The credit card industry continues to thrive, with millions of consumers searching for the best deals on rewards, cashback, and travel cards. This creates an exciting opportunity for affiliates to promote top offers and earn commissions by connecting audiences with the best credit card offers.

By joining reputable credit card programs, you not only help your audience find the perfect financial solutions but also earn generous commissions for every approved application.

In this article, we’ve highlighted 8 of the best credit card affiliate programs with important details like commission structures, cookie durations, and promotional perks. Let’s explore and choose the right fit for your affiliate marketing strategy!

Quick Comparison

| # | Affiliate Program | Commission Rate (CPA) | Cookie Duration | Payout Range (AOV) |

Est. Conversion Rate (CR)

|

| 1 | Credit Karma | $4 – $7 per signup | 30 – 45 Days | $2 – $10 | 5% – 12% |

| 2 | USAA | $5 – $80 (Varies by product) | 30 Days | $5 – $25 | 1% – 3% |

| 3 | Luxury Card | $180 – $405 per approval | 30 Days | $180 – $405 | 0.5% – 1.5% |

| 4 | Upgrade Card | $45 – $180 per approval | 30 Days | $60 – $200 | 2% – 4% |

| 5 | Capital Bank | $25 – $45 per funded card | 30 Days | $25 – $45 | 8% – 15% |

| 6 | Chase | $50 – $350 per approval | Link-based (0-7 Days) | $50 – $250 | 1% – 3% |

| 7 | SuperMoney | $5 – $75 per lead | 30 Days | $5 – $200 | 3% – 6% |

| 8 | M1 Finance | $10 – $100 per funded account | 30 Days | $10 – $100 | 2% – 5% |

Affiliate Earnings Calculator

Estimate your affiliate income based on Traffic, CTR, AOV, and Commission rate. Drag the sliders below to explore different scenarios.

Estimated Results

These figures are for illustrative purposes – feel free to adjust them to fit your specific niche.

- Conversion Rate here is defined as the percentage of traffic that buys.

- Does not account for refunds, cancellations, or varying commission rates by product.

Affiliate Earnings Calculator

Estimate your affiliate income based on Traffic, CTR, AOV, and Commission rate. Drag the sliders below to explore different scenarios.

Estimated Results

These figures are for illustrative purposes – feel free to adjust them to fit your specific niche.

- Conversion Rate here is defined as the percentage of traffic that buys.

- Does not account for refunds, cancellations, or varying commission rates by product.

8 Best Credit Card Affiliate Programs You Should Join

1. Credit Karma

Credit Karma offers users personalized recommendations for credit cards, loans, and financial products tailored to their credit profiles. In addition to credit monitoring, they provide valuable insights into credit health and help individuals take control of their finances.

Their credit card affiliate program allows you to earn $7 for every new member who signs up for an account. In addition, you can receive $4 when a Credit Karma member logs back into their account after being inactive for 365 days. The cookie window lasts 30 days from the customer’s first click on your unique link.

You must first create an Awin account to join the Credit Karma affiliate program. Once approved, you can check your performance data, like clicks, sales, and commissions, through their detailed tracking dashboard.

|

2. USAA

USAA is an American financial services company primarily serving military members, veterans, and their families. They provide many credit card options, such as cashback cards, rewards cards, and low-interest cards, to support different financial goals and spending needs.

Joining the USAA credit card affiliate program, you can earn up to $80 in commission when a visitor completes an application on the brand’s site. You have 30 days from the customer’s initial click on your link to earn money.

The brand partners with the CJ Affiliate network to manage their program. After being approved as their affiliate, you can receive a unique tracking link to put on your site and start your promotion.

|

3. Luxury Card

Luxury Card is a premium credit card provider offering the Mastercard Gold Card, Mastercard Black Card, and Mastercard Titanium Card. Cardholders can enjoy exclusive benefits such as luxury concierge services, premium travel perks, airport lounge access, and other high-end rewards.

