers make their first click.

|

7. BMO Harris Bank

BMO Harris Bank offers unlimited debit and ATM card cash withdrawals for clients in investing and mortgage. They work with government and community organizations to help lower mortgage clients’ payments and closing costs.

The BMO Harris Bank affiliate program provides a commission structure based on the types of service applications for affiliates:

- Smart Money and Premier account approved: $100

- Lending: $175

- Mortgage application: $225

The cookie remains active for 30 days, counting from the customer’s first click. This will allow you to earn commission from purchases through your link within a month.

|

8. Experian

Experian collects and maintains consumer credit information, including payment history, credit usage, and credit inquiries. Thereby, consumers can improve their credit and make informed financial decisions such as mortgage planning.

Experian runs their affiliate program via CJ Affiliate. They pay affiliates commission rates depending on each service subscription:

- Experian Boost: $6

- Free Experian account through CreditMatch: $12

The tracking period is only 10 days from the customer’s first click on your affiliate link.

|

9. Sky Blue Credit

Sky Blue Credit helps customers find solutions to lower their credit scores. They will analyze and find suitable mortgage deals for specific clients based on their repaired scores.

The Sky Blue Credit affiliate program offers up to $80 commission rate for every sale. The cookie duration lasts 90 days to count for approved commission via your affiliate link.

You can freely ask the Sky Blue Credit in-house affiliate team for effective tips and advice on promoting their products.

|

10. USAA Mortgage

USAA Mortgage aims to help military personnel find their dream home with many mortgage options. Their USAA Bank loan officer will support users throughout the process of applying for mortgage loans.

USAA Mortgage runs their affiliate program via CJ Affiliate. You can apply for their program from here and earn a $10 commission for each qualified subscription.

Their affiliate program offers a 30-day cookie duration, starting from the first customer clicks on your link. Therefore, you can only earn your commission once customers purchase within this period.

|

11. LeadPops

- Commission rate: 10-20%

- Cookie duration: Not mentioned

LeadPops assists mortgage offices in growing their business with rebel iQ mortgage lead and marketing solutions. Over the years, they’ve helped over 3,000+ mortgage professionals, teams, and enterprises boost leads.

12. FB Mortgage

- Commission rate: £200

- Cookie duration: Not mentioned

FB Mortgage provides access to over 90 lenders to find the best mortgage rates in the industry. They also provide appointment services to help people with the mortgage process.

13. Mortgage Training Centre

- Commission rate: 50%

- Cookie duration: Not mentioned

Mortgage Training Centre provides qualified licenses and knowledge for professionals in over 16 verticals, including mortgage and investing. Their courses cover in-person seminars, CDs, DVDs, Manuals, Conferences, and more available methods.

14. My Mortgage & Protection Experts Advisers

- Commission rate: 20-30%

- Cookie duration: Not mentioned

My Mortgage & Protection Experts Advisers is a UK-based company that offers expert mortgage and insurance advice. They help people with remortgage, buy-to-let mortgages, life insurance, home insurance, and more.

15. Nationwide Home Loan

- Commission rate: 0.05%

- Cookie duration: Not mentioned

Nationwide Home Loans provides a comprehensive suite of mortgage services to meet diverse needs. You’ll receive dedicated support for conventional, government-backed, and construction loans.

Why Should You Promote Mortgage Affiliate Programs Instead of Other Affiliate Niches?

Most affiliate marketers shy away from the mortgage niche. They see the strict regulations, licensing requirements, and longer sales cycles, and they run the other way.

Good. Let them run.

Their hesitation creates a massive opportunity for you.

While “easy” niches like Amazon Associates or general software reviews are crowded with competitors fighting for scraps, the mortgage sector operates on a different level.

You don’t need millions of views to succeed here; you just need the right audience.