Their affiliate program offers a generous commission of up to $180 on every qualified credit card approval you drive. The referral window stays active for 30 days from the visitor’s initial click on your unique link.

The brand manages their credit card affiliate program through the FlexOffers network. You can leverage FlexOffers’ real-time reporting and analytics to track performance and optimize your campaigns for better results.

|

4. Upgrade Credit Card

Upgrade Credit Card lets cardholders earn cash back on purchases while making predictable monthly payments. They combine credit card flexibility with a personal loan structure to help users pay off balances easily and avoid long-term debt.

You will get different commissions ranging from $45 to $180, depending on the specific product your referral issued.

- Upgrade Select Visa card: $45

- Upgrade cashback card: $180

- Other cards: $67.5

- Auto Refinancing loan: 0.9%

- Personal and Universal Loans: 1.8%

The brand lets you earn money on sales made within 30 days of the visitor’s initial click on your affiliate link.

The Upgrade Credit Card affiliate program is managed through the user-friendly FlexOffers network. That means you must create a FlexOffers account to join their program.

|

5. Capital Bank

Capital Bank is a prominent player in the banking sector with a strong focus on small business lending in the Mid-Atlantic region. The company provides the Open Sky Secured Visa Credit Card through their OpenSky division for customers looking to build or rebuild their credit.

You can get $25 on every approved application and funded account referred through your link. The cookie lasts 30 days from the customer’s first click.

The brand collaborates with CJ Affiliate to manage their credit card affiliate program. You can utilize CJ’s real-time referral report to track your promotional performance and optimize your campaigns for better results.

|

6. Chase

- Commission rate: $50

- Cookie duration: Not mentioned

Chase is one of the largest financial institutions in the United States. They offer various credit card options with attractive rewards and high-value benefits, such as cashback, travel points, and purchase protection.

7. Super Money

- Commission rate: $50

- Cookie duration: Not mentioned

SuperMoney helps consumers evaluate and compare various financial services, such as credit cards, loans, banking services, mortgages, and insurance. They let users submit a single application and receive real-time, pre-approved loan offers, including personal loans, student loans, and auto loans.

8. M1

- Commission rate: $10

- Cookie duration: Not mentioned

M1 Finance offers a robo-advisory investment platform with brokerage accounts, digital checking accounts, and lines of credit. With an M1 membership, users can access the Owner’s Rewards Card and enjoy up to 10% cash back on purchases from companies they hold stock in.