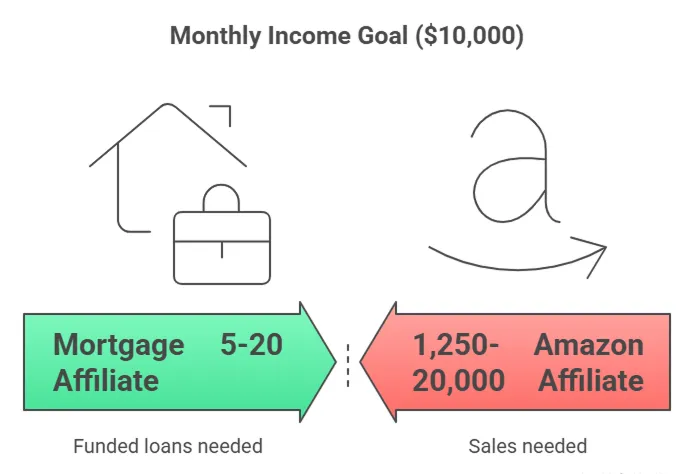

Below is the math on why specific, high-value mortgage traffic is worth 100x more than general consumer traffic.

Exceptional Per-Conversion Economics: Why One Mortgage Closing Equals 125-2,000 E-commerce Sales

In most affiliate niches, it is a volume game.

You need a tidal wave of traffic just to generate a full-time income because the payout per sale is so low. In the mortgage game, the dynamic flips: it’s about value, not volume.

Let’s look at the hard numbers.

If you promote products through Amazon Associates, you likely earn between $0.50 and $8.00 per sale.

Even in the profitable SaaS (Software as a Service) space, a signup might net you $50–$300, or a credit card approval might bring in $50–$200.

To make $10,000 a month, the math is exhausting:

- Amazon: You need 1,250 to 20,000 sales.

- Credit Cards: You need 50 to 200 approvals.

Mortgage affiliate payouts typically range from $500 to $2,000 per funded loan.

To hit that same $10,000 monthly goal, you only need 5 to 20 funded loans.

Think about the traffic required to hit those numbers. To get 2,000 Amazon sales at a 2% conversion rate, you need 100,000+ visitors.

To get 10 mortgage closings, you might only need 2,000–5,000 high-quality visitors.

My Verdict: If you are skilled at SEO or paid ads, why waste that talent sending traffic to a low-paying offer?

Promoting mortgages allows you to build a $50,000/month business with the same traffic volume that would barely scrape $5,000/month in a standard e-commerce niche.

Naturally Recurring Customer Lifecycle: Earning $2,000-8,000 Per Customer Over 10-15 Years

The hidden killer in most affiliate models is the “One-and-Done” problem. You work hard to find a customer, they buy a pair of running shoes, and then… they’re gone.

You have to start over to replace them.

The mortgage niche is unique because homeownership is a lifecycle, not a single event.

A single lead isn’t just worth one commission. They are potentially worth four or five commissions over the next decade.

Consider a single lead. Let’s call him “Homebuyer Dave.” You get his email when he looks for his first home loan.

| Year | Milestone | Service Provided | Earnings |

| Year 1 | Dave buys first starter home. | Primary mortgage loan. | $1,500 |

| Year 3 | Rates drop; Dave refinances. | Rate alert and refinance loan. | $1,200 |

| Year 5 | Dave renovates the kitchen. | Home Equity Line (HELOC). | $500 |

| Year 8 | Family grows; Dave moves up. | New purchase mortgage loan. | $2,000 |

| Year 12 | Dave buys rental property. | Investment property loan. | $1,500 |

| Total | 12-year customer lifecycle | Relationship-based lending | $6,700 |

In a standard niche, Dave was a $50 transaction. In the mortgage niche, Dave is an asset worth $6,700 over his lifetime.

This high Lifetime Value changes your entire strategy.

It justifies spending more to get a lead (like higher ad costs) and makes building an email list—rather than just driving clicks directly to an offer—the single most profitable thing you can do.

Massive Total Addressable Market: Why Even 0.01% Market Share Means Substantial Income

A single mortgage customer is incredibly valuable. But is there room for you, or is the market saturated?