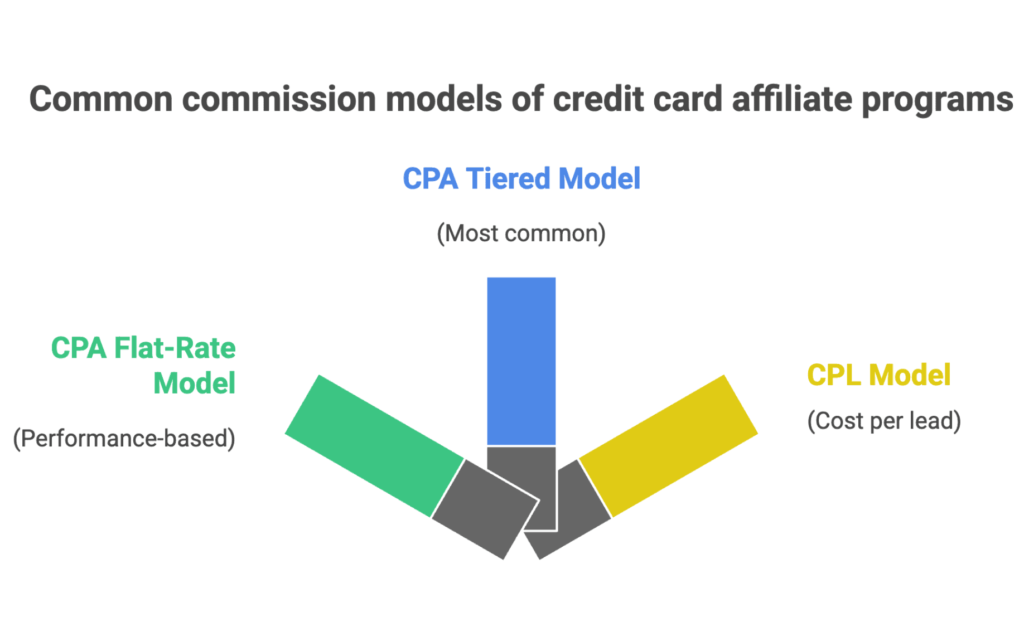

What Commission Models Do Credit Card Programs Use?

Credit card programs use different payment plans to reward their partners and grow their reach. These models often include flat fees for new sign-ups or a small percentage of every card sale.

Understanding these options helps businesses choose the best path to earn a steady income.

CPA Flat-Rate Model (Most Common)

Most credit card programs use the CPA Flat-Rate model.

It pays you a fixed price for every approved customer you refer. Whether you send five people or five hundred, your per-person payment stays the same. 💰

For example, you might earn $75 for a Capital One card or $60 for a Bank of America card. 🏦

Beginners love this model because it acts like a steady paycheck. It makes tracking your profits easy, especially if you pay for ads to find customers. 📈

However, there is a downside for those who send a lot of traffic.

Since the price is fixed, you do not earn extra bonuses for sending a massive number of customers.

CPA Tiered Model (Performance-Based)

This is where the serious money is made. The CPA Tiered Model rewards aggressive growth. Used by about 25% of programs, this model increases your commission rate as your monthly volume goes up.

Let’s look at a hypothetical tiered structure to see the impact. Imagine a program offering the following tiers based on monthly approved applications:

- Tier 1 (1–49 approvals): $100 per approval

- Tier 2 (50–99 approvals): $125 per approval

- Tier 3 (100–199 approvals): $150 per approval

- Tier 4 (200+ approvals): $175 per approval

However, this model introduces a unique stress known as “The Cliff.” As these tiers usually reset monthly, missing a threshold by a single approval can cost you thousands.

For example, you see the gap between Tier 1 and Tier 2:

If you get 49 approvals (Tier 1 rate), you earn $4,900.

If you get 50 approvals (Tier 2 rate applies retroactively to all), you earn $6,250.

That single 50th approval is effectively worth $1,350. This creates a lot of pressure at the end of the month, but it is the best way for top performers to earn more.

CPL (Cost Per Lead) Model

While CPA models pay you for a result (an approved account), the Cost Per Lead (CPL) model pays you for an action (a completed application submission).

Under this model, the brand pays you the moment the user hits “Submit.” It does not matter if they get approved or denied.

For that reason, the payouts are naturally smaller, typically ranging from $5 to $35 per submission.

You won’t often find CPL offers directly from major issuers like Chase or Amex. Instead, this model is used by comparison platforms and sites that offer credit repair services.

- Credit Karma: $4–$7 per lead

- LendingTree: Up to $35 per lead

- Bankrate: $15–$25 per lead

Trading a $75 CPA payout for a $25 CPL payout might look like a bad deal at first. But you have to look at your actual earnings per click.

In the credit card world, many people get rejected.

If you send 10 people to a CPA offer and four get approved at $75, you make $300.

If you send those same 10 people to a $25 CPL offer, you make $250.

So, in case your audience has poor credit, the CPL model is actually better. This way, you still get paid even when a bank says “no.”

How Do You Choose the Right Credit Card Affiliate Program?

Choosing an affiliate program isn’t just about picking the one with the highest payout. A $300 commission is worthless if the tracking is broken or the issuer declines 90% of your traffic.

To build a steady income, you must evaluate potential partners based on four key factors: commission structure, payment terms, and affiliate support.

Commission Structure Analysis: Flat-Rate vs. Tiered Programs

When you compare two programs, do not just look at the headline number. You have to analyze the structure relative to your current traffic volume.

Let’s say you are deciding between Program A (Flat-Rate) and Program B (Tiered).

- Program A (Flat): Pays $115 for every approval, no matter what.

- Program B (Tiered): Pays $100 base, but bumps to $125 if you hit 50+ approvals.

If you currently drive 30 approvals a month, Program A pays you $3,450. Program B only pays $3,000. You would lose $450 by chasing the “potential” of the higher tier.

However, if you are growing fast and expect 60 approvals next month, Program B becomes the winner ($7,500 vs. $6,900).

Beyond the math, you should look at the variety of cards the program offers.

Single-Card Programs

High risk. If that one card changes its terms or pauses applications, your income stream dries up overnight.

Multi-Card Portfolios

Programs offering 10+ varieties (ranging from secured cards at $50 commission to premium travel cards at $200) allow you to target different segments of your audience.

If a user gets rejected for the premium card, you can down-sell them to a secured card and still earn a commission.

Payment Reliability Research: How to Verify Program Trustworthiness

Experienced affiliates often have one major nightmare. They see thousands of dollars in “pending” money, but the program never pays up.

In the finance niche, where validation periods can drag on, researching a program’s payment history is a must.

An easy way is to find unfiltered feedback from other affiliates. Spend 2–3 hours searching these specific resources:

🔍 Affiliate Forums: Check STM Forum or Afflift. Search the program’s name + “payment late” or “shaving” (a term for hiding valid conversions).

🔍 Review Aggregators: Look at AffPaying or Business of Apps. While some reviews are fake, a pattern of “net-90” complaints is a reliable warning sign.

🔍 The BBB: For direct issuer programs, a low Better Business Bureau rating often points to poor support.

If you see any of these warning signs, walk away:

Long wait times: Most banks take 30 to 60 days to verify leads. However, if a program takes more than 120 days, they may be holding your cash to fund their own business.

Unfair pay changes: Good programs only change rates for future work. Shady programs will lower the price for traffic you already sent.

The “Silent Treatment”: Pay attention to how fast they reply. If a manager takes a week to answer a simple email now, they will likely ignore you when a payment goes missing.

Promotional Flexibility Assessment: Matching Programs to Your Traffic Strategy

It creates a sickening feeling when you spend weeks building a funnel, only to find out the program bans your primary traffic source.

Credit card issuers are heavily regulated. Unlike selling e-books or supplements, they can’t let affiliates say whatever they want.

That’s why you need to cross-reference the program’s Terms & Conditions against your specific strategy.