In most “hot” affiliate niches like drone reviews or keto supplements, the market is a small pond. To make real money, you must be the biggest fish, capturing 20% or 30% of the entire audience.

The mortgage market is not a pond. It’s an ocean.

You can be a tiny player and still generate a 7-figure revenue stream.

In a typical year (using 2024 projections), US mortgage originations hover around $2.1 trillion.

That represents roughly 5–6 million home purchases and another 10–15 million refinance transactions depending on interest rates.

Unlike niche hobbies with a $50 million market cap, the mortgage industry is a massive economic engine supporting thousands of profitable affiliates, lenders, and brokers simultaneously.

Historically, people got mortgages by walking into local bank branches.

That era is over. In 2015, about 50% of buyers started their mortgage research online. Today, that number exceeds 75% and is climbing.

As Millennials and Gen Z enter their peak buying years (a trend lasting through the 2030s), they demand digital-first experiences through comparison sites, blogs, and apps.

Because the pie is so big, you don’t need a huge slice. If you capture just 0.01% of a $2.1 trillion market, you’re driving over $200 million in loan volume.

At standard commission rates, that tiny sliver translates to substantial income.

You don’t need to dominate the market to win. You just have to show up.

How to Choose the Right Mortgage Affiliate Program

You’ve seen the lists of “Top Mortgage Programs,” and right now, you might feel like a kid in a candy store.

The payouts look huge, the brands look shiny, and the potential revenue seems limitless.

But here is the hard truth: Not all mortgage programs are built to help you win.

Some are structured to make it nearly impossible for you to get paid. Others have tracking windows so short that you lose credit for the leads you worked hard to generate.

If you just sign up for the program with the biggest headline number, you are gambling with your traffic.

You need a system. Before you grab your affiliate link, run every program through this evaluation framework. Here is how to separate the high-performers from the time-wasters.

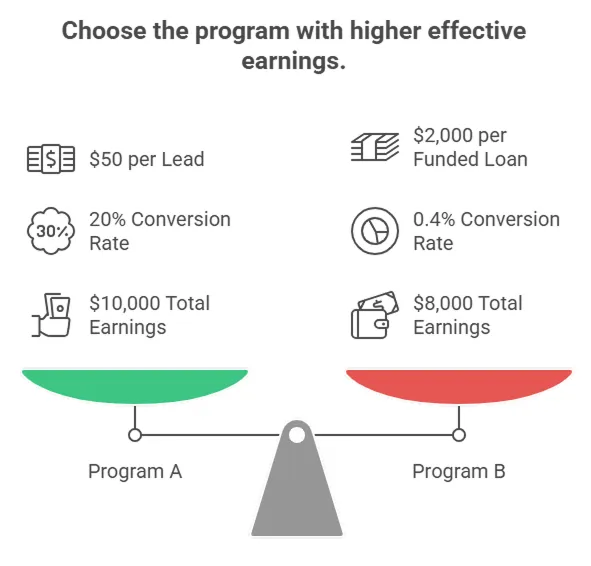

Evaluating Commission Structures: Look Beyond the Headline

It’s tempting to click “Join” on the program promising $2,000 per sale.

It looks like a lottery ticket. But in affiliate marketing, the “Headline Rate” is like a “Gross Salary”: it doesn’t tell you what you actually take home after taxes and deductions.

To find the real money, examine the fine print.

The “Qualified Lead” Definition:

What triggers a payout? A simple contact form (Name + Email)?

Or a full application with credit check? The harder the action, the lower your conversion rate.

Approval-to-Funding Ratios:

This is the silent killer.

A program might pay $1,500 per funded loan, but industry data suggests only 3-10% of mortgage leads actually get funded. You’re doing 90% of the work for free.

Cookie Duration:

Mortgage decisions take time.

A user might click your link today but not apply for 60 days. If the program only offers a 30-day tracking window, you lose that commission. Look for 90-day or lifetime windows.

Tiered Incentives:

Does the program reward volume?