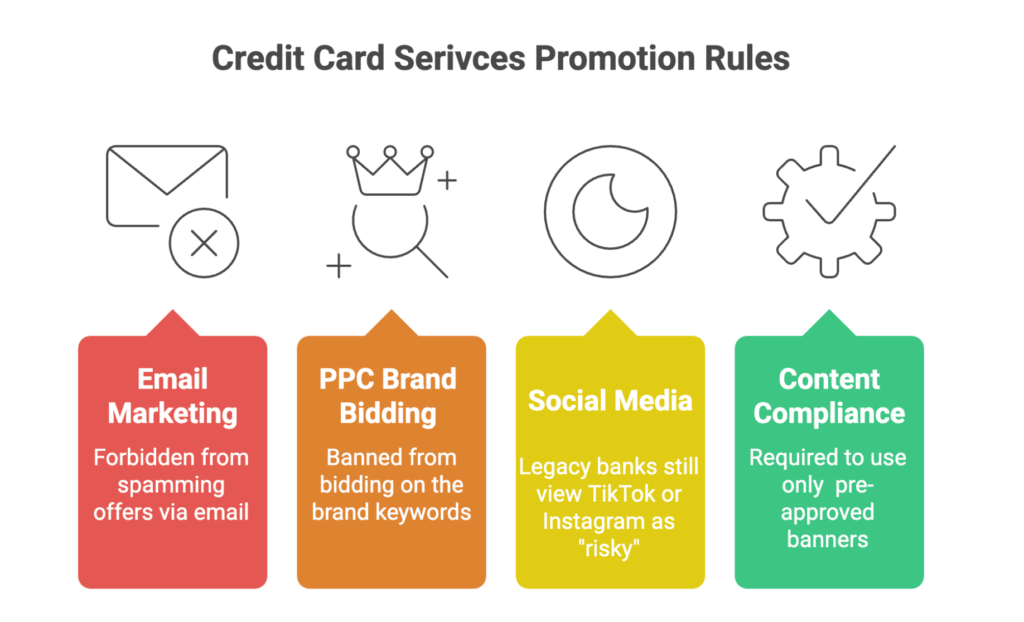

Email Marketing

Many premium programs (like Amex or Chase) strictly forbid affiliates from sending offers via email due to spam risks. If 80% of your revenue comes from your newsletter, these programs are a dead end for you.

PPC Brand Bidding

Almost every program will ban you from bidding on their brand keywords (e.g., bidding on “Capital One card”). If you do this, you will be banned instantly. However, check if they allow “generic” bidding (e.g., “best travel credit cards”).

Social Media

Some legacy banks still view TikTok or Instagram as “risky” and won’t approve affiliates who primarily use these platforms.

Content Compliance

Do they require you to use only their pre-approved banners, or can you write your own review copy? The latter is essential for SEO.

Affiliate Support Quality: The Value of Dedicated Account Management

When things go wrong—and they will—who are you going to call?

The difference between a “good” month and a “great” month often comes down to your relationship with your Affiliate Manager. There are generally two tiers of support you’ll encounter:

The “Mass-Market” Experience (Generic Support): No assigned contact person, just a generic support@ email address.

You rely on FAQs. Ticket responses take 5–7 days. If a link breaks on a Friday, you’re losing money until Tuesday. This is common for beginner affiliates with low volume.

The “Dedicated Manager” Experience (VIP Support): You have a specific person (e.g., “Sarah”) with a direct phone or email line.

A dedicated AM does more than just fix tech issues in 24 hours. They are your inside track to profit.

They can tell you which offers are converting right now, provide exclusive creative assets, and—crucially—negotiate custom commission rates once you hit volume (e.g., bumping you from $100 to $110 per approval).

How Do You Promote Credit Card Affiliate Offers?

There are several ways to promote affiliate offers, from SEO content, email marketing, to YouTube videos.

Below, we’ll note down some key tips and tricks when it comes to different types of promotional content.

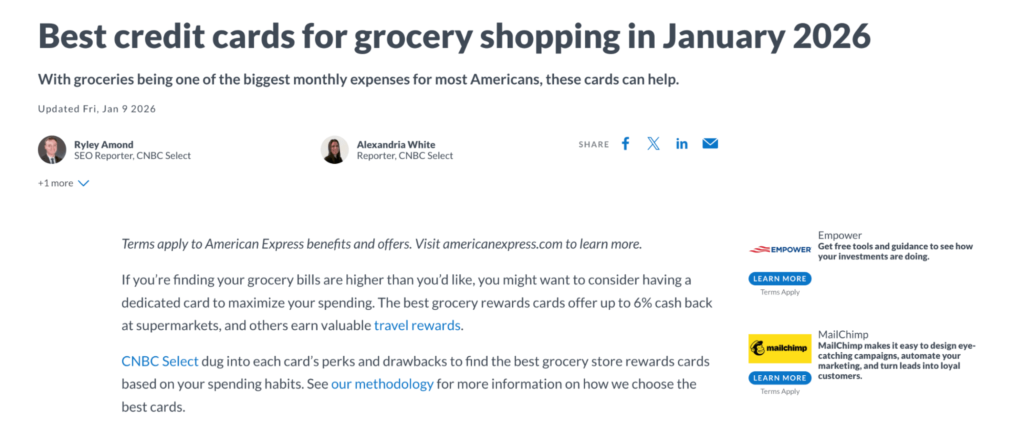

SEO-Optimized Comparison Content

SEO is the best tool for affiliates because it finds people at the perfect moment.

When someone searches for a credit card comparison, they are usually ready to apply. To capture this traffic, you need to focus on “money” keywords rather than generic topics.

Do not waste time writing generic articles like “What is a credit score?” The competition is too high, and the user intent is too low.

Instead, you should target keywords with 500–10,000 monthly searches that signal a desire to apply:

- “Best” Modifiers: “Best cash back credit cards for groceries”

- “Vs” Comparisons: “Capital One Venture X vs. Platinum”

- “Review” Keywords: “Is the Citi Double Cash worth it?”

In this niche, users want to scan, compare, and click. Comparison tables are essential.

✅ First, you place a table at the very top of your page with three to five top cards and clear “Apply Now” buttons.

✅ Then, follow the table with a deep dive of over 2,000 words to provide a full analysis.

✅ Finally, add a clear verdict section.

Email Marketing to Finance Subscribers

Email marketing is like hunting. You have a list of engaged people, and you can present an offer to them whenever you want.

However, financial email marketing is tricky because it requires permission and trust.

Nobody joins a newsletter just to get credit card ads. You have to offer value first. High-converting lead magnets in this space include:

- “The 800 Credit Score Blueprint” (PDF Guide)

- “Travel Rewards Spreadsheet” (Template)

- “Debt Payoff Calculator” (Tool)

You can grow your list by using pop-ups when people leave your site or by running Facebook ads for a few dollars per lead.

Once you have 5,000 to 10,000 subscribers, you have enough people to earn serious income.

Timing also plays a huge role in your success.

In the first few months of the year, people want cards that help them pay off holiday debt. During this time, applications often spike by 30% to 50%. 📈

By the end of the year, shoppers shift their focus to cards that offer high cash back for holiday gifts.