Look for structures that bump your pay based on performance (e.g., $800 base, but $1,200 if you send 5+ loans monthly).

You have 1,000 visitors to your landing page.

- Program A: Pays $50 per lead (simple form fill). 20% conversion rate = 200 leads x $50 = $10,000.

- Program B: Pays $2,000 per funded loan. 0.4% conversion rate = 4 loans x $2,000 = $8,000.

The “boring” $50 offer puts $2,000 more in your pocket. Always calculate “Effective Earnings Per Click” (EPC), not just commission per sale.

🚩 Red Flag: Avoid programs with massive commissions but vague “quality” requirements that let them disqualify leads without proof.

Verifying Payment Reliability and Reputation

Nothing kills momentum faster than crushing a campaign only to face payment silence.

Networks collapse, advertisers dispute leads, and as affiliate veterans warn: reputation is everything. Protect your cash flow with this 5-step checklist:

Check AffiliateFix, Warrior Forum, or STM for “[Program Name] + payment issues.”

One complaint means nothing—look for patterns. Multi-page threads asking “Anyone get paid?” are red flags.

Net-30 is standard; Net-60 is tolerable. Anything longer means they’re using your money as an interest-free loan. Avoid it.

Hunt for “scrubbing” or “quality deduction” clauses in the Terms. I lost thousands promoting a loan offer that let them deduct 20% for “low contact rates”—caused by their terrible call center.

Email the affiliate manager with a simple question.

✅ Good response: clear answer within 24 hours.

❌ Bad response: vague replies or 3+ day silence. Poor communication before you earn means worse when problems arise.

Even if you can send 1,000 daily leads, don’t.

Run limited traffic for 60-90 days and wait for two consecutive on-time payments before scaling. Never risk your entire budget testing their financial stability.

Your traffic has value. Make networks prove they deserve it before going all-in.

Assessing Affiliate Support and Resources

You might find a program with great pay, but without proper support, you’ll struggle. Think of your affiliate manager as your pit crew.

You’re the driver bringing traffic, but if you’re changing your own tires, you’ll lose the race.

Top-tier programs know your success is theirs. Look for these four things:

You need a dedicated person who knows your name and goals, not a generic support email. Good managers tell you which landing pages are converting right now.

Mortgage marketing has strict rules. You shouldn’t write legal disclaimers yourself.

- Gold Standard: Programs like Rocket Mortgage provide pre-approved emails, landing pages, and compliance training.

- Red Flag: One blurry banner and “Good luck.”

Live rate displays convert better. A widget showing “Current 30-Year Rate: 6.5%” beats a simple text link.

Mortgage rates change daily. A five-day email response means you’re already behind.

Send this email before you apply:

“Hi, I plan to drive traffic via [Your Method]. Do you have updated compliance guidelines for this, and what is your current average lead-to-approval rate?”

Pass: Helpful reply from a human within 48 hours.

Fail: Generic auto-response or silence.

Test their support before committing. Quality partners respond quickly with real answers.

Matching Geographic Coverage to Your Audience

You’ve checked commission and support. Now check the hidden factor that wastes thousands: Licensing Mismatches.

Selling mortgages is strictly regulated. A lender cannot write loans in unlicensed states.

You spend months building a campaign. 70% of visitors come from Texas, Florida, and California.

But your affiliate program is a Boston-based regional lender licensed in only 15 East Coast states.

The Result: 70% of clicks are worthless. Texas applicants get instantly rejected. You earn $0, and users have terrible experiences.

Open Google Analytics: Audience → Geo → Location. Identify your top 5-10 states. Know exactly where readers live.

Most programs list this in FAQs. If not, ask the manager directly.

Concentrated traffic (e.g., mostly New York)? Find a state specialist.

Nationwide traffic? Use network aggregators like LendingTree that work with hundreds of lenders across all zip codes.

California and New York have tighter ad laws. Confirm the program provides legal marketing materials for these states.

UK or Canadian readers? US mortgage links won’t work. Use country-specific programs and geo-targeting to send users to the right offer.

Never assume a lender is “national.” Check the map before building your campaign.

What Traffic Sources Convert Best for Mortgage Affiliate Offers?

You’ve chosen the right program. You’ve verified they pay on time. You’ve checked their geographic coverage.

Now comes the question that determines whether you make a profit or burn cash: Where do you find the customers?

In the mortgage industry, not all traffic is equal. A visitor reading a definition of “what is a mortgage” is worth pennies.

A visitor searching for “current 30-year fixed rates in Texas” is worth gold.

Based on real industry data, conversion rates can swing wildly—from a dismal 0.3% to a staggering 20%—depending entirely on the traffic source.

This section breaks down the performance hierarchy so you can focus your efforts where the money is.

Organic Search Traffic: Why “Intent” Matters More Than Volume

Many new affiliates obsess over “high volume” keywords. They want to rank for huge terms like “mortgage” or “home loan.”

This is a rookie mistake. In affiliate marketing, Intent > Volume.

A user searching for a broad term is usually just browsing. A user searching for a specific solution is ready to buy. Here are the three tiers of SEO traffic quality:

| Feature | Tier 1: High-Intent “Shoppers” | Tier 2: Medium-Intent “Learners” | Tier 3: Low-Intent “Browsers” |

| Conversion Rate | 3% – 8% | 1% – 3% | 0.3% – 1% |

| User Mindset | Active buyers; know their credit score; ready to act. | Early-stage research; planning for the future. | Purely informational; students or long-term dreamers. |

| Buying Timeline | 7 – 14 days | 3 – 6 months | Years away (or never) |

| Example Keywords | “Best mortgage lenders for 650 credit score,” “Current rates in [City],” “How to get pre-approved” | “How to buy a house,” “First-time home buyer guide,” “Mortgage calculator” | “What is a mortgage,” “History of interest rates,” “Mortgage definition” |

| Core Strategy | Prioritize & Capture: Target even if volume is low; quality over quantity. | Nurture: Capture emails and build trust until they are ready to buy. | Avoid: Do not waste budget; traffic is vanity and doesn’t generate revenue. |

| Business Value | Highest: 100 visitors > 10,000 Tier 3 visitors. | Moderate: Builds a future pipeline. | Lowest: Looks good on reports, but pays $0. |

Email Campaign Performance: How Segmentation Drives 5-25% Conversion Rates

If SEO catches people looking, email catches people ready.

Email delivers the highest ROI in this space, but only with segmentation. Generic “Apply Now!” blasts guarantee unsubscribes.

The secret to 5-25% conversion rates is sending the right message to the right person at the right moment.

1️⃣ The “Abandoned Calculator” Follow-Up (15-25% Conversion)

- Trigger: User checks your mortgage calculator but doesn’t apply

- Message: Send within 1 hour: “I saw you checking rates. Here are 3 lenders matching your credit score.”

- Why It Works: Intent is hot. They were thinking about it today.

2️⃣ The Rate Drop Alert (12-20% Conversion)

- Trigger: Market rates drop 0.25%+

- Message: “Breaking: Rates just hit a 3-month low. See if you can lower your payment.”

- Why It Works: Creates instant urgency and tangible savings.

3️⃣ The Seasonal Buying Campaign (8-12% Conversion)

- Target: Subscribers who opened emails in last 30 days

- Message: “Spring buying season is starting. Get pre-approved now to beat the rush.”

- Why It Works: Aligns with real estate market cycles.

4️⃣ The Educational Onboarding Sequence (5-8% Conversion)

- Target: New leads from your “First Time Buyer Guide”

- Message: 14-day sequence explaining Credit Score → Down Payment → Pre-Approval

- Why It Works: Builds trust before asking for the sale.

Send from a personal name (“Mike from MortgageTips”), use curiosity-driven subject lines (“Bad news for rates?”), and customize CTAs: “See if you qualify for an FHA loan” beats “Click Here.”