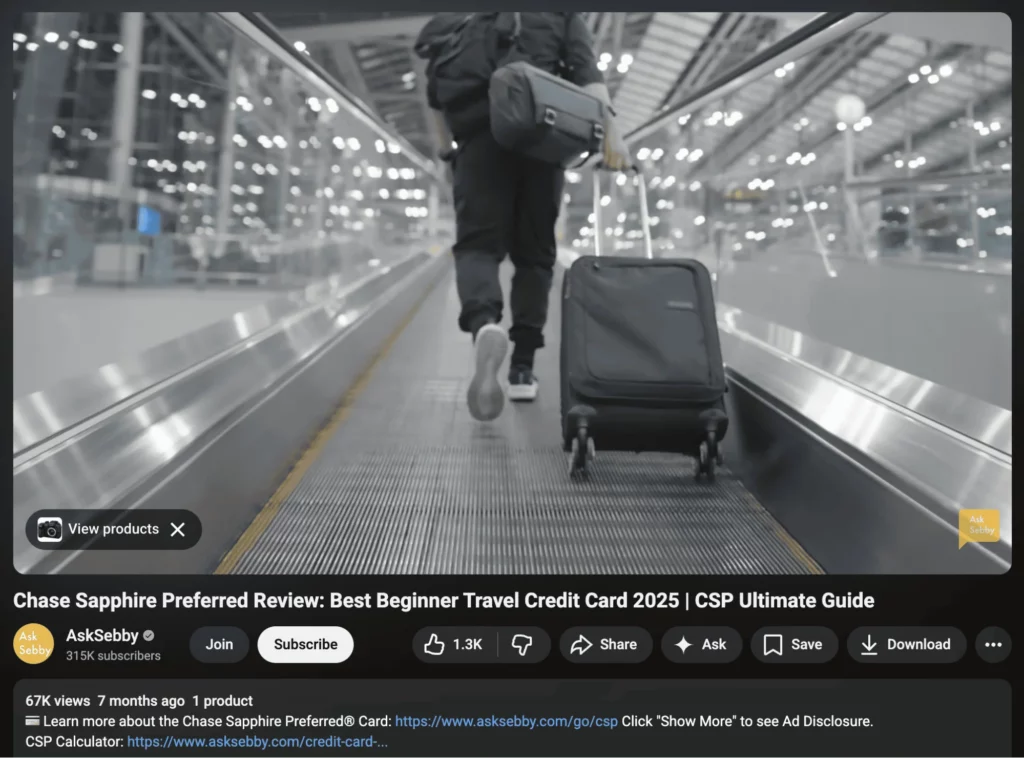

YouTube Video Reviews and Comparisons

YouTube is a powerful tool because seeing a real person builds trust quickly.

Successful channels in this niche (like AskSebby or The Credit Shifu) don’t just rely on ad revenue. The real money is in the affiliate links tucked into the video description.

A channel with just 5,000 subscribers can easily earn $2,000–$5,000 per month in commissions because the viewers are hyper-targeted.

When promoting credit cards on YouTube, you need to answer specific questions.

“The Unboxing”: Show the physical card. It sounds simple, but people love seeing the metal design and packaging.

“The Showdown”: Compare two direct competitors (e.g., Chase Freedom Flex vs. Unlimited).

“The Strategy Guide”: Explain a complex concept, like “The Chase 5/24 Rule.”

However, YouTube links are tricky. You can’t just spam them.

It’s better to place your best link in a pinned comment. Besides, you can also link to a “bridge page” on your own website first.

This way will protect you if YouTube’s algorithm changes or if a specific affiliate link dies.

Niche Community Engagement and Forums

There are corners of the internet where credit card obsessives gather to trade secrets. Places like r/churning, r/CreditCards, and FlyerTalk.

These communities are goldmines of high-intent users. But be warned: they are also the most hostile to spammers. If you drop a link and run, you will be banned in minutes.

So what you should do is to act like a helpful member of the group.

During your first three months, you should not promote anything at all. Just answer questions, debunk myths, and share news about card changes to build your reputation. 🗣️

Once people trust your voice, you can try a “soft sell.”

Instead of posting a direct sales link, you offer personalized advice based on a user’s spending. You can link to a detailed breakdown on your own blog rather than using a direct affiliate link.

Each platform has its own set of rules:

Reddit: This site is very strict and rarely allows direct affiliate links. Use it to build your authority and do research. 🚫

FlyerTalk: This site often allows links in your digital signature if you are a helpful contributor. ✍️

Quora: You can include links in your answers as long as the post provides a lot of value on its own. ✅

FAQs

1. What is a credit card affiliate program?

A credit card affiliate program allows publishers to earn commissions by referring users to apply for credit cards through tracked affiliate links.

2. How much can affiliates earn from credit card programs?

Commissions typically range from $25 to $300+ per approved application, depending on the bank, card type, and region.

3. Are credit card affiliate programs free to join?

Yes. Most credit card affiliate programs are completely free to join through affiliate networks or directly with financial institutions.

4. Is promoting credit cards legal?

Yes, but affiliates must comply with financial advertising regulations, disclosure requirements, and platform policies.

5. Can I run paid ads for credit card affiliate offers?

Some programs allow paid traffic, but many restrict brand bidding or require compliance approval. Always check program terms.

6. Are credit card affiliate programs beginner-friendly?

Yes. Beginners can succeed by creating comparison content, reviews, and educational finance articles targeting high-intent keywords.

7. Do users need to be approved for affiliates to earn commissions?

Yes. Most programs only pay when the user’s application is approved by the issuing bank.

8. Are credit card affiliate programs available worldwide?

They are available in many countries, but commission rates, regulations, and available offers vary by region.

Conclusion

In conclusion, choosing the right credit card affiliate program is essential for driving meaningful results in your affiliate marketing efforts. With top-notch brands and reliable services, these programs can help you earn attractive commissions while recommending financial products your audience will find useful. Let’s compare carefully to choose your best match, and start your promotion today!