YouTube and Video Traffic: Building Trust That Converts

SEO gets people to your site. Email keeps them interested. But video builds relationships.

Mortgages are scary—the biggest debt most people take on.

They need reassurance, not just facts. Video traffic closes at 18-25% compared to 12-18% for blog traffic. The trust factor is higher.

Become the “Trusted Advisor” by creating content like “Rocket vs. LendingTree: Which is Cheaper?” Film yourself walking through applications.

Tactic: Use verbal CTAs (“Check the link in the description”) and pin that link in the top comment.

Place 15-second ads on real estate channels.

The Hook: “Stop guessing your rate. Use our free tool to compare 15 lenders right now.”

Why It Works: Seeing your face and hearing you explain “Points vs. No Points” transforms you from salesperson to expert. Trust leads to approved loans.

96% of visitors leave without clicking. Retargeting brings them back. Warm traffic converts 3-5x higher than cold traffic.

Calculator Users (6-10% Conversion)

- Who: Used your calculator but didn’t apply

- Ad: “Did the numbers look good? See which lender matches that payment.”

Comparison Shoppers (4-7% Conversion)

- Who: Read your “Rocket Mortgage Review”

- Ad: Show specific Rocket ad with “Check Rates” button

High-Intent Visitors (8-12% Conversion)

- Who: Visited 3+ times this week

- Ad: “Still looking? Rates might change tomorrow. Lock yours in today.”

Time-Based Nudge

- Who: Visited 7 days ago

- Ad: “It’s been a week. Have you found your lender yet?”

Facebook’s “Housing” category has strict rules and 2-4 week approval. Google Display approves faster but has lower volume.

The Rule: Spend 30-40% of paid budget on retargeting. Bringing back warm leads is cheaper than finding new ones.

FAQs

What is a mortgage affiliate program?

A mortgage affiliate program allows publishers to earn commissions by referring users to mortgage lenders, brokers, or comparison platforms. Affiliates are typically paid per lead, application, or approved loan.

How do mortgage affiliate programs work?

Affiliates promote mortgage offers using links, landing pages, or lead forms. When a user submits their information or completes a qualified action, the affiliate earns a commission based on the program’s payout model.

How much can you earn from mortgage affiliate programs?

Earnings vary widely. Some programs pay $20–$150 per lead, while others offer revenue share or higher CPA payouts for funded loans. Because mortgages are high-value products, commissions are generally higher than many other affiliate niches.

Are mortgage affiliate programs beginner-friendly?

They can be challenging for beginners. Mortgage traffic is competitive, regulated, and requires trust. However, beginners with strong SEO, content marketing, or paid traffic skills can succeed with the right strategy.

Do mortgage affiliate programs pay per lead or per sale?

Most mortgage affiliate programs pay per lead, such as a completed quote request or application. Some advanced programs pay per funded loan or offer hybrid models combining CPA and revenue share.

Is mortgage affiliate marketing legal?

Yes, but it is heavily regulated in many countries. Affiliates must comply with financial advertising laws, disclosure requirements, and platform policies. Claims about rates, approvals, or guarantees must be accurate and transparent.

Do you need a license to promote mortgage offers?

In most cases, affiliates do not need a mortgage license if they only refer leads and do not provide financial advice. However, requirements vary by country and by program, so affiliates should always verify compliance rules.

Are mortgage affiliate programs good for SEO websites?

Yes. Mortgage programs are well-suited for SEO-driven sites that publish guides, comparisons, calculators, and educational content. Long-tail keywords often convert better than generic “best mortgage” terms.

Can mortgage affiliate programs be promoted worldwide?

Some programs are global, but many are country-specific due to lending regulations. Affiliates must target users in approved regions and ensure content matches local mortgage laws and terminology.

Conclusion

In conclusion, these above 16 mortgage affiliate programs are among the top programs with competitive commission rates and affiliate perks. By using relevant content, you can earn some serious money from this promising niche.

You should choose the right program that aligns with your target audience and start making more profits today!